Get the free Promissory Note - Horse Equine s template

Show details

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a written promise to pay a specified amount for the purchase or loan of a horse and outlines the terms of repayment.

pdfFiller scores top ratings on review platforms

It was very helpful and made things a whole lot easier to get things done.

It was so easy to use and I completed the project quickly!

Nice and easy/simple to use.

Nice user interface.

PDFfiller is so easy to use!! PDF's are so often difficult to manipulate when you need to complete a form. PDFfiller makes it simple to do!

This is a great program, easy to use and is going to be a great asset

So far I 'am totally amazed @ what I can accomplish!

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Promissory Note on pdfFiller

Filling out a promissory note is simple with the right guidance. This comprehensive guide will explore all aspects of promissory notes, including their components, legal implications, and how to utilize pdfFiller for efficient document management.

What are promissory notes?

A promissory note is a written promise from one party to pay a specified sum to another party under defined terms. This legal document serves both as a loan agreement and a security agreement, making it vital in financial transactions.

-

Promissory notes establish formal contracts for loans, specifying how and when repayment will occur.

-

These typically include the Principal Sum, Interest, and Due Date.

-

Secured notes are backed by collateral, while unsecured notes are not.

What key elements should be in your promissory note?

Every promissory note should contain crucial elements that outline the terms of the loan. This ensures both parties understand their obligations.

-

This is the original loan amount. Understanding how to calculate and set this figure is critical.

-

You'll need to choose between fixed or variable rates, which will affect overall repayment amounts.

-

Clearly define the obligations of both the lender and borrower.

How do you fill out your promissory note?

The filling process can be straightforward, especially with tools like pdfFiller that streamline document creation.

-

Follow each step on pdfFiller for a seamless experience.

-

Enter accurate Names, Addresses, Amounts, and Dates to avoid legal issues.

-

Double-check all entries and ensure compliance with applicable laws.

What legal compliance issues should you consider?

Understanding local regulations is crucial when creating a promissory note to ensure it is enforceable.

-

Compliance varies by region and can impact the validity of your note.

-

Clear clauses should outline the consequences of failing to meet terms.

-

Adhering to best practices enhances the enforceability of your promissory note.

How do you edit and manage promissory notes?

Using pdfFiller’s tools allows for effective document management when dealing with multiple versions of promissory notes.

-

Make modifications easily with built-in editing features.

-

Share and sign documents with stakeholders directly through pdfFiller.

-

Monitor document versions to maintain clarity and compliance.

What implications does prepayment have?

Prepayment clauses are important aspects of a promissory note that affect loan repayment.

-

Know how early repayment can change interest calculations.

-

Learn how to compute these adjustments responsibly.

-

Paying early can reduce total interest obligations.

What steps should you take for late payments and defaults?

Addressing late payments promptly can prevent escalation into defaults.

-

Understanding potential legal repercussions is critical.

-

Explore available choices for both lenders and borrowers.

-

Tools like pdfFiller can help in keeping records of all transactions.

How can pdfFiller facilitate your promissory note needs?

pdfFiller offers a robust platform for managing all types of promissory notes and other documents.

-

Explore functionalities relevant for document management.

-

Fill out and edit your promissory note from any device.

-

Ensure compliance with industry standards for data protection.

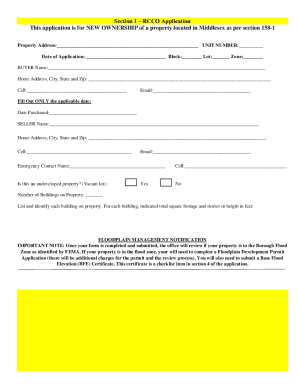

How to fill out the promissory note - horse

-

1.Open the promissory note - horse template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Next, fill in the name and address of the borrower and lender in the designated fields.

-

4.Specify the amount of the loan or purchase price in the appropriate section.

-

5.Indicate the payment terms, including interest rate, repayment schedule, and any penalties for late payments.

-

6.If applicable, include details about collateral or security related to the horse being financed.

-

7.Read through the agreement to ensure all information is accurate and that it complies with local laws.

-

8.Have both parties sign the document electronically if using pdfFiller's e-signature feature.

-

9.Save and download the completed promissory note for both parties' records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.