Last updated on Feb 17, 2026

Get the free Cash Flow Statement template

Show details

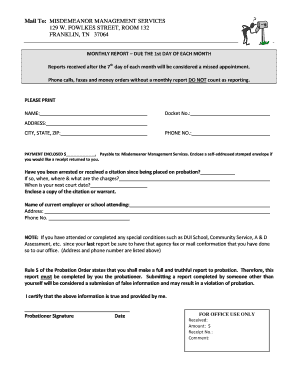

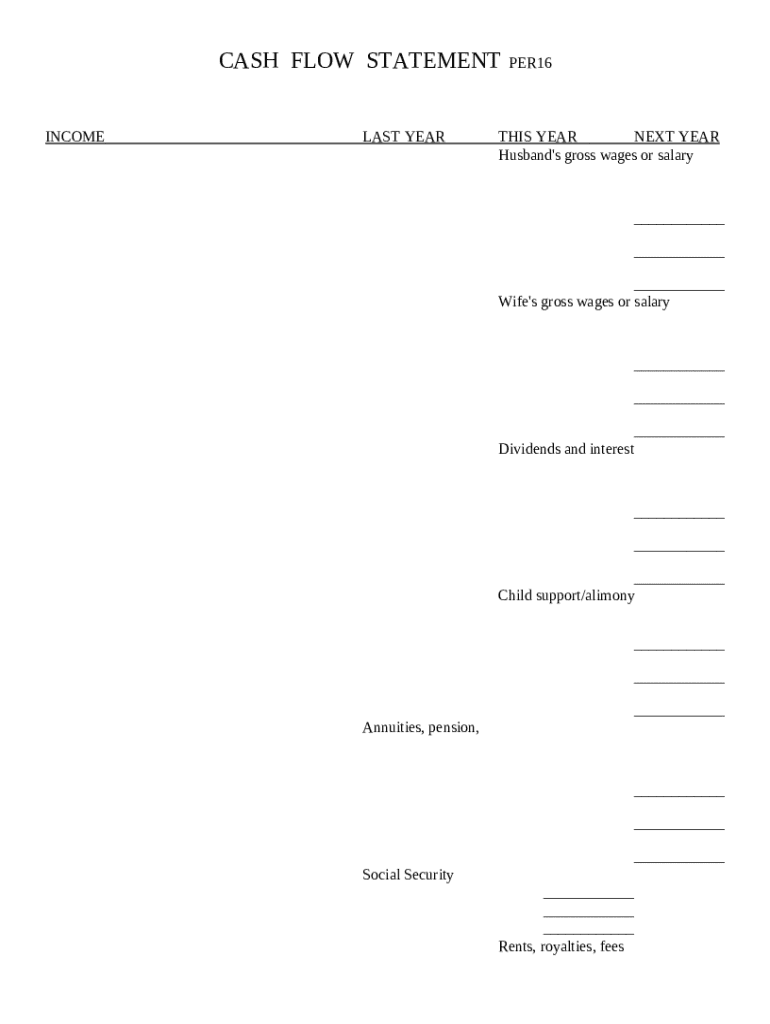

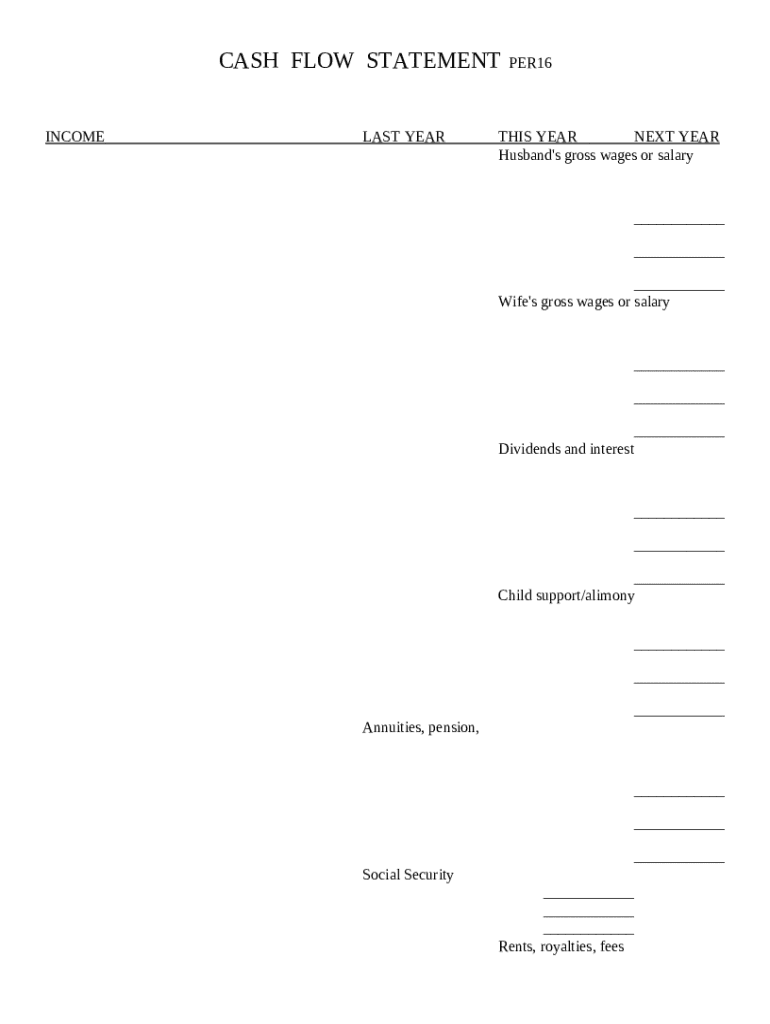

Cash Flow Statement - Arizona: This is a standard statement which includes all the money coming in and the money going out each month. There are places for wage information, as well as debt payment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is cash flow statement

