Get the free Quitclaim to Trust template

Show details

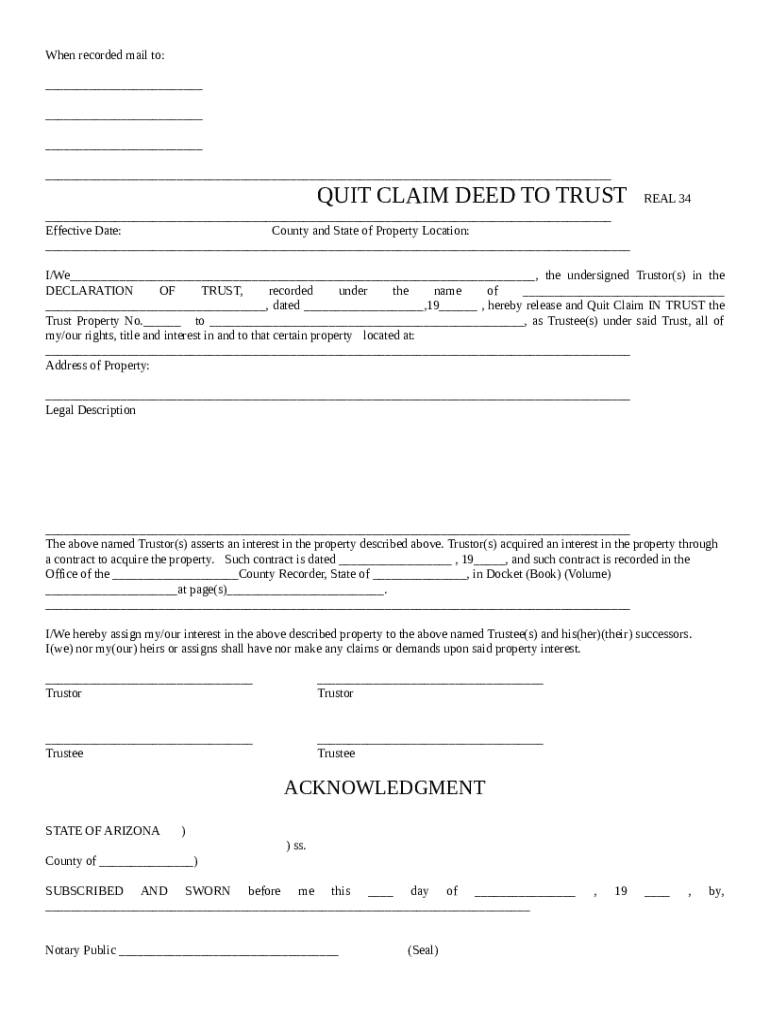

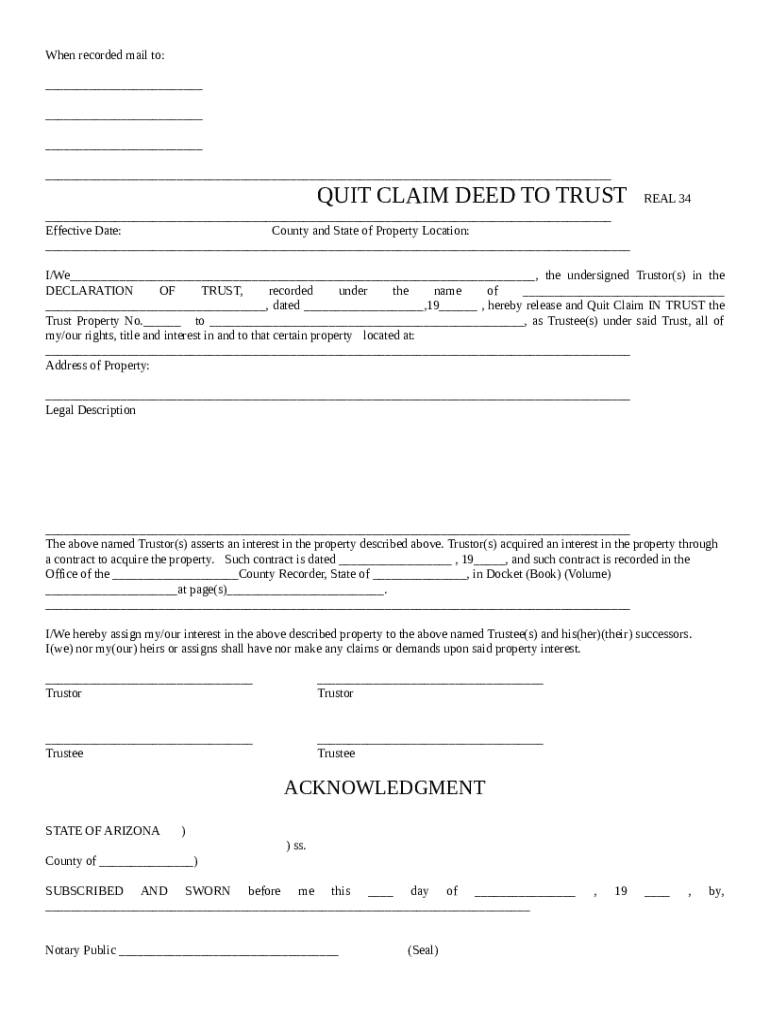

Quitclaim to Trust: This form is used by a Trustor of a trust, when he/she gives their rights to the property in the trust to the Trustee. The disclaimer further states that the Trustor will no

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is quitclaim to trust

A quitclaim to trust is a legal document that conveys property ownership rights to a trust without any warranties.

pdfFiller scores top ratings on review platforms

GREAT.

