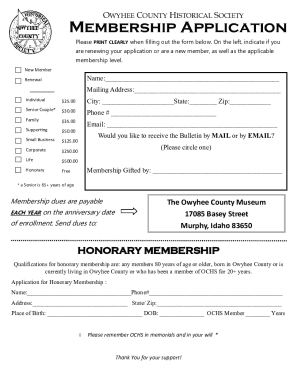

Get the free Note In Series template

Show details

Note In Series: A Note in Series is most commonly used when the Payor and Payee are going to have a continual relationship. In other words, if the Payor and Payee are going to continue buying and

We are not affiliated with any brand or entity on this form

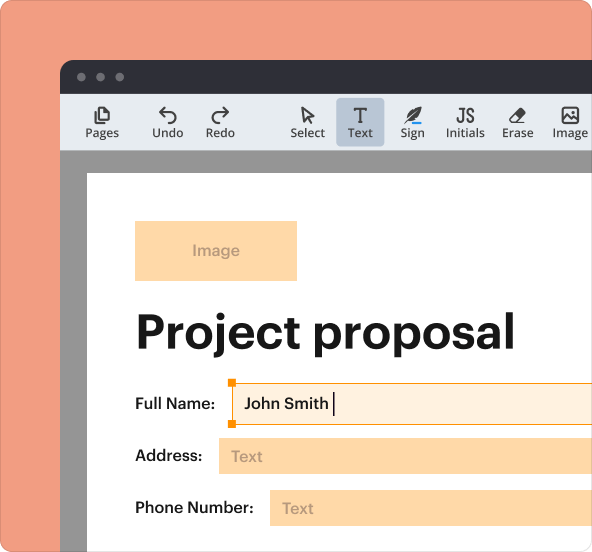

Why choose pdfFiller for your legal forms?

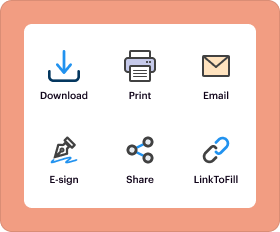

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is note in series

A note in series is a financial instrument that represents a promise to pay a specified sum of money at a future date, typically issued by corporations or governments as a form of borrowing.

pdfFiller scores top ratings on review platforms

Answered and helped with awesome customer service

Would like docs from previous subscription to be auto loaded into MyBox.

So far so good, got my first document printed and it's almost perfect.

A nice format that allows a professional presentation but the data input is still tedious and could be streamlined. All things considered, I'm satisfied with the product.

Great app! Loaded with features for editing pdf's.

No to bad so far only time will tell! Thank you Ken

Who needs note in series template?

Explore how professionals across industries use pdfFiller.

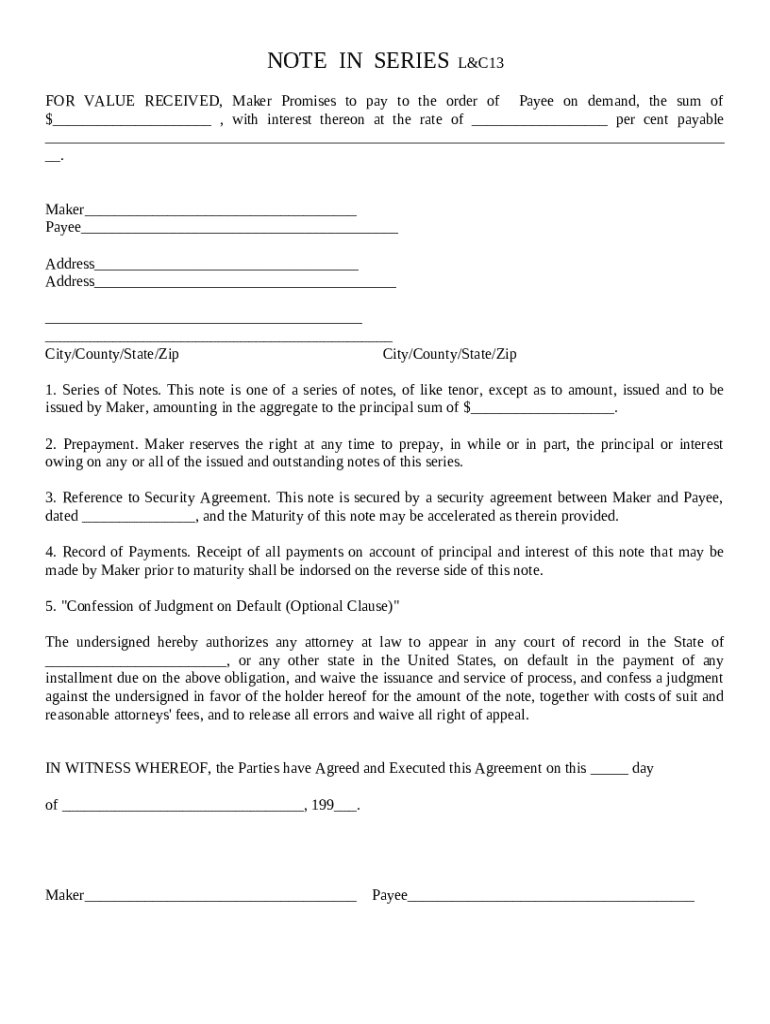

Note in series form: A comprehensive guide to understanding and completing your series notes

What is a note in series form?

