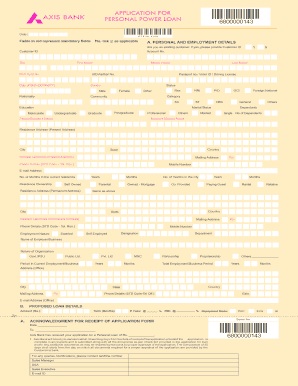

Get the free Property of Estate with Appraisals Designated - Schedule A template

Show details

Property of Estate with Appraisals Designated - Schedule A - Arizona: This form is used when an administrator of an estate is called upon to list all the property, with appraisals of said property,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is property of estate with

A 'property of estate with' document outlines the ownership and rights associated with a specific property within an estate.

pdfFiller scores top ratings on review platforms

Seemed simple process..

good job on app

I am satisfied with the features of the…

I am satisfied with the features of the system. It meets my requirements.

Great program with no issues

Great program with no issues! Works every time!!

great!

great! I love it

I'm loving it so far.

Who needs property of estate with?

Explore how professionals across industries use pdfFiller.

Long-Read How-To Guide on Property of Estate with Form Form

What is the property of estate and why is it important?

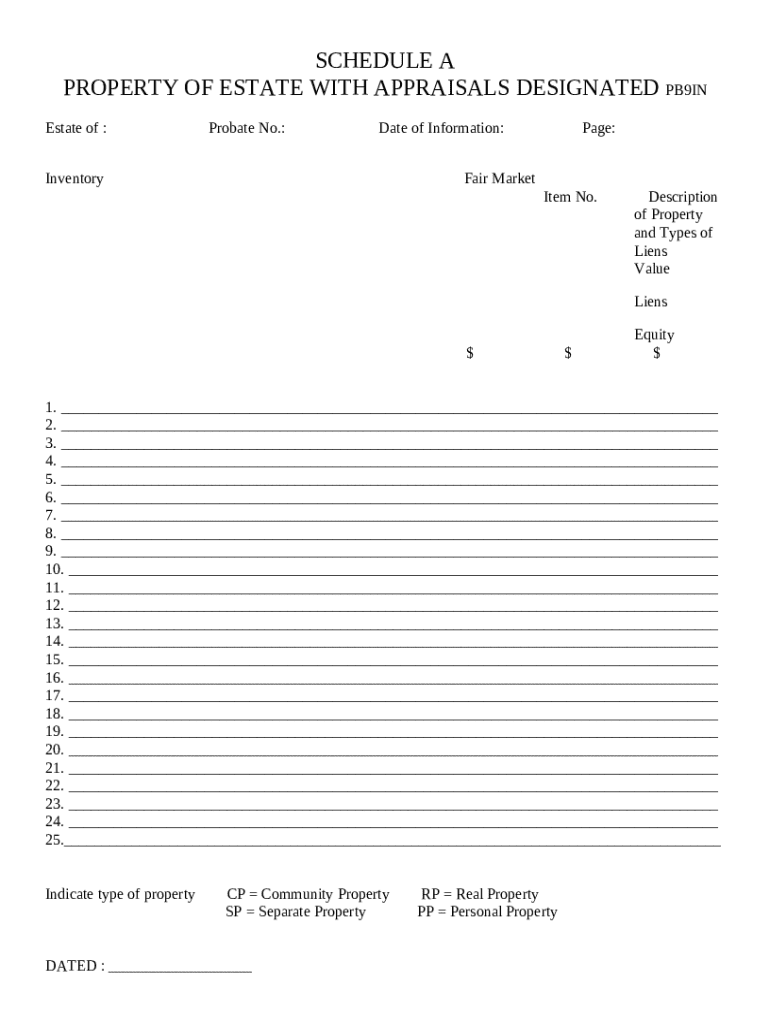

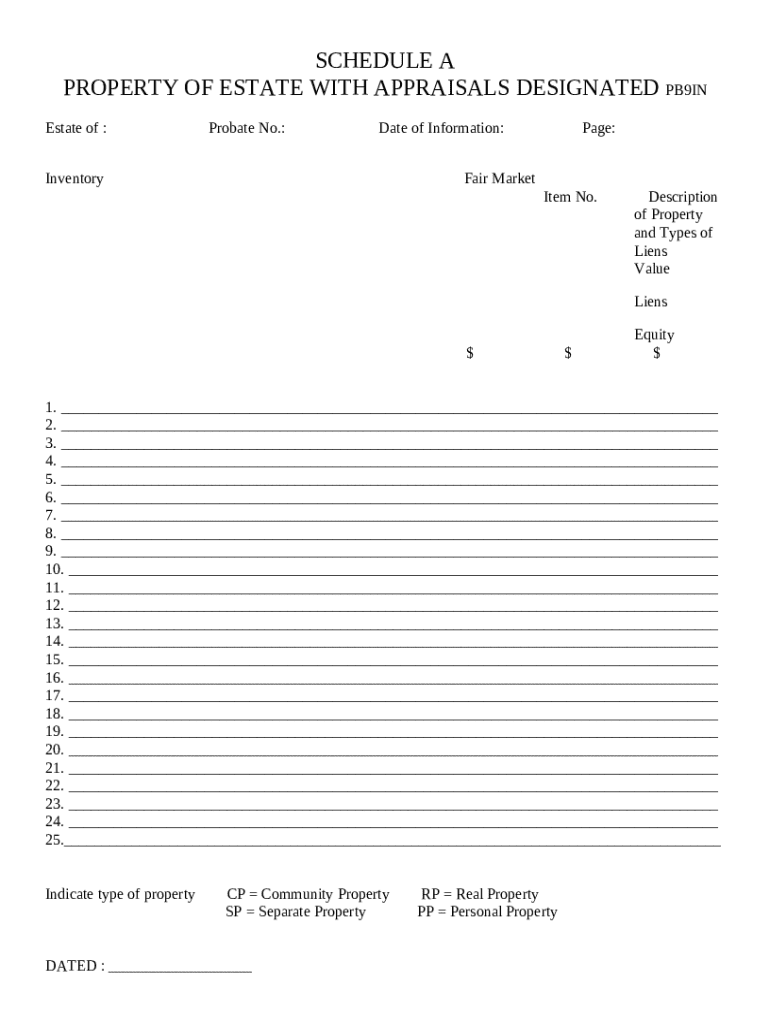

The property of estate refers to the assets and obligations belonging to a person who has passed away, significant during the probate process. Understanding its components—such as estate name, probate number, and information date—facilitates smoother legal and administrative procedures, ensuring that the deceased's wishes are respected.

-

The official title of the estate, which can play a role in legal identification.

-

Unique identification assigned to the estate during the probate process.

-

The date when the estate information was recorded, pertinent for legal timelines.

How do you navigate the property inventory process?

Navigating the property inventory process is essential for accurately documenting what the estate holds. Schedule A, for instance, contains comprehensive details about assets, including real estate, personal belongings, and any debts or liens attached. Documenting these accurately aids in establishing the total value of the estate, which is pivotal for settling affairs.

-

Different categories of property such as real estate and financial assets.

-

Any debts or claims against the property that may impact its value.

-

The estimated price the property would sell for on the open market.

What are effective strategies for filling out form components?

Filling out form components accurately is critical for the successful administration of an estate's assets. Carefully completing the Inventory section involves a step-by-step approach to ensure no details are overlooked. Common mistakes include vague descriptions and miscalculations of value, which can lead to legal complications down the line.

-

Ensure all descriptions are precise and accurately reflect the assets.

-

Implement methods for calculating fair market values and associated liens to avoid discrepancies.

What types of property are included under estate considerations?

Various classifications of property are recognized under estate laws. These include community property, which is jointly owned by spouses, separate property that belongs to one individual, real property like land and buildings, and personal property such as cars and jewelry. Understanding the implications of each classification plays a significant role in probate cases.

