Last updated on Feb 17, 2026

Get the free Qualifying Affidavit of Personal Sureties template

Show details

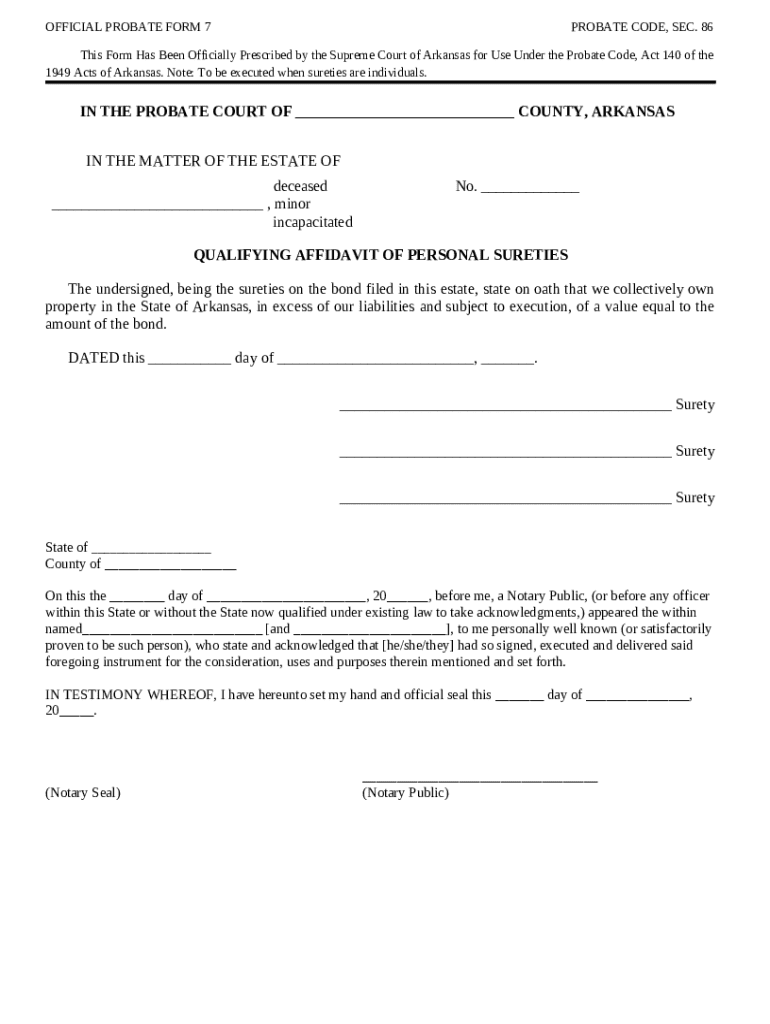

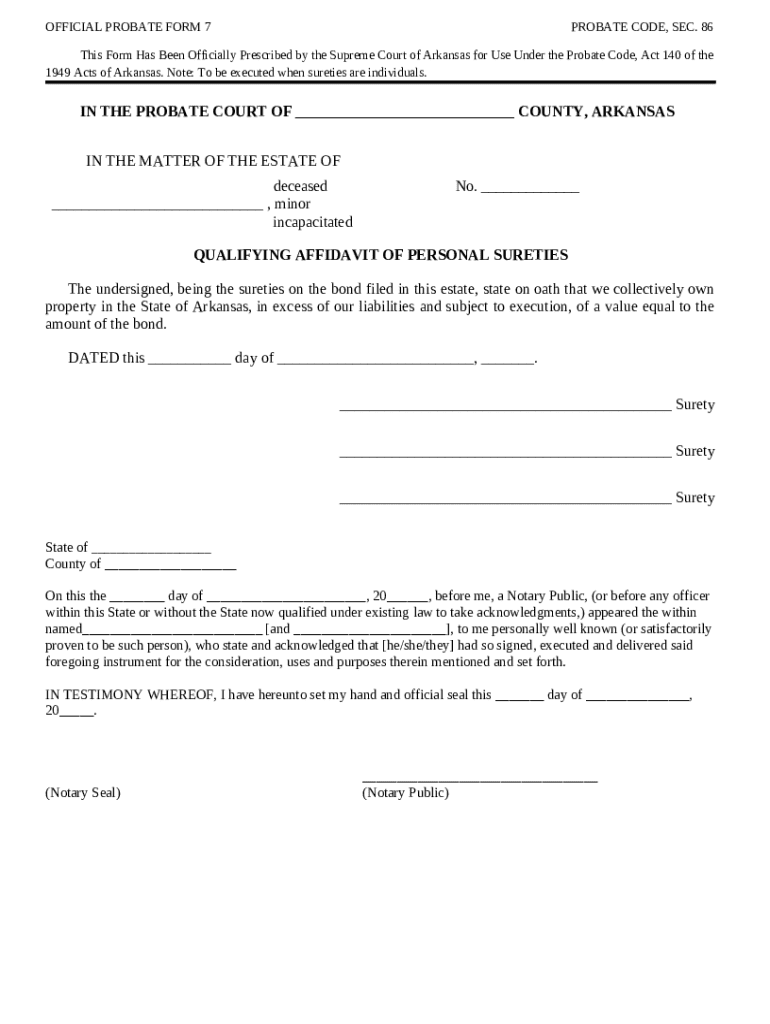

Qualifying Affidavit of Personal Sureties. This official probate form is executed by the sureties to a bond posted with the probate court by the personal representative or other administrator of the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is qualifying affidavit of personal

