Get the free Garnishment Provisions for Consumer Debt

Show details

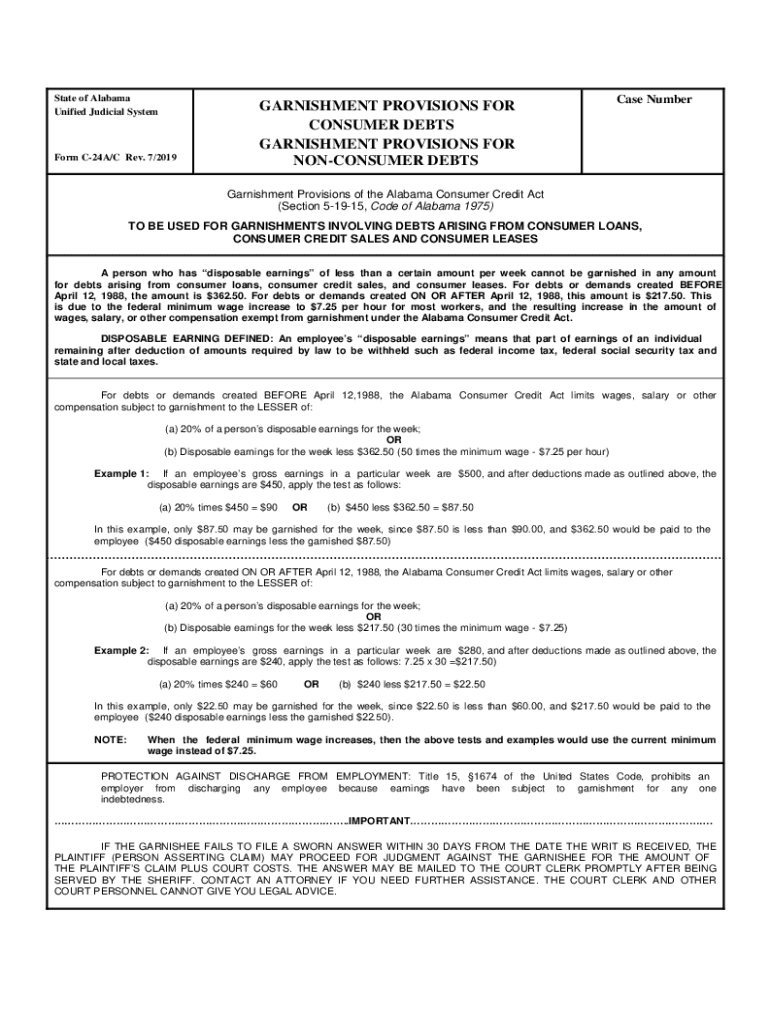

Alabama Official Form - Garnishment Provisions for Consumer Debt Pursuant to the Alabama Consumer Credit Act.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is garnishment provisions for consumer

Garnishment provisions for consumer are legal terms that outline the process and conditions under which a creditor can seize a consumer's wages or bank assets to satisfy a debt.

pdfFiller scores top ratings on review platforms

great! found forms I needed desperately!

Great app. Features are exactly what I need for the work that I do. Thanks!

I have very little experience with PDF fille

Very good if what you need is that available form, and you don't need to edit anything.

Straight forward easy to use web based interface; can't ask for much more.

I haven't really used it yet so I have no opinion at this time

Who needs garnishment provisions for consumer?

Explore how professionals across industries use pdfFiller.

Garnishment provisions for consumer form on pdfFiller

How do garnishment provisions work?

