Get the free Deed of Distribution of Probate Estate template

Show details

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Distribution of Probate Estate -Arizona, can be used in the transfer process

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

With this site I can get any and all my paper work done in the manner that I wish to have done.

Typing out my paperwork in the correct format. Always there when I need it done. Able to use it anywhere.

It's ease of use,it's ability to take on tasks that I need done,the customer service is always there with answers to questions that I need answered. All the different jobs this site can achieve. I can not get along with out this site. Thank You for being there for us.

I usually do not leave reviews but this tool is sensational

Ease of use, the functionality is greatly appreciated. Gliding through forms is of ease. Moving from box to box is a cinch

The save feature to my computer can be a little friendlier. It can take several try to find the forms after I save them

Great for clarity

The ease of using it and the clarity of documents being in the typed form as opposed to me having to handwrite them.

This product is very easy to use. It is very useful for clarity of documents when it comes to being legible.

Stupid-Easy to use

Very easy to get used to.

This should be called PDF-Text for Dummies.

I literally had this program up and running in less than 5 minutes of downloading and installing it.

Wish it was a little cheaper.

If you are not using it often it hard to justify the monthly cost.

It may be better to go with the annual subscription instead of the monthly in some cases.

needed a PDF filler software easy to use

easy to fill out lots of PDF forms without hassle

Easy to use. Can save forms for future use. Does not require any extra learning. Intuitive format makes easy for anyone to use.

Cost was a bit much, but decided the year membership was the best savings deal.

Have used it multiple times already in the first few months so I am glad I did not do a month to month membership.

Awesome service!

helpful for customers

Ease of use! Love it. I love that i can change forms and addresses. This has been a lifesaver for work purposes.

I wish you had more options as far as fonts go and wish you had more options as far as font sizes..something to think about

Comprehensive Guide to the Deed of Distribution Form

How to fill out a deed of distribution form

Filling out a deed of distribution form involves understanding its components, completing it accurately, and submitting it in compliance with local regulations. This guide will walk you through each step to ensure you prepare the form correctly for your probate process.

