Get the free Bad Faith and Related Fraud Complaint template

Show details

Alabama sample Bad Faith and Related Fraud Complaint.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bad faith and related

Bad faith and related refers to actions taken in disregard for honest standards of conduct, often in legal contexts.

pdfFiller scores top ratings on review platforms

So far, so good. Will be sending out forms for completion soon.

This app is a life saver for anyone moving. I've used it for school/daycare registration, new billing forms and so much more.

Easy to use. My documents look fantastic now, as I am not handwriting on them

It's been fantastic so far. I would highly recommend pdf fille

Easy to use. Just had to remember what Social Account I signed in with.

I'm sorry, I couldn't even remember the name of the company I was using for this. Finally I guessed and that was correct.

Who needs bad faith and related?

Explore how professionals across industries use pdfFiller.

How to file a complaint for bad faith insurance in Alabama

What is bad faith insurance?

Bad faith insurance occurs when an insurance company fails to fulfill its contractual obligations to its policyholders. This can include denying valid claims, failing to conduct a thorough investigation, or delaying payments without just cause. Recognizing these practices is crucial for insurance consumers to protect their rights.

-

Bad faith refers to dishonesty or a refusal to fulfill obligations, often leading to unfair treatment of clients.

-

Recognizing bad faith practices helps individuals advocate for their rights and encourages compliance with ethical guidelines.

-

Examples include denying a claim without a valid reason, offering unreasonably low settlements, or failing to communicate effectively with the policyholder.

What are the key elements for a bad faith claim?

To establish a bad faith claim, certain elements must be present. This includes demonstrating that the insurance company breached its duties under the policy and acted unreasonably. Collecting necessary documentation, such as claim forms and communication records, is crucial for building a strong case.

-

The primary ingredients include a valid insurance policy, a claim that was improperly handled, and evidence of the insurer's wrongful actions.

-

Essential documents may include denial letters, emails, policy details, and notes on phone calls with your insurer.

-

In Alabama, specific laws govern bad faith claims, requiring clear proof that the insurer acted in a way that was unreasonable or in violation of the insurance contract.

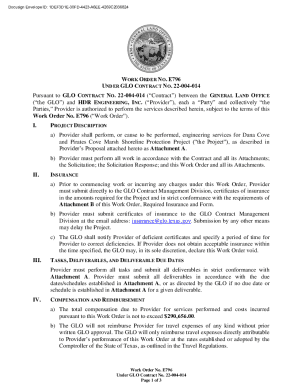

How do you file a complaint of bad faith?

Filing a complaint against an insurance provider due to bad faith is an essential process. This can involve completing a formal complaint document detailing your grievance. Using online tools, like the e-sign electronic submission form on pdfFiller, can simplify the submission process.

-

1. Gather all relevant documents. 2. Complete the complaint form accurately. 3. Submit the complaint to the appropriate regulatory body.

-

pdfFiller offers an easy way to fill out the complaint form online, ensuring you can e-sign and submit your document.

-

Ensure clarity and consistency in your complaint. Double-check the information for accuracy before submission.

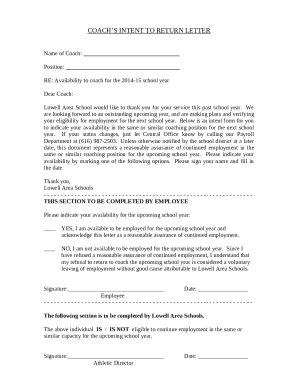

What is the structure of a complaint?

A well-structured complaint is vital for clarity and efficiency. The initial title should state the court and jurisdiction, such as 'IN THE CIRCUIT COURT OF COUNTY ALABAMA.' Clearly identifying the parties involved is also crucial.

-

Your complaint should include a formal title that specifies the court and location.

-

Clearly outline who the plaintiffs and defendants are to provide context for the case.

-

Provide a brief yet thorough background of the situation leading to the complaint to help the court understand your case.

How do you draft a bad faith insurance letter?

An effective bad faith insurance letter must clearly outline your complaint and the actions you expect from the insurer. Providing templates through pdfFiller can serve as a great starting point, ensuring you adhere to professional standards.

-

Elements should include a clear subject line, a detailed explanation of the complaint, and your contact information.

-

Utilize pdfFiller's library of templates to ensure proper formatting and language.

-

Avoid vague language and ensure all relevant facts are accurately represented to prevent misunderstanding.

What are the legal guidelines in Alabama?

Alabama has specific laws governing bad faith insurance claims. Familiarizing yourself with these legal standards is essential for a successful claim. This includes understanding relevant state statutes and the consequences of non-compliance, which could adversely affect your case.

-

Alabama law defines clear parameters for bad faith practices, emphasizing the need for insurers to act in good faith.

-

Key statutes outline rights and responsibilities in the context of insurance claims, impacting your strategies.

-

A lapse in compliance can lead to court penalties and a negative influence on your overall claim.

How can pdfFiller assist in document management?

pdfFiller offers a range of tools for creating, signing, and managing your complaint documents. The cloud-based platform allows you to collaborate with legal teams, ensuring that all documents are easily accessible and modifiable.

-

Users can easily create and store documents, keeping everything organized in one platform.

-

Features allow multiple users to edit and comment on documents, streamlining communication.

-

Utilize pre-designed templates to save time and maintain consistency in your documents.

Where to find support for bad faith insurance claims?

Support is available through various channels for individuals facing bad faith insurance issues. Resources from pdfFiller include comprehensive guides and contact information for legal assistance to ensure you have the help you need.

-

Check pdfFiller for user guides and templates specifically designed to assist with complaint processes.

-

Seek legal advice to better understand your rights and navigate the complexities of insurance claims.

-

Resources for reaching out to professionals who can provide further insight and support.

How to fill out the bad faith and related

-

1.Open pdfFiller and upload the 'bad faith and related' document you need to complete.

-

2.Review the document to understand the sections that require your input.

-

3.Begin with the personal information section - fill in your name, address, and contact information.

-

4.Proceed to the specific details about the situation - be concise and factual in your statements.

-

5.Include any relevant dates and identifiers that pertain to the bad faith issue.

-

6.Attach supporting documentation or evidence if required - ensure files are clear and legible.

-

7.Double-check all filled fields for accuracy and completeness.

-

8.Use the tools in pdfFiller to sign the document electronically if needed.

-

9.Save your progress regularly to avoid losing any information.

-

10.Once completed, download the final document or share it directly from pdfFiller as per your need.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.