A cash flow statement is a financial report that provides an overview of all cash inflows and outflows within a specific period, highlighting the liquidity of a company.

pdfFiller scores top ratings on review platforms

I have only completed 2 simple documents so far. It has been very easy to use, but there are many more features available to learn about

great and easy to use

Super easy and fast... love this, its so convienet!

super

Great site, I can release anything I want speedly

very well

Who needs cash flow statement template?

Explore how professionals across industries use pdfFiller.

Your comprehensive guide to cash flow statement forms

A cash flow statement form is a crucial financial tool that helps you track the flow of cash within your business or personal finances. This guide will walk you through everything you need to know about preparing a cash flow statement, its components, and how to effectively use tools like pdfFiller to streamline the process.

TL;DR: Filling out a cash flow statement form involves gathering financial data, detailing income and expenses, and calculating cash available for savings or investments. This ensures you maintain a clear overview of your financial health.

Understanding cash flow statements

A cash flow statement is a financial report that summarizes the amount of cash and cash equivalents entering and leaving a company. Its primary purpose is to provide insight into a company's liquidity, which can help stakeholders make informed financial decisions.

This statement is crucial in financial planning as it highlights cash inflows and outflows over a period, showing how well a business manages its cash position. The key components include operational, investing, and financing activities.

What are the components of a cash flow statement?

-

Understand where your money is coming from, categorized into operating, investing, and financing activities.

-

Ensure your cash flow statement accounts for tax obligations and potential deductions to get a realistic view of your finances.

-

Detail fixed and variable costs, allowing you to see exactly where your cash is going each month.

-

Calculate how much cash remains after all expenses, which can guide your savings and investment strategies.

How do you prepare your cash flow statement?

-

Collect all relevant financial documents, including invoices, receipts, and bank statements, to have a complete picture.

-

Enter all income sources, ensuring to categorize them appropriately for clarity.

-

Sum all forms of income to determine your total cash inflow for the period.

-

List all applicable taxes and deductions to get a true reflection of net cash.

-

Record all your living expenses, separating them into fixed and variable categories.

-

Subtract total expenses from total income to see how much cash you have for saving or investing.

What interactive tools can help with completing your cash flow statement on pdfFiller?

pdfFiller offers a range of interactive tools designed to simplify the process of creating and managing cash flow statement forms. With pdfFiller, you can create customized cash flow statements, edit existing forms, and efficiently manage your documents in a cloud-based environment.

-

The platform allows users to create cash flow statements quickly and make any necessary edits easily.

-

Collaborate with team members or advisors by sharing documents and collecting eSignatures without needing to print.

-

Access your cash flow statements from anywhere with an internet connection, ensuring you always have your documents on hand.

Analyzing an example cash flow statement

Reviewing a completed cash flow statement form can highlight areas of improvement. For example, you might notice recurring expenses that could be reduced, or opportunities for greater income through diversification of revenue streams.

-

Common errors include underestimating expenses or failing to account for seasonal income fluctuations.

-

Tailor your statement to reflect your unique financial reality, ensuring it becomes a vital tool in your planning.

Understanding differences: cash flow statement vs. balance sheet

While both cash flow statements and balance sheets provide crucial financial information, they serve different purposes. The balance sheet reflects a company's assets, liabilities, and equity at a specific point in time, while the cash flow statement shows the movement of cash over a period.

-

The cash flow statement focuses on liquidity, while the balance sheet emphasizes solvency.

-

Use cash flow statements to inform cash management decisions, whereas the balance sheet is important for understanding long-term financial health.

-

Together, they provide a comprehensive view of financial stability and operational efficiency.

How do you enhance decision-making through financial statements?

Leveraging cash flow statements can significantly enhance your decision-making process. They provide insights into how well your financial systems work, allowing you to forecast future trends based on historical data.

-

Review your cash flow statements regularly to identify trends and make timely adjustments to your financial strategies.

-

Use up-to-date cash flow information to project future cash needs and manage short-term operational decisions.

-

Incorporate cash flow analysis into regular strategic reviews to enhance long-term planning and resource allocation.

How to fill out the cash flow statement template

-

1.Obtain the cash flow statement template from pdfFiller.

-

2.Open the template in pdfFiller and familiarize yourself with the structure.

-

3.Identify the reporting period for your cash flows and prepare necessary financial data.

-

4.Begin with cash flows from operating activities: list net income, adjustments for non-cash items, and changes in working capital.

-

5.Next, move to cash flows from investing activities: outline cash transactions for the purchase or sale of long-term assets.

-

6.Then, detail cash flows from financing activities: indicate inflows from issuing stocks or bonds and outflows for dividends or repayment of debts.

-

7.Ensure all cash inflows and outflows are properly signed and calculated, leading to net cash increase or decrease for the period.

-

8.Finally, review the entire statement for accuracy and completeness; save and download your completed cash flow statement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.