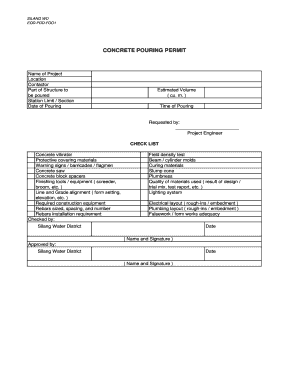

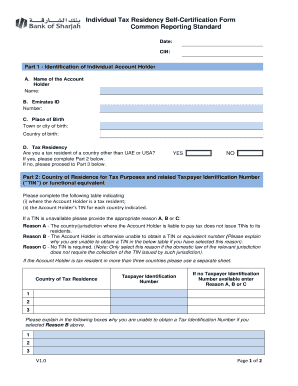

Get the free Notice of Levy for Delinquent Taxes template

Show details

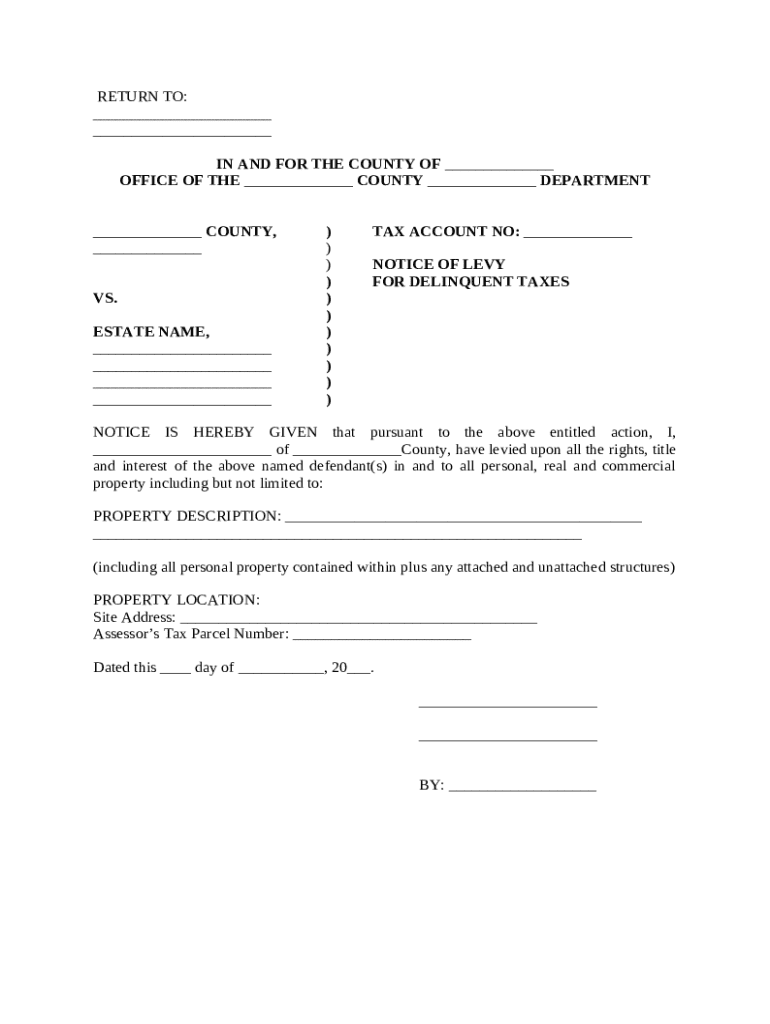

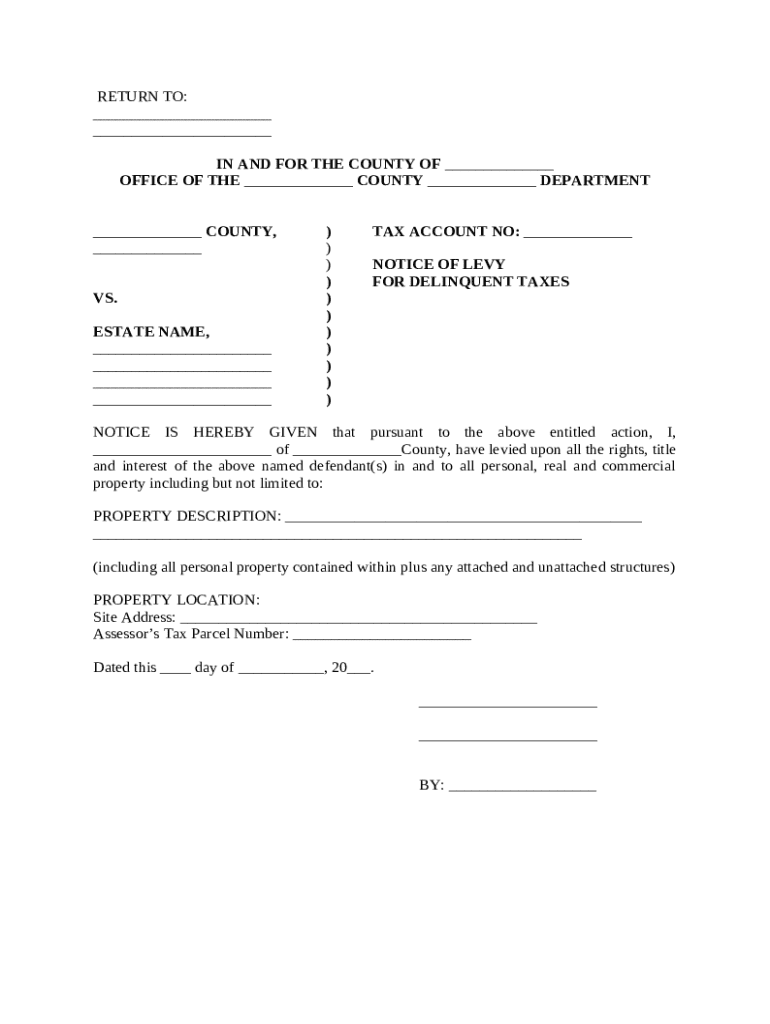

This Notice of Levy permits the legal seizure of title and interest to all personal, real, and commercial property to satisfy a tax debt.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of levy for

A 'notice of levy for' is a legal document used by a creditor to inform an individual or entity that their property, funds, or wages are subject to seizure due to a debt obligation.

pdfFiller scores top ratings on review platforms

jhony

perfect application

Very useful app

Excellent!

Excellent! Easy to use and easy to notarize the documents.

useful

It is quite expensive. But it is nice that they have a month of free trial

PDF Filler is wonderful

This is a fabulous company and product with all-star customer support! You can't go wrong with PDF Filler!

THIS PROGRAM IS AMAZING ITS SAVED ME SO…

THIS PROGRAM IS AMAZING ITS SAVED ME SO MUCH TIME! EASY TO USE AND GREAT CUSTOMER SERVICE!

Who needs notice of levy for?

Explore how professionals across industries use pdfFiller.

How to fill out a notice of levy for form form

Understanding the Notice of Levy

A notice of levy serves as an official document notifying you that the IRS is seizing your assets to satisfy a tax debt. Understanding its purpose can help you manage your finances effectively. Key terms often associated with levies include 'Property Description' and 'Estate Name,' which outline the specifics of what is being seized.

-

This indicates the specific asset, like a bank account or property, that is subject to the levy.

-

Typically the name of the individual or business entity whose assets are being levied.

Overview of Form 668-A and Form 668-W

Form 668-A and Form 668-W are two primary documents used for IRS levies. Knowing the differences between each form is crucial for appropriate compliance with tax regulations. Form 668-A generally pertains to levies on property other than wages, while Form 668-W is specifically for wage garnishment.

-

Used for levying property that is not related to wages, such as bank accounts or tangible assets.

-

Specifically utilized to garnish wages directly from an individual’s paychecks.

The Levy Process Explained

The IRS follows a structured process when it comes to levies. Understanding each step can prepare you for what to expect. A levy can be issued by the IRS or a state taxation agency under certain conditions, and failing to comply can have serious financial consequences.

-

The IRS sends you a notice outlining the intent to levy your property.

-

You have a limited time to respond before the levy is executed, often a window of 30 days.

