Get the free Deed of Gift template

Show details

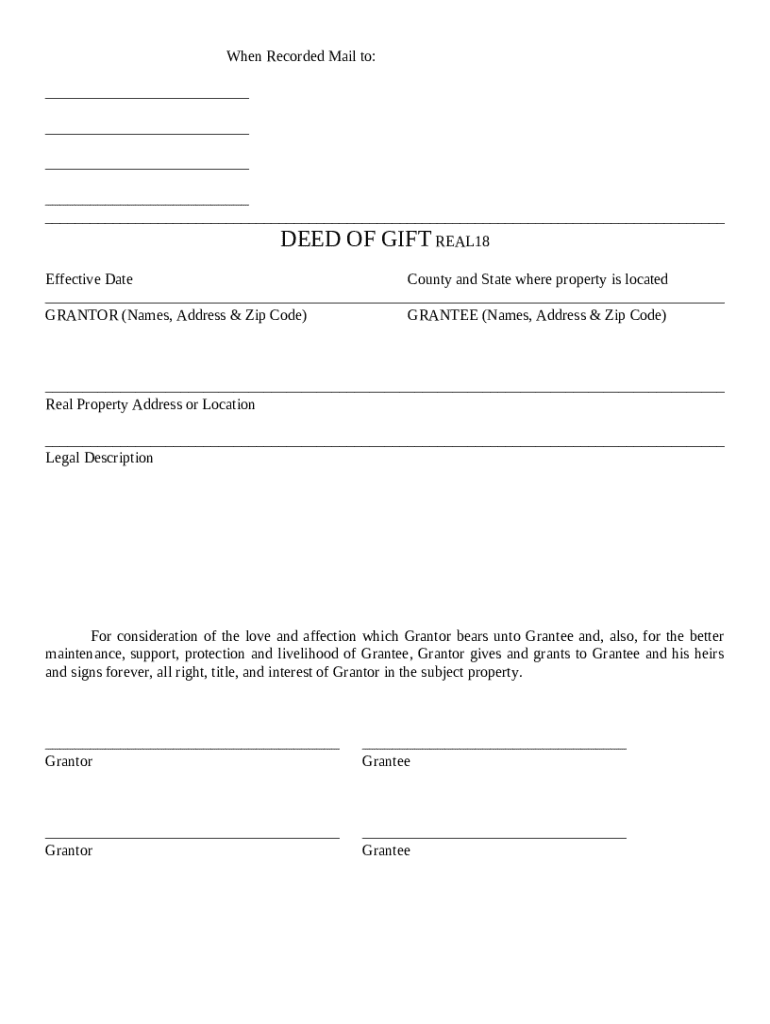

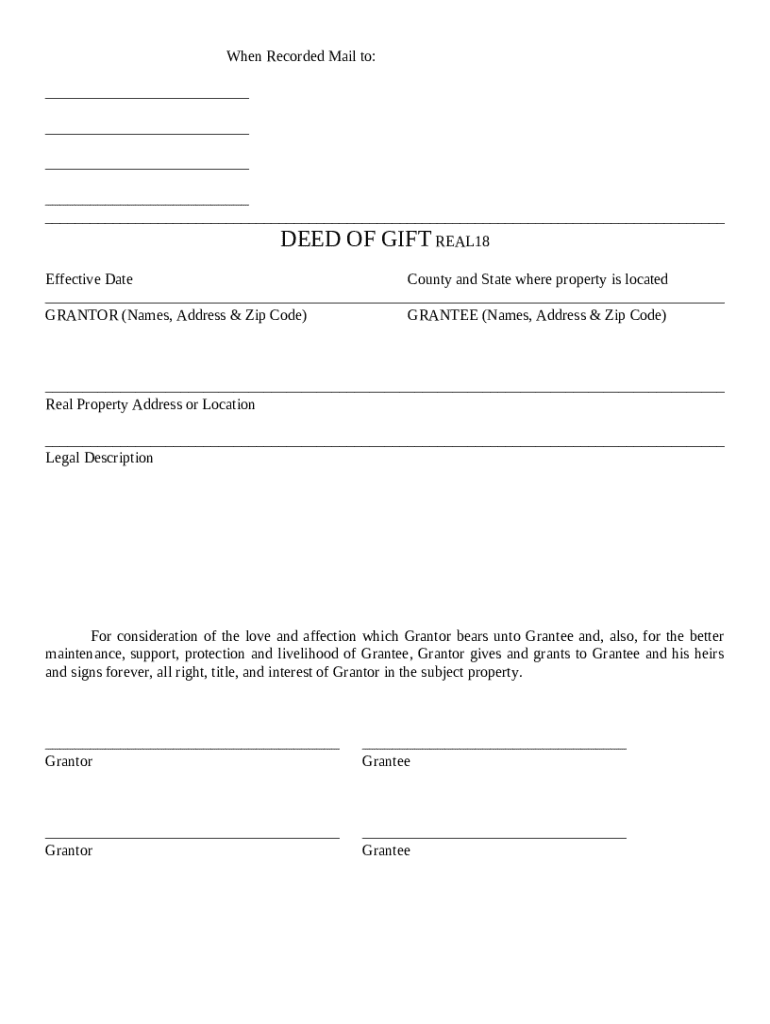

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Gift - Arizona, can be used in the transfer process or related task. Adapt

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of gift

A deed of gift is a legal document that formally transfers ownership of personal property from one individual to another without exchange of payment.

pdfFiller scores top ratings on review platforms

The best and easiest way I've found to find and fill out standard business forms!