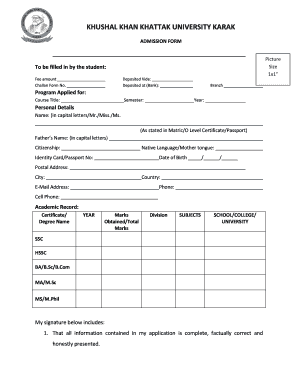

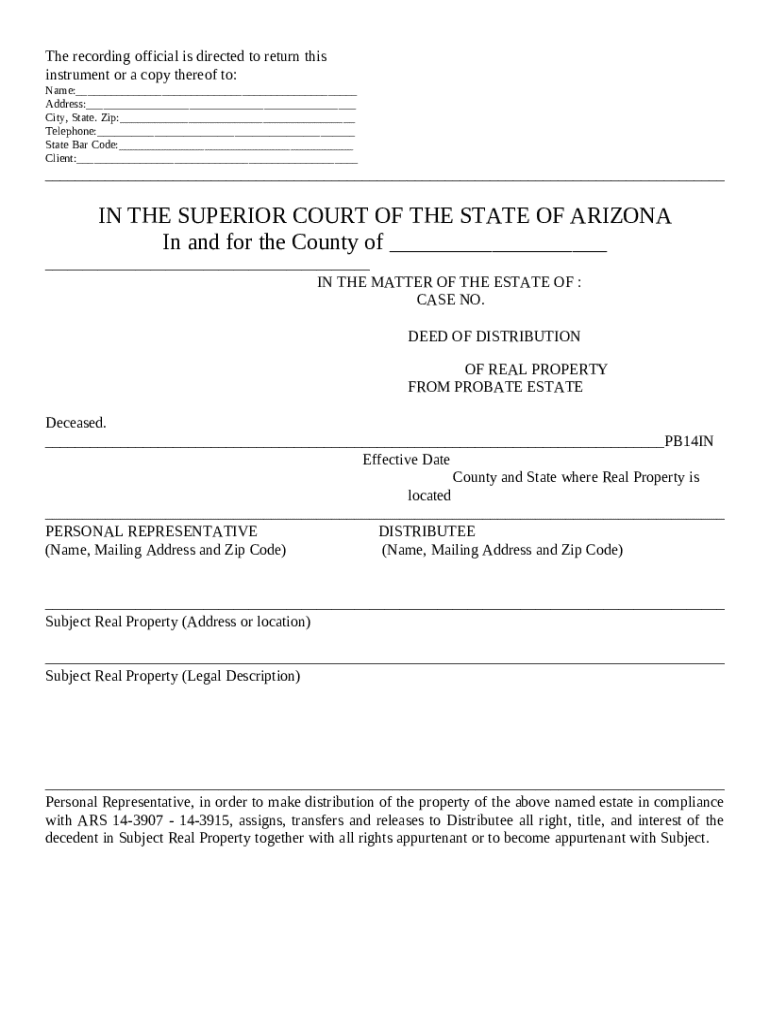

Understanding the deed of distribution

A deed of distribution is a legal document used to distribute assets from an estate to the rightful heirs or beneficiaries following a probate process. It is crucial in ensuring that the distribution is carried out according to the decedent’s wishes and the applicable laws.

-

This document specifies how an estate's assets will be divided among beneficiaries.

-

A properly executed deed is essential for the legal transfer of ownership of property and assets.

-

In Arizona, statutes such as ARS 14-3907 govern the execution and significance of the deed of distribution.

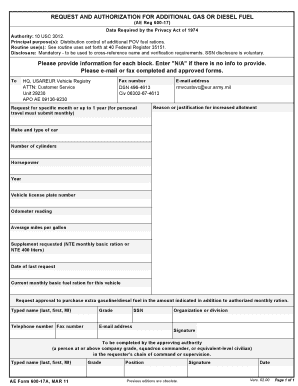

What are the key components of the deed of distribution form?

The deed of distribution form must be meticulously filled out to contain accurate and complete information. It addresses the parties involved and the specifics of the assets being distributed.

-

The recording official is tasked with verifying the accuracy and legality of the document.

-

Essential details such as names, addresses, and contact information of the distributees must be provided.

-

Accurate county and state information ensure the deed is enforceable in the appropriate jurisdiction.

-

Including the case number assists in tracking and managing the probate file.

How to fill out the deed of distribution form?

Filling out the deed requires careful attention to detail. Ensure you understand what each section requires before filling it out.

-

Follow a structured process to fill out each section correctly.

-

Many fail to double-check personal information or leave sections incomplete.

-

Use clear, legible dates and precise legal language when describing assets.

What should you check when reviewing the deed of distribution?

After completing the deed, it is essential to review it thoroughly for completeness and accuracy.

-

Verify all fields are filled and all assets are accounted for.

-

The Personal Representative must ensure that the deed meets all legal standards.

-

All involved parties should collectively ensure that the document is accurate.

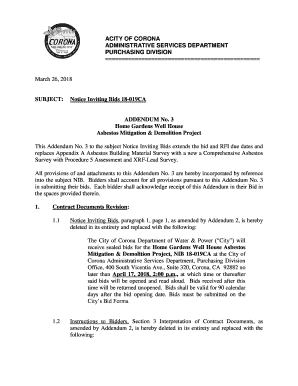

How to sign and file the deed of distribution?

Proper signing and filing is crucial for the deed's legal standing. Arizona mandates specific steps must be taken.

-

Signatures from both the Personal Representative and the judge are typically required.

-

The deed must be filed with the appropriate county recorder's office.

-

This section confirms the deed has been officially recorded.

How to manage documents with pdfFiller?

pdfFiller enables easy editing and signing of your deed of distribution form online, streamlining the process significantly.

-

Simply upload your form and use the tools to fill it out correctly.

-

Access your documents from anywhere and collaborate with others seamlessly.

-

Easily share the form for input or signatures from other stakeholders.

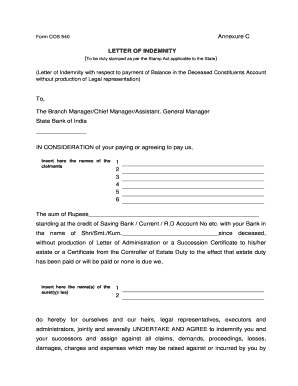

What legal considerations should you keep in mind?

Understanding legal aspects before proceeding with the deed of distribution can prevent potential issues later.

-

Statutes like ARS 14-3907 through 14-3915 outline the legal framework for distribution.

-

Consulting with an attorney ensures compliance and mitigates risks during distribution.

-

Be aware of disputes among beneficiaries or mistakes that can complicate the process.

What are the next steps after the distribution process?

After filing the deed, there are several critical actions to perform to finalize matters.

-

Confirm recording and serve required copies to all beneficiaries.

-

Keep copies in a safe place as they are crucial for estate records.

-

Ensure all debts are settled and beneficiaries receive their respective shares.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.