-

Assets acquired during marriage, typically divided equally between spouses.

-

Includes all land and any structures on that land.

-

Assets owned by one spouse before marriage or received as a gift or inheritance.

-

Includes movable items like vehicles, furniture, and collectibles.

What roles do legal signatories play in the estate management process?

Legal signatories are pivotal in the management of an estate. Personal representatives oversee the execution of estate terms while conservators manage the financial aspects for incapacitated individuals. The attorney's signature is critical for validating documents and ensuring they meet legal standards, highlighting the importance of diligent dating for all legal forms.

-

Individuals appointed to administer the estate, ensuring the deceased's wishes are honored.

-

They manage the financial affairs of individuals who are unable to do so themselves.

-

Essential for legal validation of documents within the probate process.

How do you comply with state-specific regulations regarding property?

Compliance with state-specific regulations is a necessity for managing estate properties effectively. Regulations often vary by region, affecting how estates are handled. Research and verify these regulations to ensure adherence, which can prevent legal issues or delays in the probate process.

-

Familiarize yourself with the common regulations governing estate properties.

-

Understand the specific compliance notes relevant to your state or region.

-

Leverage platforms like pdfFiller for efficient management of compliance documents.

How can pdfFiller boost your document management?

pdfFiller offers a suite of tools designed to simplify the process of estate document management. Users can create, edit, and manage important forms seamlessly—capabilities that enhance collaboration and streamline workflows. Additionally, features such as eSigning allow you to complete transactions quickly and efficiently from any location, reinforcing pdfFiller's positioning statement of empowering users through cloud-based document solutions.

-

Users can easily create and modify estate forms to meet their specific needs.

-

Allows multiple stakeholders to work on documents simultaneously.

-

Access and manage documents anywhere, reassuring efficient estate management.

How to fill out the property of estate with

-

1.Open the PDF document titled 'property of estate with' in pdfFiller.

-

2.Begin by filling in the name of the property owner at the top of the document.

-

3.Next, enter the legal description of the property, including address, parcel number, and any relevant details.

-

4.Provide the date of the ownership transfer and any existing encumbrances.

-

5.Indicate the beneficiaries and their relationship to the estate owner in the designated section.

-

6.Attach any necessary documents that support the claims made in the form, such as property deeds or trust documents.

-

7.Review all filled information for accuracy and completeness.

-

8.Once confirmed, save the completed document and choose 'submit' or 'print' as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.