Get the free Sale of Assets - Asset Purchase template

Show details

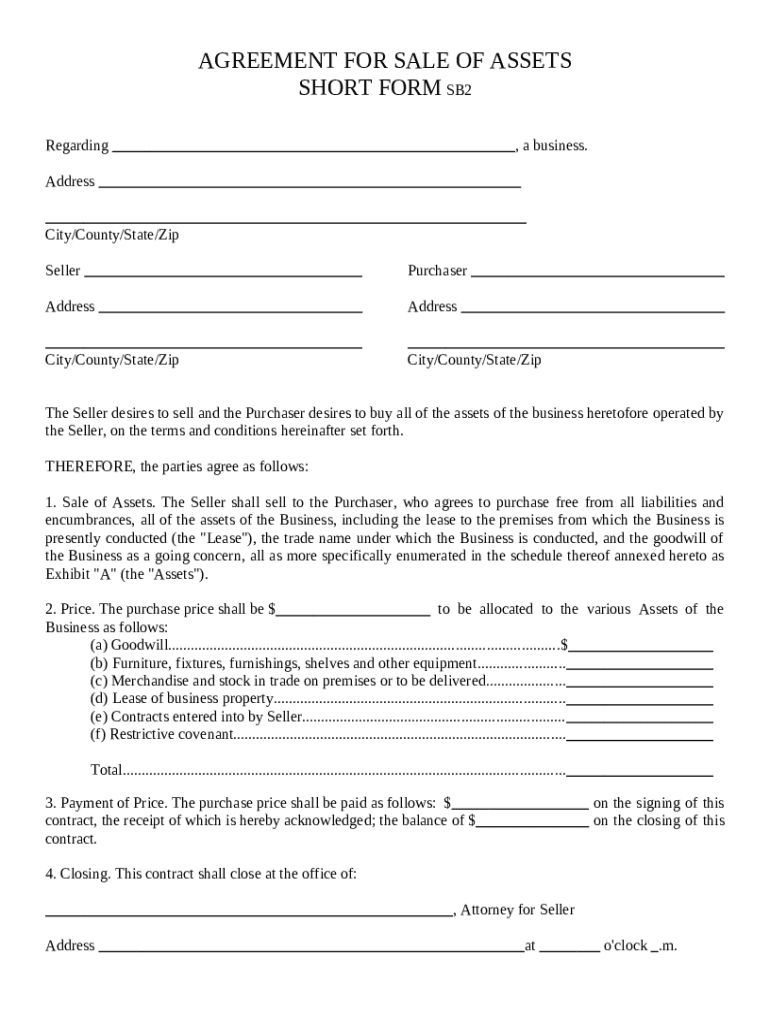

Seller desires to sell and purchaser will buy all of the assets of a business that is being operated by seller. Purchaser agrees to buy free from all liabilities and encumbrances, all the assets of

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sale of assets

The sale of assets refers to the process of transferring ownership of tangible or intangible property from one party to another.

pdfFiller scores top ratings on review platforms

I would like to attend a webinar to help me understand it better. Just signed up

Took a little time to get acquainted with program but overall a good program.

HAVE YET TO FIND A FORM I COULDN'T FILL OUT ON PDFfiller. THE ULTIMATE TIME SAVER FOR OUR BUSINESS!

would like to work on implementing into my medical practice

The process was easy, and I was satisfied with the results.

Easy access to almost every form. Reuse, email, FILE

Who needs sale of assets?

Explore how professionals across industries use pdfFiller.

Detailed Guide to Sale of Assets Forms

How to fill out a sale of assets form?

Completing a sale of assets form involves understanding its key components and accurately detailing each party's information. Start by gathering necessary documentation and understanding legal terms to ensure accuracy throughout the form.

Understanding sale of assets forms

A sale of assets form is a legal document used to outline the sale of business assets from one party to another. Its primary purpose is to ensure both parties agree to the terms of the sale and to provide a record for legal and tax purposes. Key components include a description of assets being sold, the sale price, and relevant party details.

