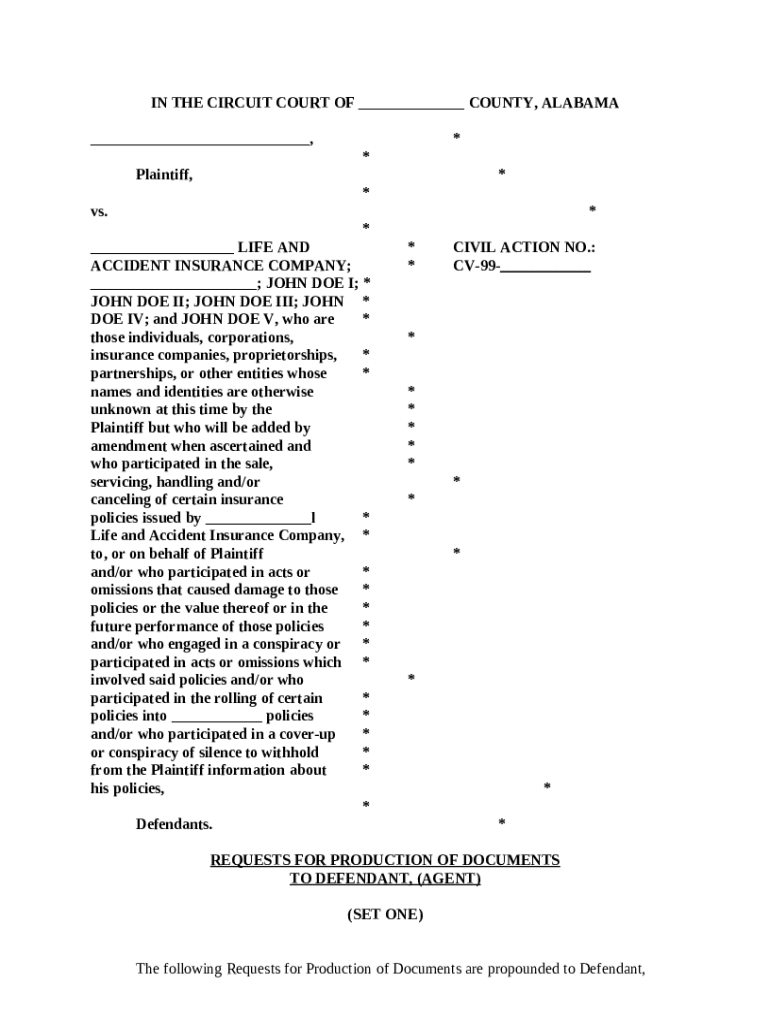

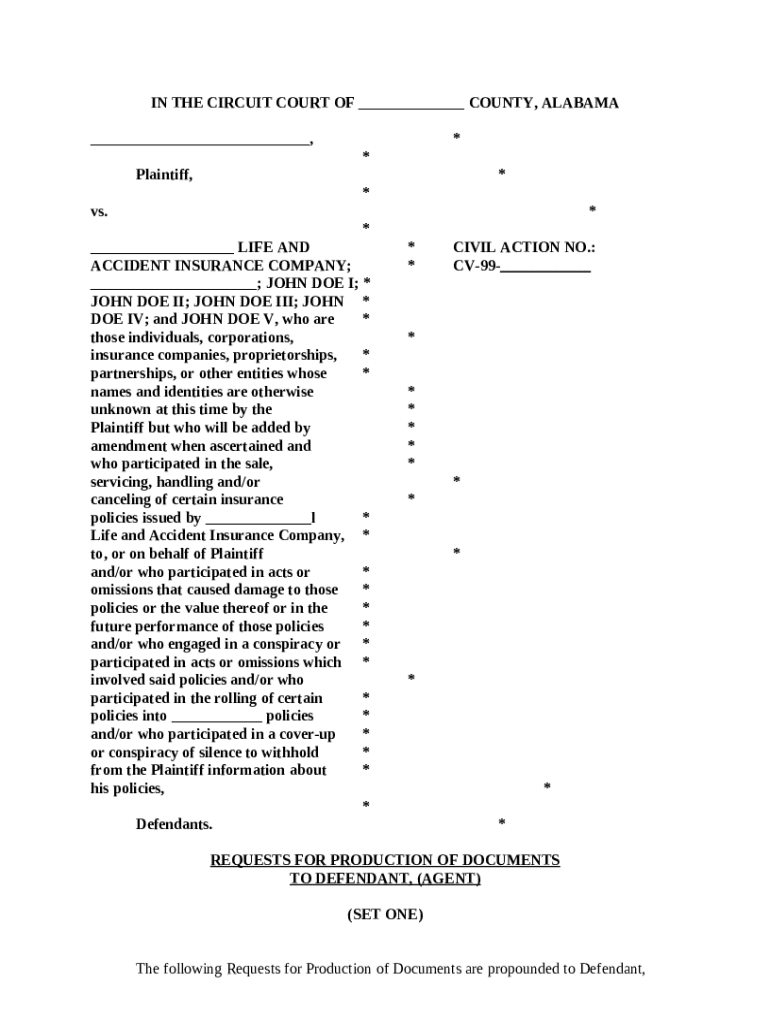

Get the free Life Insurance Fraud - Requests for Production of Documents to Defendant Agent template

Show details

This is sample requests for discovery against a defendant insurance company in the care of alleged life insurance fraud.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is life insurance fraud

Life insurance fraud involves deceitful practices to gain financial benefits from a life insurance policy, typically by misrepresenting information or circumstances surrounding a policyholder's death.

pdfFiller scores top ratings on review platforms

I haven't quite figured it out yet without having to go to support

I JUST STARTED IT AND ALREADY LIKE IT ITS EASY AND HAS ALOT OF FORMS AVAILABLE

the Grant Deed form I am using appears to be using an old notary blurb. This was pointed out to me from a title company

Mostly easy; text boxes seemed erratic at some points

It has been limited thus far. Just doing 1099's. But love how easy it is!!

