Get the free Transfer of Real Property of a Decedent - Community Property with Right of Survivorship

Show details

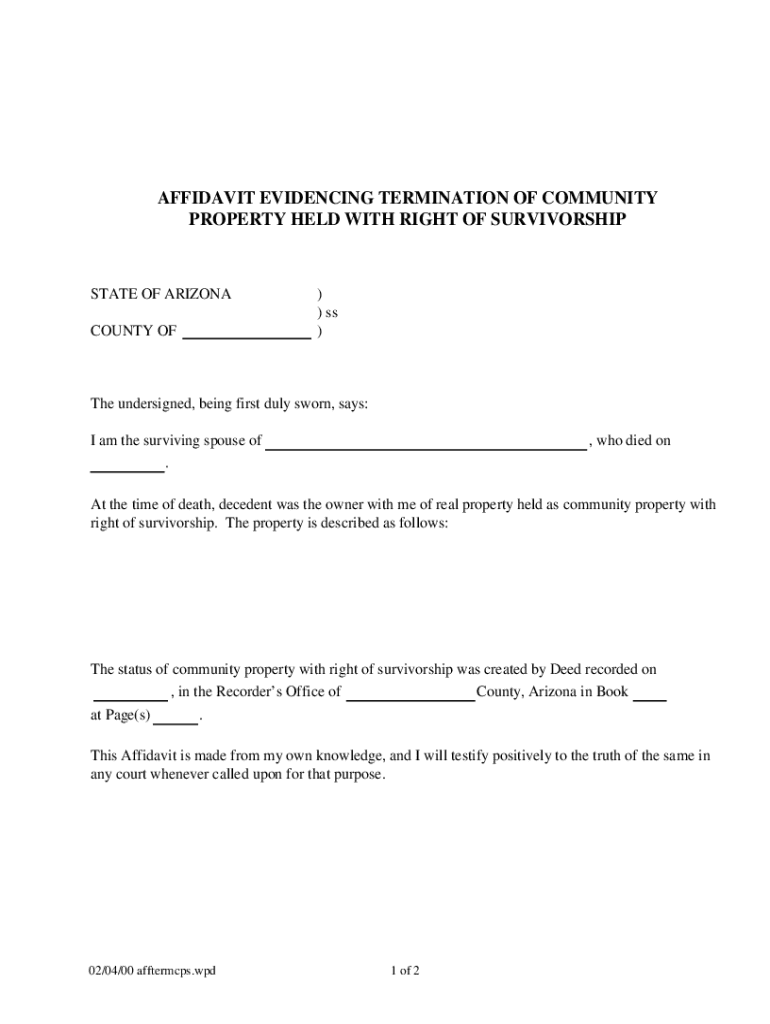

This form is an affidavit evidencing the survivorship of the spouse of the decedent and testifying to his/her right to the real property. This is an official form from the Arizona Court System,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer of real property

A transfer of real property is the legal process by which ownership of real estate is conveyed from one party to another.

pdfFiller scores top ratings on review platforms

No nonsense, lets me fill out as I want, invaluable tool

Too may little boxes when your trying to type in with text editor.

It will be great as soon as I learn how to navigate bette

I can't put "/" in some of the box

Very nice online experience using this website and the forms.

Can't afford the subscription at this time. Thank you.

Who needs transfer of real property?

Explore how professionals across industries use pdfFiller.

Completing the Transfer of Real Property Form: A Comprehensive Guide

The transfer of real property form is essential for legally documenting the transition of property ownership, especially when it involves community property and the estate of a deceased individual. Understanding the nuances of this form can greatly enhance the process of property transfer and ensure compliance with legal requirements.

How important is the Transfer of Real Property Form?

-

The Affidavit confirms the termination of community property, clarifying ownership rights after the death of a spouse, which can ease complications during property transfers.

-

Owning property as joint tenants with rights of survivorship allows the property to pass directly to the surviving spouse without going through probate.

-

For surviving spouses, the transfer form simplifies the inheritance process, ensuring that property ownership transitions smoothly and legally.

What do you need before you start?

-

Gather essential documents like the Certificate of Death and Estate Tax Waiver to facilitate the transfer process.

-

Have the name, date of death, and property details of the decedent ready to ensure accurate form completion.

-

Understanding prior property records, including deeds and county filings, is crucial for establishing a clear ownership path.

How do you fill out the Transfer of Real Property Form?

-

Ensure that the Affiant's name and relationship to the decedent are filled out accurately to verify standing in the transaction.

-

Provide the location and precise legal description of the property, ensuring clarity for the Recorder's Office.

-

Include information regarding the recorded Deed that established rights of survivorship to facilitate processing.

What is the notarization process?

-

Follow the necessary steps to correctly notarize the Affidavit, which is integral for its legal validity.

-

Valid identification is required to verify your identity, ensuring the integrity of the notarization.

-

Notarization enhances the legal efficacy of the document, making it official and enforceable.

How do you submit the Transfer of Real Property Form?

-

Locate the appropriate Recorder's Office for filing your form to ensure legal processing at the right jurisdiction.

-

Be aware of the filing procedures and any associated fees to avoid delays in submission.

-

Know the typical timelines for submission and how to track the status of your filing to remain informed.

What are common issues you might encounter?

-

Identifying mistakes while filling out the form can save you time and prevent legal issues down the line.

-

Ensure compliance with local laws, particularly if you are in the State of Arizona, to avoid complications.

-

Seek resources, such as local legal aid or pdfFiller support, for guidance if you face challenges.

What are the next steps after filing the form?

-

Properly managing and retaining copies of filed documents is crucial for future reference and legal needs.

-

Be aware of future implications on property taxes or revised estate planning that may arise after the transfer.

-

Utilize pdfFiller’s resources for document management to streamline future document-related activities.

How to fill out the transfer of real property

-

1.Open the PDFfiller application and locate the 'Transfer of Real Property' template.

-

2.Click on the fields that need to be filled out to enter relevant information such as the names of the buyer and seller, property details, and the sale amount.

-

3.Make sure to include the property address, legal description, and any applicable contingencies or special conditions.

-

4.Review the filled-out information for accuracy and completeness before finalizing the document.

-

5.Once confirmed, proceed to sign the document either electronically or by printing it out for manual signatures.

-

6.Save the completed document to your account or download it for your records after submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.