Last updated on Feb 17, 2026

Get the free Personal Surety Bond of Personal Representative template

Show details

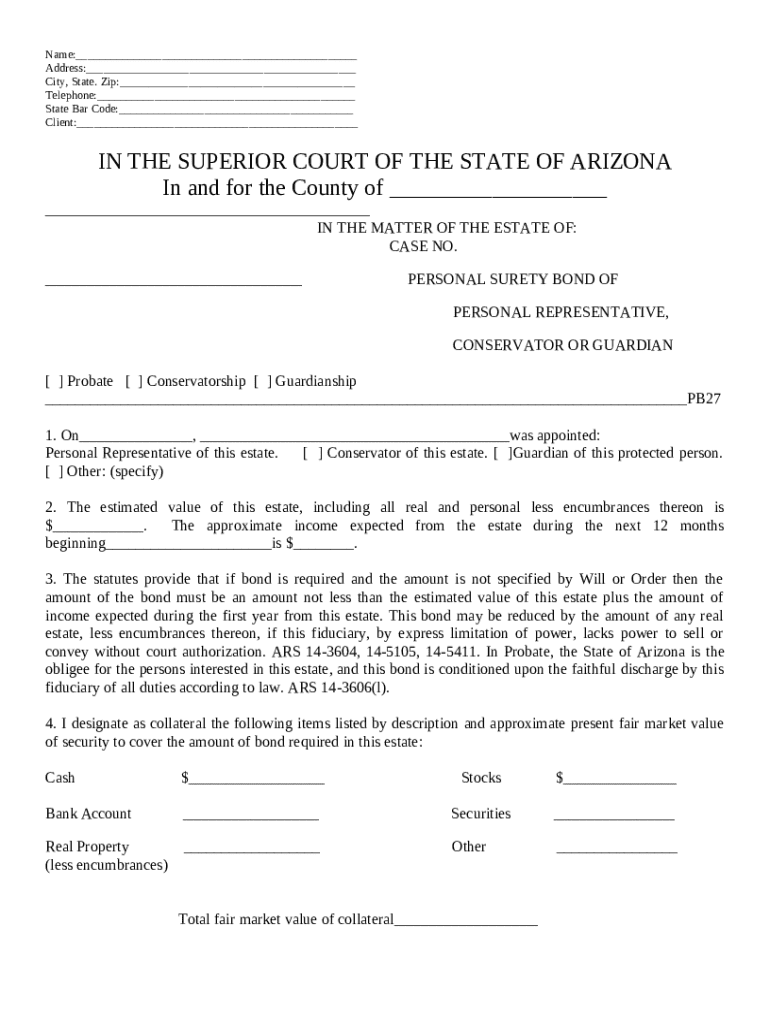

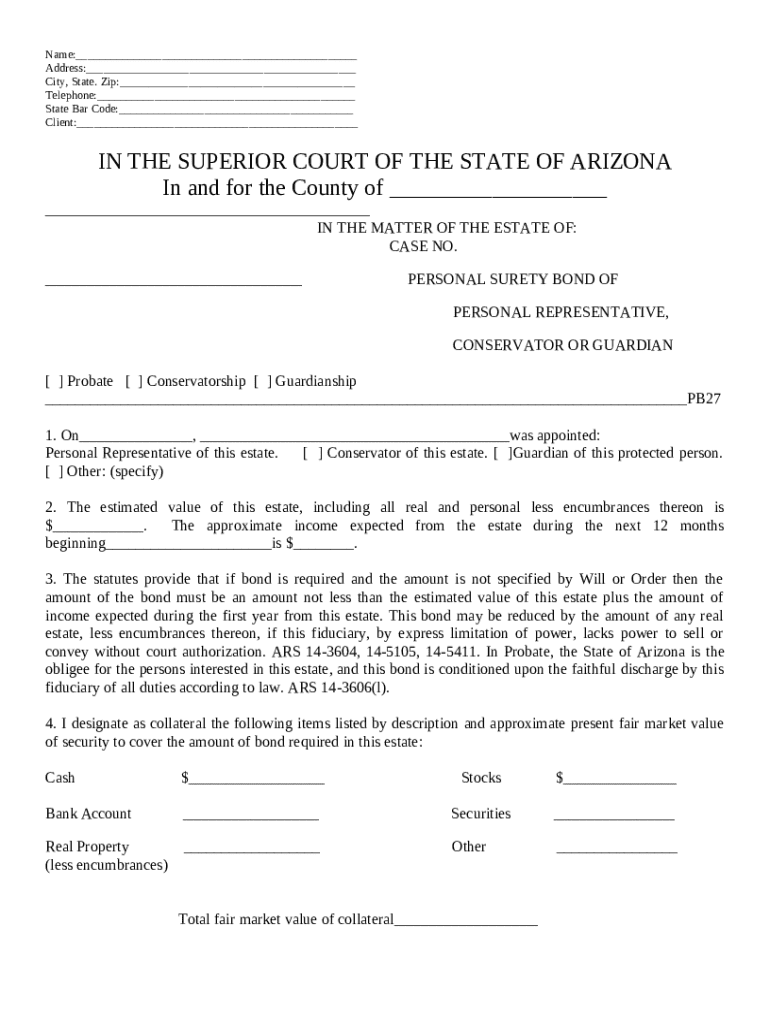

Personal Surety Bond of Personal Rep. - Arizona: This form lists personal items to be used as collateral for the surety bond of the personal representative. The bond is to be of an amount less than

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is personal surety bond of

A personal surety bond is a financial guarantee provided by an individual to ensure the fulfillment of a specific obligation or contract.

pdfFiller scores top ratings on review platforms

this works great

great help

great help. used for answering questions

Works great for my needs!

