Last updated on Feb 17, 2026

Get the free Security Agreement template

Show details

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is security agreement

A security agreement is a legal document that grants a lender a security interest in an asset or property as collateral for a loan or obligation.

pdfFiller scores top ratings on review platforms

Very good and usefull

I am able to perform some functions but others are harder and not so intuitive. Would in interested in getting a tutorial.

worked like it was supposed to

It's really easy to edit PDF's

I have had a very good experiente with pdf filler. I added an identification tag to almíscar all pdf files I had to send to the Court.

I was a Little disappointed because there is not a tool to make these files less heavy... but may be you can develop it soon...

IT IS NICE BUT EXPENSIVE

Who needs security agreement template?

Explore how professionals across industries use pdfFiller.

Complete guide to security agreement form

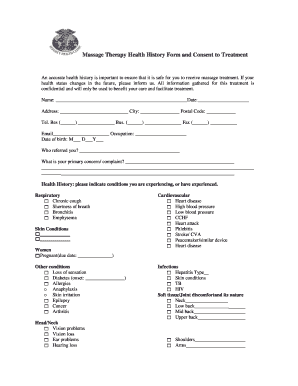

How to fill out a security agreement form?

Filling out a security agreement form is an essential process when securing a loan or credit. This guide provides step-by-step instructions and insights on accurately completing this necessary document to ensure legal compliance and safeguard your interests.

Understanding the security agreement

A security agreement is a legal document that outlines the terms under which collateral is pledged to guarantee a debt. It's pivotal for lenders as it helps ensure that a loan is backed by tangible assets, offering them reassurance in case of default.

-

The security agreement defines the terms of the collateral and its value, should the borrower default on the loan.

-

It protects both the lender and the borrower, establishing clear expectations and reducing potential disputes about collateral.

-

The secured party is the lender who holds the security interest, while the debtor is the borrower who provides the collateral.

What are the components of a security agreement?

Understanding the components of the form is imperative for accurately conveying the terms of the contract and avoiding legal issues.

-

Include the full name and address of the secured party to establish their identity and claim to the collateral.

-

Accurate details about the debtor, such as personal identification and contact info, are essential for enforceability.

-

A thorough description of the collateral being pledged must be included to avoid ambiguity and ensure clarity.

-

Clearly state the payment terms and conditions to uphold the borrower's commitment.

How to fill out the security agreement form effectively?

Completing this form accurately is crucial for legal validity. Using tools that guide you through the process can minimize errors.

-

Follow the user-friendly interface on pdfFiller, which walks you through each section of the agreement.

-

Interactive tools can help verify information in real-time, preventing mistakes that could jeopardize your document's integrity.

-

Double-check details like names, addresses, and the property description, as minor errors can lead to significant legal issues.

How to edit and customize your document?

Editing your security agreement form can streamline its functionality and ensure it meets your specific needs.

-

Leverage pdfFiller’s robust editing features to tailor your agreement according to unique requirements.

-

Incorporate electronic signatures to expedite the agreement process while maintaining legal integrity.

-

Export the final document in various formats, ensuring ease of sharing and storage.

What are best practices for managing your security agreement?

Safeguarding your security agreement and its relevant details is essential to prevent complications in the event of disputes or defaults.

-

Using secure cloud storage solutions provides easy access while protecting your document from unauthorized access.

-

Ensure that all parties involved have access to the document, promoting transparency and accountability.

-

Grasping the potential consequences of missed payments can guide decisions to avoid default.

What are the legal considerations and compliance issues?

Navigating the legal landscape surrounding security agreements is crucial for ensuring compliance and protecting your rights.

-

Stay informed about laws specific to your location that govern security agreements to avoid legal pitfalls.

-

Familiarize yourself with industry best practices concerning legal requirements to ensure your agreement remains valid.

-

Be cautious about amendments, as they may alter your rights and obligations outlined in the original document.

Common scenarios for using a security agreement

Knowing when and how to use a security agreement could significantly mitigate risks associated with borrowing.

-

Personal loans often require security agreements when significant sums are involved, ensuring both parties' interests are protected.

-

Businesses frequently use security agreements to secure lines of credit or loans to operate smoothly.

-

Utilizing a security agreement lowers the risk of loss for lenders and can improve loan terms for borrowers.

How to fill out the security agreement template

-

1.Open pdfFiller and upload the security agreement template.

-

2.Begin by entering the names and contact details of the parties involved at the top section.

-

3.Specify the loan amount and terms in the designated fields.

-

4.Identify the collateral in detail, including descriptions, serial numbers, or addresses, as required.

-

5.Indicate the rights and obligations of each party clearly in the corresponding sections.

-

6.Review the agreement for any errors or omissions, and ensure all fields are completed accurately.

-

7.Sign the document electronically where required, ensuring all parties also sign if needed.

-

8.Save the filled security agreement and download it or send it directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.