A note in series form is an essential financial document used primarily in lending scenarios. It outlines the terms of a loan, including borrower and lender details, interest rates, and repayment schedules. Understanding this document is crucial for both parties to ensure clarity and compliance.

-

Series notes are legally binding agreements specifying the terms under which a borrower agrees to repay a loan. They may involve multiple payments or installments.

-

These notes are vital for ensuring that both parties understand their obligations and rights, making them critical in legal and financial contexts.

-

Familiarity with terms like 'maker', 'payee', 'interest rates', and 'terms of payment' is essential when working with series notes.

What are the key components of the note in series form?

Understanding the components of a note in series form is crucial for accurately documenting a lending agreement. Each element works together to provide a comprehensive overview of the loan's terms.

-

This section specifies who is lending (the maker) and who is borrowing (the payee), including their contact information, ensuring that the agreement is legally enforceable.

-

This includes the interest rate and the repayment schedule, vital for understanding how and when payments should be made.

-

Accurate address fields ensure that legal notices and communications regarding the note can be delivered promptly.

How do you fill out your series note?

Filling out a note in series form should be done with precision to avoid any legal complications. Each step must be carefully contemplated and completed.

-

Fill in all identifying information for both parties involved, ensuring accuracy in spelling and terms.

-

Clearly document the total amounts and interest rates to avoid disputes over future payments.

-

If applicable, explain any terms regarding prepayment that protect the payer’s rights.

-

Include references to any security agreements if the note is secured by collateral.

-

Ensure both Maker and Payee sign the document for legal enforcement.

How to manage prepayments and payment records?

Managing prepayments and records is vital for maintaining transparency and ensuring financial integrity in a note in series form.

-

Many notes allow for early payment without penalty; understanding these terms helps avoid unnecessary fees.

-

Maintaining detailed records of payment schedules is crucial for both parties to track the remaining balance and interest accrual.

-

Prepayments can affect interest calculations; be aware of how your agreement stipulates these changes.

What are the legal considerations in series notes?

Legal considerations are paramount when drafting a note in series form. Understanding these elements can provide the parties with protection and clarity.

-

A clear security agreement can protect the lender’s interests by detailing collateral backing the loan.

-

Including a confession of judgment clause can simplify legal recourse in the event of default.

-

Recognize that laws governing series notes can vary by region, necessitating compliance with local regulations.

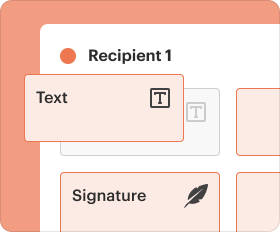

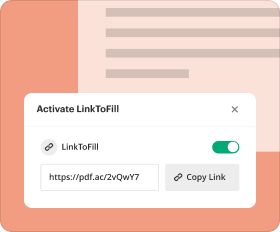

How can pdfFiller assist you with your series note?

Leveraging tools like pdfFiller can make the process of creating and managing your note in series form significantly more efficient.

-

pdfFiller offers functionalities that simplify drafting and editing series notes, making complex documents manageable.

-

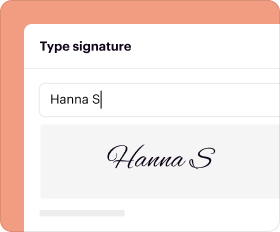

eSigning your series note via pdfFiller enhances security by providing an encrypted, legally recognized signature.

-

Collaboration features allow teams to manage documents effectively, ensuring everyone has access to the latest versions.

What are examples and scenarios of series notes in action?

Examining real-life examples can provide valuable insight into the use of notes in series form.

-

Consider a small business using a series note to finance equipment purchases; this facilitates manageable payments over time.

-

Common errors include overlooking key details or failing to understand terms, which can lead to disputes.

-

Different industries may have unique requirements for series notes, such as real estate versus personal loans.

How to fill out the note in series template

-

1.Access the pdfFiller platform and log into your account.

-

2.Select 'Create New Document' and upload the PDF form for the note in series.

-

3.Review the fields within the document and determine what information is required based on your specific situation.

-

4.Begin filling out the document by entering the title of the series in the appropriate field.

-

5.Input the principal amount to be borrowed in the designated section.

-

6.Specify the maturity date for the note in series to indicate when the amount is due.

-

7.Enter the interest rate that will be applicable to the note, detailing how interest will be computed.

-

8.Fill out the issuer's information, including the name and contact details of the organization or individual offering the note.

-

9.Check for additional fields such as signatures and witness requirements and fill those out as necessary.

-

10.Review all entered information for accuracy before final submission or saving the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.