Good for editing.

It's really good.

All work perfectly, thanks.

Who needs personal surety bond of?

Explore how professionals across industries use pdfFiller.

Personal Surety Bond of Form Form Guide

How does a personal surety bond work?

A personal surety bond functions as a financial guarantee that ensures obligations will be met in various legal contexts like probate, conservatorship, and guardianship. It protects the interests of those involved by promising that if the bondholder fails to fulfill their obligations, the surety company will cover the financial losses. In Arizona, specific legal requirements must be adhered to when issuing personal surety bonds.

-

It is a contract where one party (the surety) guarantees the performance or obligations of a principal to a third party (the obligee).

-

Necessary for providing assurance to courts and affected parties that fiduciaries will manage responsibilities appropriately.

-

In Arizona, bonds must be legally recognized and drafted to fit the specific estate and obligations placed upon the personal representative.

What are the roles of the personal representative, conservator, or guardian?

Each role within personal representative, conservatorship, and guardianship frameworks plays a crucial part in managing sensitive legal matters, including the handling of an individual's estate. These roles entail extensive responsibilities to ensure that the wishes of the deceased or protected individual are followed.

-

They are responsible for managing the deceased's estate, ensuring wills are executed correctly, and addressing debts and taxes.

-

Conservators manage the financial and personal affairs of individuals who are unable to handle their own matters due to incapacity.

-

Guardians are required to protect the welfare of incapacitated individuals, making decisions regarding their health and living arrangements.

How do you fill out the personal surety bond form?

Completing the personal surety bond form is vital as it serves as a formal commitment to fulfill fiduciary duties. Ensuring accuracy in every field of the form is crucial to avoid legal complications.

-

Begin with personal information such as 'Name', 'Address', 'City', 'State', and continue through the essential fields.

-

Fields like 'State Bar Code' and 'Client' are critical and should reflect accurate data to prevent issues.

-

Always double-check abbreviations, ensure that all required fields are filled, and keep a copy for your records.

How is the required bond amount calculated?

Determining the necessary bond amount involves a thorough evaluation of the estate's value and anticipated incomes. Understanding these calculations is imperative for compliance and financial transparency.

-

Begin by conducting a detailed appraisal of all assets within the estate to form an accurate value.

-

Consider all forms of potential income for the estate over the upcoming months to ensure adequate coverage.

-

Follow Arizona's legal standards for minimum bond amounts to ensure compliance with state requirements.

What does collateralizing your personal surety bond involve?

Collateral for a surety bond acts as added security against any default or failure to comply with the bond's obligations. Understanding what qualifies as collateral can be beneficial in securing your bond.

-

Collateral is an asset or property that a bondholder pledges to secure the completion of obligations under the bond.

-

Common items include cash deposits, stocks, real property, or any other asset with a fair market value.

-

When submitting your collateral, it must be accurately listed, and appropriate valuations must be provided.

What are the legal obligations and statutory guidelines?

Understanding the legal framework surrounding personal surety bonds is vital for compliance and to avoid any legal repercussions. Statutory guidelines dictate the responsibilities and liabilities associated with these bonds.

-

The laws governing personal surety bonds in Arizona are designed to protect both the fiduciary and the interests of the beneficiaries.

-

Failure to meet bond obligations can result in financial penalties or even legal action from the state.

-

In its role as the obligee, the state has the authority to initiate action if bond conditions are not met.

What are common mistakes and how can they be avoided?

Many individuals encounter challenges when completing their personal surety bond forms. Proactively identifying common errors can significantly improve your chances of a smooth process.

-

Common mistakes include incorrect name spelling, missing signatures, and entering wrong dates.

-

Utilize checklists and ensure that all necessary documentation is attached to the bond submission.

-

Consider using online tools like pdfFiller to verify and correct form entries before submission.

How to manage personal surety bond forms with pdfFiller?

Utilizing pdfFiller enhances the experience of working with personal surety bond forms. It simplifies the process, allowing seamless editing, signing, and sharing of important documents.

-

Easily modify forms, fill in data, and ensure all fields are completed accurately.

-

Share forms with others to collect necessary approvals and signatures efficiently.

-

Stay organized and access your documents from anywhere, streamlining your workflows.

How to fill out the personal surety bond of

-

1.Access the PDF document of the personal surety bond template on pdfFiller.

-

2.Begin by entering the principal's name, address, and contact information in the designated fields.

-

3.Next, fill out the surety's information, including name, address, and bond number.

-

4.Indicate the specific purpose of the bond in the appropriate section.

-

5.Complete the amount of the bond, ensuring it reflects the required financial guarantee.

-

6.Review all details entered for accuracy and completeness to avoid issues.

-

7.Once satisfied with the entered information, save the document.

-

8.Choose the option to submit the bond or print it out for physical signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.