At first I did have problems figuring out how to use it. I don't see a "copy/paste" button and wish there was one. Overall, as I start to use it more and more I am liking it.

Regards.

This is something of a category killer. I'm really glad I signed up for this service. It's great for the property rental market. The UX is a little basic and could use some help but it is functional. (Kevin Kell, UX Architect)

My first day! As far away from tech savvy as you can get! With help on "Team Viewer" I learned how to solve all the problems I had getting started. I will certainly use tech support again but off to a fun start.

Great. Still getting used to it though. But is very helpful indeed. When I paid for this it cost $120 but my credit card was deducted $170. I am still waiting for a response please and a refund

Great system, though I could do without the annoying "Next" boxes.

Who needs deed of gift template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Deed of Gift Form

How does a deed of gift work?

A deed of gift is a legal document that allows for the transfer of property from one party, the grantor, to another, the grantee, without any exchange of money. Understanding the deed of gift is essential for anyone considering transferring ownership of real estate, personal property, or other assets as a gift. This process has significant legal implications and must adhere to various state laws.

What are the essential components of the deed of gift form?

The deed of gift form includes several crucial components that need attention for a valid transfer. Each section serves a specific purpose that facilitates the completion of the document.

-

These fields capture essential details about both the grantor and the grantee to ensure legal clarity.

-

This section outlines what is being gifted, providing a clear and legal interpretation of the asset being transferred.

How do complete the deed of gift form?

Filling out the deed of gift form requires precision and attention to detail. The following steps will guide you through the process.

-

Complete this section accurately to ensure the deed is sent to the correct address post-recording.

-

Indicate when the transfer will take effect, as this will be important for legal and tax reasons.

-

Include accurate full names and contact details to avoid any future disputes regarding ownership.

-

Provide a detailed account of the property, which helps in identifying the asset and prevents any ambiguity.

What are the signing and notarizing requirements?

The signing and notarizing process for a deed of gift is a critical step in validating the document. Both the grantor and grantee must provide their signatures to legitimize the gift.

-

Both the grantor and grantee must sign for the transaction to be legally binding.

-

Certain regulations dictate who can act as a notary, ensuring there is an unbiased third party to witness the signing.

-

It is vital to avoid errors such as unsigned fields or incorrect dates, which might invalidate the deed.

What are the tax considerations when gifting property?

Gifting property comes with tax implications that both the grantor and the grantee should consider. Understanding these implications can provide significant financial benefits.

-

Depending on the value of the gift, there may be federal gift tax responsibilities that the grantor needs to address.

-

Gifting can lead to potential tax deductions for the grantor, making it favorable for tax planning.

-

Establishing a deed of gift could provide lasting benefits, including simplified estate processes and possible reductions in estate tax.

How should manage the deed of gift after signing?

After signing the deed of gift, proper management of the document ensures the legitimacy of the transfer.

-

This step involves submitting your deed to the local county office to make the gift legally recognized.

-

It's advisable to keep copies of all signed documents, communications, and receipts related to the transaction.

What are the regional specifics for Arizona?

Each state has its own set of requirements for the deed of gift, and Arizona is no exception. Familiarizing yourself with these specifics will ensure compliance.

-

Arizona residents need to adhere to local laws which may affect the format and content of the deed.

-

Identifying nearby notaries and recording offices can streamline the process for Arizona residents.

-

Ensuring your deed aligns with state laws regarding property gifting is crucial for legal enforcement.

How can PDFfiller help with the deed of gift form?

PDFfiller simplifies the process of completing a deed of gift form, making it a practical tool for creators and collaborators. Its interactive features can enhance your document experience.

-

PDFfiller provides templates that guide users through the completion of forms, leading to fewer errors.

-

Users can securely sign documents online, saving time and reducing the need for physical copies.

-

The platform allows teams to work together on document management, facilitating smooth workflows and ensuring compliance.

How to fill out the deed of gift template

-

1.Start by accessing the deed of gift template on pdfFiller.

-

2.Fill in the names of the donor and the recipient in the designated fields.

-

3.Clearly describe the item or property being gifted, including any identifying details.

-

4.Specify the date of the gift and any conditions related to the transfer.

-

5.Review the information for accuracy and completeness before signing.

-

6.Add signatures of both donor and recipient where indicated, ensuring they do so in the presence of a witness if required.

-

7.Save or download the completed document in your chosen format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.