One month free trial with possibility to cancel and actually getting a refund.Customer service available 24/7 (even on a saturday night within 30 minutes!)Can absolutely recommend.Samuel Reider

LOVE IT

IT IS SO EASY TO USE

had a few problems with text

had a few problems with text, once I got hang of it, it was OK, tried to add "auto-fill" for signature of doc, having troubles.

BEST SERVICE EVER

PDF Filler is a great program to add to…

PDF Filler is a great program to add to any small business. It is very easy to use and has handled all my needs to this point.

Excellent tool for editing teaching…

Excellent tool for editing teaching resources with an error in them!

Who needs quitclaim to trust template?

Explore how professionals across industries use pdfFiller.

How to fill out a quitclaim to trust form

What is a quitclaim deed to trust?

A quitclaim deed to trust is a legal document that transfers ownership of real property to a trust. This form serves to legally record and finalize the transfer, offering an efficient way to ensure that property is managed according to the terms set out in the trust agreement.

-

The primary function of a quitclaim deed to trust is to transfer title without warranty, meaning the grantor does not guarantee a clear title.

-

Unlike warranty deeds which provide guarantees about the title's validity, a quitclaim deed offers no such assurances, making it a quicker, if less secure, method of transferring property.

-

Transferring property into a trust can aid in estate planning, ensure privacy, and provide protection against probate, often simplifying the management of the asset.

What are the key components of the quitclaim deed to trust form?

Understanding the essential components of the quitclaim deed to trust form ensures that all necessary data is accurately captured and safeguards the validity of the document.

-

Key fields include the names of the grantor and grantee, the legal description of the property, and the name of the trust.

-

Effective dates indicate when the transfer takes place, which can have legal implications, especially regarding taxes and liabilities.

-

The Trustor is the person establishing the trust while the Trustee manages and holds the property on behalf of the beneficiaries.

How can you fill out the quitclaim deed to trust form?

Filling out the quitclaim deed to trust form requires attention to detail. Follow explicit instructions for each section to avoid any pitfalls.

-

Carefully complete each section, ensuring accuracy in the details including trust names and property descriptions.

-

Double-check for missing signatures and incorrect property descriptions, as these can lead to complications in the transfer.

-

Use pdfFiller to electronically sign and save your document securely, ensuring that all parties have access to the finalized file.

What legal considerations and compliance issues should you be aware of?

Understanding the legal landscape surrounding quitclaim deeds to trusts is essential for compliance and protection against potential disputes.

-

Each jurisdiction may have specific rules regarding deeds and trusts, necessitating awareness of local regulations.

-

Ensure that the quitclaim deed adheres to state real estate laws, which may impact its legitimacy.

-

Consulting with a legal professional prior to executing the deed can provide clarity and safeguard against errors.

How do you submit the quitclaim deed to trust?

After filling out the quitclaim deed to trust form, proper submission is crucial to ensure that the transfer is recognized by relevant authorities.

-

Record the deed at the county recorder's office in the jurisdiction where the property is located.

-

When mailing the recorded deed back to you, include all necessary forms and a cover letter to expedite the process.

-

Be aware of the expected timeline for processing which can vary by region, impacting the finalization of the transfer.

What are the best practices for managing your trust after a property transfer?

Managing a trust is an ongoing process that requires diligent records maintenance and adherence to the trust's terms.

-

Keep meticulous records of all trust-related documentation, such as transactions and changes in trustee responsibilities.

-

Understand the procedures for updating the trust, including modifications to beneficiary designations.

-

The trustee must act in the best interests of all beneficiaries, adhering to the stipulations laid out in the trust agreement.

How can pdfFiller's interactive tools assist you in filling out and managing the quitclaim deed to trust form?

pdfFiller provides a myriad of tools designed to enhance your experience with document management, ensuring a smooth process for filling out forms.

-

Utilize pdfFiller's editing tools to customize the quitclaim deed to trust form according to your specific requirements.

-

Engage multiple users for collaborative editing, ensuring all stakeholders have input while finalizing the document.

-

Protect sensitive information within your documents using pdfFiller’s robust security measures and encryption options.

How to fill out the quitclaim to trust template

-

1.Open the quitclaim to trust template on pdfFiller.

-

2.Provide the full name of the property owner(s) in the designated section.

-

3.Enter the name of the trust in which the property will be transferred.

-

4.Write the legal description of the property being transferred, including address and parcel number.

-

5.Identify the current date of the transfer.

-

6.Include signatures of the property owner(s) and a witness if required, ensuring they match the names provided earlier.

-

7.Fill in any notary public information if necessary, ensuring that the document is properly notarized.

-

8.Review the completed document for accuracy and completeness.

-

9.Save or print the document for official use.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.