-

Defines the transaction of selling business assets, detailing which items are for sale and under what conditions.

-

Includes seller and purchaser information, descriptions of assets, and agreed-upon purchase price.

-

Plays a crucial role in business transactions by providing a clear framework for recording agreements and facilitating future reference.

The significance of Form 8594 in asset sales

Form 8594 is essential for reporting the sale of a business and helps identify the allocation of the purchase price among various assets sold. It is required in certain situations, and not using it when necessary can lead to issues with the IRS.

-

Used mainly for reporting the details of sales involving multiple assets, allowing for transparency in how transaction values are assigned.

-

Unlike other forms that may only report individual transactions, Form 8594 aggregates multiple transactions, providing comprehensive asset details.

-

Required when selling assets that encompass a trade or business, ensuring that the IRS has a thorough understanding of asset distribution.

Preparing to complete the sale of assets form

Preparation is key in accurately completing a sale of assets form. This includes identifying who is involved in the transaction and gathering the necessary documentation.

-

Clearly state who the seller and purchaser are, ensuring correct and legal identification.

-

Collect all related documents such as business asset lists and any existing contracts to facilitate smooth completion.

-

Familiarize yourself with terms used in the form and agreements to avoid misinterpretations.

Step-by-step guide for completing the form

Filling out a sale of assets form can be simplified by following a structured process. Each section should be meticulously filled with accurate information.

-

Provide complete seller information, including name, address, and contact information.

-

Similarly, include full purchaser details to ensure clarity in the transaction.

-

Clearly describe each asset included in the sale, ensuring that buyers understand exactly what is being purchased.

-

Categorically outline the valuation of each asset to avoid future disputes.

-

Make sure to establish payment terms and conditions prior to finalizing the agreement, ensuring all parties are aware of their responsibilities.

Common errors in completing sale of assets forms

Mistakes in sale of assets forms can lead to significant complications, especially regarding tax implications and compliance issues.

-

Missing key information can result in confusion and legal complications down the line.

-

Incorrectly categorizing asset values can prompt scrutiny from the IRS and lead to penalties.

-

Failing to comply with local regulations can invalidate the sale or lead to penalties.

Navigating compliance and legal considerations

Ensuring compliance with local regulations is critical during asset sales to avoid legal repercussions. The specific requirements may vary depending on the [region].

-

Research the local laws and regulations governing asset sales in your area to ensure compliance.

-

Inaccurate information can lead to severe penalties from regulatory bodies.

-

Having legal experts review your form can help prevent errors and ensure that all necessary steps are taken.

Final steps before closing the sale

The final steps in the sale process are critical to ensuring a smooth transaction. Proper preparation and understanding of obligations can facilitate the closing process.

-

Ensure all relevant documentation is ready and meetings are scheduled for the closing day.

-

A bill of sale serves as a confirmation of transfer; it should be delivered on closing day.

-

Both buyer and seller should be clear about their responsibilities after the sale closes.

Utilizing pdfFiller to simplify your document process

pdfFiller offers extensive features for editing, filling out, and managing sale of assets forms, streamlining the document process significantly.

-

Easily edit and fill out sale of assets forms with built-in tools designed for user-friendliness.

-

Securely share and sign documents electronically, enhancing the overall convenience of the transfer process.

-

Keep all sale-related documents organized and accessible through a centralized cloud-based platform.

How to fill out the sale of assets

-

1.Begin by downloading the sale of assets form from pdfFiller or open an existing document in your account.

-

2.Fill in the names and addresses of both the seller and the buyer in the designated fields.

-

3.Clearly describe the assets being sold, including any relevant details such as condition, valuation, and ownership history.

-

4.Specify the sale price for the assets in an appropriate section of the document.

-

5.Include any contingencies or terms of the sale that may be necessary, such as warranties or payment methods.

-

6.Review all information for accuracy and completeness, ensuring all required signatures are available.

-

7.Once filled out, you can save, print, or share the document directly from pdfFiller to facilitate the transaction.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.