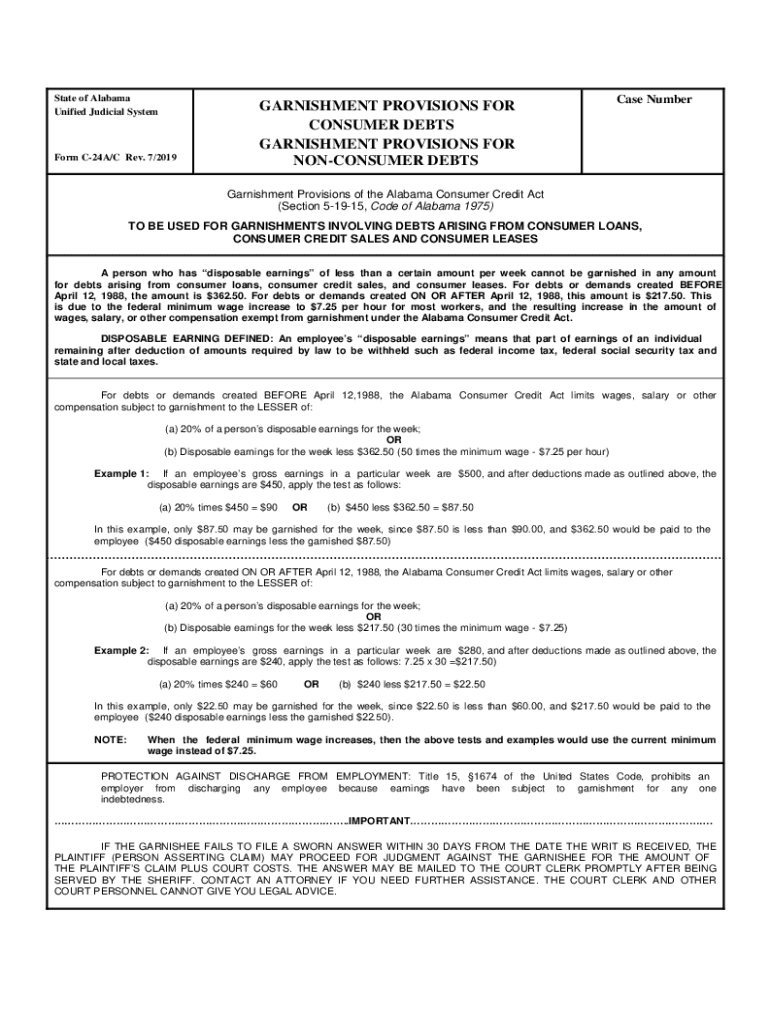

Garnishment provisions are legal processes that allow creditors to take a portion of a debtor’s earnings directly from their paycheck. These provisions typically apply to consumer debts, which can include credit card debts, personal loans, and other financial obligations. Understanding the implications of garnishment, such as its impact on disposable income, is crucial for both creditors and debtors.

What are the key aspects of the Alabama Consumer Credit Act?

The Alabama Consumer Credit Act is a pivotal piece of legislation governing consumer credit transactions in the state. This Act outlines the rights and responsibilities of both borrowers and lenders in consumer loans, credit sales, and leases, providing a framework to ensure fairness in lending. Key provisions can include limits on interest rates, disclosures required from creditors, and specific guidelines related to garnishment.

-

It encompasses various forms of consumer credit including personal loans, auto loans, and credit cards.

-

Creditors must provide clear information about interest rates, fees, and payment terms.

-

The Act also addresses how much can be garnished, ensuring creditors follow proper procedures.

How is disposable earnings defined and calculated?

Disposable earnings are defined under Alabama law as the amount of income remaining after mandatory deductions, such as taxes and social security. This figure is crucial because it determines how much of a debtor's wages can legally be garnished. Calculating disposable earnings involves a simple formula that subtracts these mandatory deductions from gross earnings.

-

Total income before any deductions.

-

Include federal and state taxes, Social Security, and Medicare contributions.

-

The remaining amount indicates what can be subject to garnishment.

What are the limitations on wage garnishments?

There are general limitations on how much of a debtor’s wages can be garnished. Under Alabama law, the maximum amount that can be garnished is limited to 25% of disposable earnings or the amount by which disposable earnings exceed 30 times the federal minimum wage, whichever is less. Additionally, certain exceptions apply for debts related to child support and federal obligations, which may allow for higher garnishment amounts than typical consumer debts.

What are state-specific compliance requirements?

Employers in Alabama have specific compliance requirements regarding wage garnishments. It is critical for employers to respond promptly to garnishment orders to avoid legal repercussions. Noncompliance can lead to penalties, including being held liable for any unpaid wages that should have been garnished.

-

Employers must act quickly to comply with garnishment orders, usually within a specified timeframe.

-

Employers should maintain thorough records of all deductions made from employee wages.

How to use pdfFiller for document management?

pdfFiller offers a streamlined approach to creating and managing garnishment forms. Users can easily create forms by utilizing customizable templates, making it a practical choice for both individuals and employers. The platform also supports secure eSigning and sharing, enhancing collaboration and ensuring compliance with legal standards.

-

Easily create garnishment forms with user-friendly templates.

-

Sign documents digitally and securely share them with relevant parties.

-

Work with team members on documents in real-time for quick updates and approvals.

What interactive tools does pdfFiller offer?

pdfFiller provides various interactive tools for managing garnishments effectively. Users can fill out garnishment provisions forms quickly and access a library of customizable templates tailored to meet Alabama garnishment requirements. These tools ensure that users comply with legislation while saving time and reducing errors.

-

Edit documents easily with intuitive tools designed for precision.

-

Access a library of templates designed specifically for garnishment forms.

Conclusion and next steps

In summary, understanding the garnishment provisions for consumer form is essential for anyone navigating debts and creditor requirements. This article has explored the intricacies of Alabama's garnishment laws, as well as how pdfFiller can assist in document management. By utilizing these resources, individuals and businesses can ensure compliance and streamline the management of their garnishment processes.

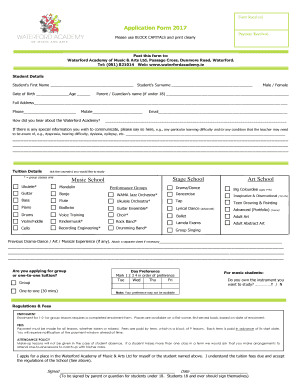

How to fill out the garnishment provisions for consumer

-

1.Open the garnishment provisions document on pdfFiller.

-

2.Carefully read the instructions provided within the document to understand each section.

-

3.Start with the debtor's personal information; fill in the full name, address, and occupation accurately.

-

4.Next, provide the creditor's details, including their name, contact information, and address.

-

5.Fill in the amounts owed under the relevant sections, ensuring that you check the details of any original agreements.

-

6.If applicable, include any additional information such as case numbers or judgments related to the debt.

-

7.Review the filled form for any errors or missing information before finalizing.

-

8.Once completed, save the document and follow the prompts to submit it, either by printing or electronically via pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.