A qualifying affidavit of personal is a legal document affirming an individual's identity and intent in relation to legal matters.

pdfFiller scores top ratings on review platforms

Easy to navigate

The product was useful for completing a 1099 tax form

n/a

Excellent

B

gud

Who needs qualifying affidavit of personal?

Explore how professionals across industries use pdfFiller.

How to fill out a qualifying affidavit of personal sureties

A qualifying affidavit of personal sureties is a crucial document in the probate process that ensures the estate is administered in accordance with the law. This guide will walk you through what a qualifying affidavit is, its prerequisites, how to fill it out, and the submission process. Understanding this form is essential for individuals acting as sureties in estate administration.

What is a qualifying affidavit?

A qualifying affidavit of personal sureties is a legal document that verifies a person’s eligibility to act as a surety in the process of estate administration. This affidavit serves as confirmation that the personal sureties agree to take on financial liability for the estate as opposed to a corporate bond.

-

It is a formal statement confirming the financial reliability and legal accountability of the sureties.

-

This affidavit protects the interests of heirs and creditors by ensuring the surety has the financial capability to fulfill obligations.

-

A qualifying affidavit is necessary when the executor or administrator does not provide a corporate surety bond.

What are the prerequisites for using the qualifying affidavit?

Before using a qualifying affidavit, specific prerequisites must be met to ensure compliance with legal and financial standards required by the probate court.

-

Personal sureties must be over 18 years old and reside in the same jurisdiction as the estate.

-

Sureties must demonstrate adequate financial standing, generally proven via assets or income verification.

-

Signing the affidavit means the surety has legal obligations and financial liabilities should the estate fail to meet its debts.

What essential documents should you prepare?

Preparing the right documents is critical in filling out your qualifying affidavit accurately, ensuring a seamless submission process.

-

Gather documents like identification, proof of income, and summaries of your assets.

-

These may include bank statements, pay stubs, and other assets documentation to reflect your capability.

-

Ownership documents for real estate or significant financial assets lend credibility to the affidavit.

How do you fill out the qualifying affidavit?

Filling out the affidavit requires careful attention to detail to avoid mistakes that can delay processing.

-

Follow the user-friendly instructions available on platforms like pdfFiller to complete your form efficiently.

-

Make sure to understand the purpose of each section of the form, which can often be clarified online.

-

Double-check your information; common errors include incorrect asset valuations or missing signatures.

What does the notarization process involve?

Notarization provides an additional layer of verification for your qualifying affidavit, ensuring its legitimacy in court.

-

You’ll need to present valid identification and be in the presence of a licensed notary public.

-

Search for notary services available in your area or utilize online notary platforms.

-

This process authenticates the document, preventing possible disputes in the future.

How do you submit the qualifying affidavit?

Submitting your completed affidavit is the final step before the probate court can proceed with estate matters.

-

You can typically submit the affidavit in person or electronically, depending on your jurisdiction.

-

Expect a timeframe for the court to review and approve your affidavit; this can vary by location.

-

Keep a copy for your records and monitor for any communications from the probate court regarding your submission.

How can pdfFiller assist you with document management?

Tackling the complexities of legal documents becomes easier with tools offered by pdfFiller, a platform designed for efficient document handling.

-

Utilize pdfFiller to edit your qualifying affidavit and tailor it to your specific needs seamlessly.

-

eSign your forms electronically and easily share documents safely with other relevant parties.

-

Leverage collaboration features that allow multiple users to engage with the document, facilitating teamwork.

How to fill out the qualifying affidavit of personal

-

1.Begin by downloading the qualifying affidavit of personal template from pdfFiller.

-

2.Open the document in pdfFiller's editor.

-

3.Fill in your personal information, including your full name, address, and contact information in the designated fields.

-

4.Provide a brief statement of the purpose of the affidavit, explaining why it is necessary.

-

5.Sign and date the document in the specified area, ensuring your signature is clear and legible.

-

6.If required, include a notary section where a notary public can verify your identity.

-

7.Review all entries for accuracy and completeness before finalizing the document.

-

8.Save your filled affidavit and export it in your preferred format, such as PDF or Word.

-

9.If needed, print a copy for your records and any parties who may require it.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.