-

Failure to respond can lead to wage garnishments, liens on property, or seizure of assets.

Filling out the Notice of Levy Form

Filling out the notice of levy form accurately is critical for ensuring compliance and avoiding complications. Required fields typically include the Property Description, Site Address, and Tax Account Number.

-

Clearly identify what asset is being levied.

-

Provide the precise location of the property or where the wages are drawn.

-

Include your IRS tax account number, crucial for the IRS to connect the form to your case.

Managing a Levy: Your Rights and Options

Receiving a levy notice can be daunting, but it's important to know your rights. Options for disputing or appealing a levy exist, and negotiating a release is possible under certain circumstances.

-

Contact the IRS immediately to discuss your options before the levy is enforced.

-

You have the right to appeal the levy if you believe it was issued in error.

-

You may negotiate a levy release if you can prove financial hardship.

Tools and Resources on pdfFiller for Handling Levies

pdfFiller provides a host of tools for filling out and managing your notice of levy forms. Its easy-to-use interface includes collaborative features that allow multiple users to work on a document simultaneously.

-

Provides detailed instructions for filling out the Notice of Levy form accurately.

-

Allows users to securely sign and store their completed forms in the cloud.

Real-World Scenarios: How Levies Impact Individuals and Businesses

Levies can have profound impacts on both individuals and businesses. Understanding these consequences can help in planning effective responses.

-

Individuals may see significant changes to their budgeting and spending due to wage garnishments.

-

In businesses, levies on accounts receivable may hinder cash flow and operations.

How to fill out the notice of levy for

-

1.Access the pdfFiller website and log in to your account.

-

2.Search for 'notice of levy for' template in the search bar.

-

3.Select the appropriate template and open it for editing.

-

4.Fill in the debtor's personal details, including their name, address, and the amount owed.

-

5.Provide the creditor's information, such as name, company, and contact details.

-

6.Indicate the type of property you intend to levy, whether it's wages, bank accounts, or personal property.

-

7.Include the date of the notice at the top of the document.

-

8.Review the filled information for accuracy and correctness.

-

9.Use the tools available to add your signature and any witness signatures if required.

-

10.Save the completed document and export it in the desired format, usually PDF, for distribution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.