I really had a relief when i started using this app....

Who needs life insurance fraud?

Explore how professionals across industries use pdfFiller.

The Ultimate Guide to Life Insurance Fraud Forms on pdfFiller

How do you define life insurance fraud?

Life insurance fraud occurs when individuals or groups seek to gain an unlawful advantage by providing false information or withholding truth during claims processes. This type of fraud not only undermines the integrity of the insurance industry but can also lead to severe legal consequences for the perpetrators. Understanding its implications is crucial for policyholders and insurers alike.

-

Life insurance fraud typically involves deceitful actions that can distort the true nature of a policyholder's situation, affecting claims approval and insurance costs.

-

Various studies indicate that billions are lost annually due to insurance fraud, presenting a significant issue within the industry.

-

Fraud schemes can include falsifying health information or even staging incidents to claim life insurance benefits prematurely.

What is the process for reporting suspected fraud?

Reporting suspected life insurance fraud is a structured process designed to maintain integrity within the insurance landscape. It is essential to follow specific steps to ensure that your report is taken seriously and acted upon.

-

Start by gathering any relevant documents and details, followed by contacting the insurance company directly or reporting through designated fraud hotlines.

-

Include all relevant evidence like policy details, dates, and correspondence related to your suspicion of fraud.

-

Meticulously note every interaction regarding the suspected fraud, maintaining a timeline of events and communications.

How do you fill out the suspected fraud form?

Filling out the Suspected Fraud Form correctly is vital to get your concerns addressed efficiently. Understanding its structure and required information will facilitate smoother processing of your report.

-

The form generally includes sections for personal information, a detailed description of the suspected fraud, and a declaration statement.

-

Be clear and concise in providing the information; for example, detail how you believe fraud was committed based on specific evidences.

-

Ensure that the personal data you provide is accurate, and be aware of how this information will be used to protect your privacy.

What legal considerations should you keep in mind?

Understanding your rights when reporting fraud is critical for all parties involved. Reporting fraud must be handled carefully to avoid potential legal complications.

-

You have the right to report suspicions without facing retaliation, regardless of the outcome of the investigation.

-

If the fraud is confirmed, repercussions may include criminal charges for the fraudsters and potential civil actions for recovery by insurers.

-

Consider consulting a legal expert to navigate complex issues arising from fraud reporting or if you feel you may be wrongfully accused.

What tools can assist in document management?

Using collaborative tools can enhance your experience in managing insurance documents and reports. pdfFiller offers functionalities tailored for efficient document handling.

-

With pdfFiller, you can create, edit, and prepare forms, including fraud reports, with ease and efficiency.

-

Submit forms securely online with electronic signatures, ensuring authenticity and reducing processing time.

-

Utilize team collaboration tools within pdfFiller to review forms, ensuring all necessary details are captured in your report.

Why is ethical behavior important in preventing fraud?

Ethical conduct in the insurance sector is paramount for preventing fraud. Understanding how to recognize and avoid fraud can protect both consumers and insurers.

-

Maintaining integrity fosters trust among policyholders and encourages industry standards that deter fraudulent activities.

-

Being attentive to too-good-to-be-true offers and conducting thorough research on insurance products can help avoid falling victim to fraud.

-

Various organizations offer educational resources on ethical practices, vital for both consumers and professionals in the insurance industry.

What can be learned from real-life cases of fraud detection?

Case studies of successful fraud reporting highlight the importance of vigilance and appropriate actions. Examining these examples can foster better understanding and prevention strategies.

-

Analyzing successful reports reveals common strategies that can enhance your own reporting effectiveness.

-

Through varied contexts, you can learn about red flags and indicators that signal potential fraud.

-

Organizations have developed and implemented more robust fraud prevention strategies in response to learned lessons from past cases.

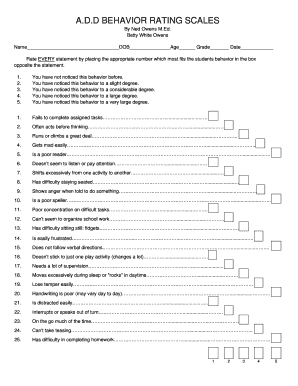

How to fill out the life insurance fraud

-

1.Access the pdfFiller website or app and log in to your account.

-

2.Locate the template for reporting life insurance fraud in the template section.

-

3.Click on the template to open it in the editor.

-

4.Begin filling in your personal information at the top, including your name and contact details.

-

5.Provide the necessary policy details, such as the policy number and the insured person's name.

-

6.Describe the fraudulent activity clearly, including dates and any relevant circumstances surrounding the incident.

-

7.Attach any supporting documentation that validates your claims, like photographs or sworn statements.

-

8.Review the information you have entered for completeness and accuracy.

-

9.Once satisfied, save the document and proceed to send or share it as required by the intended recipient or the insurance company.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.