Get the free Negotiable Promissory Note for Stock template

Show details

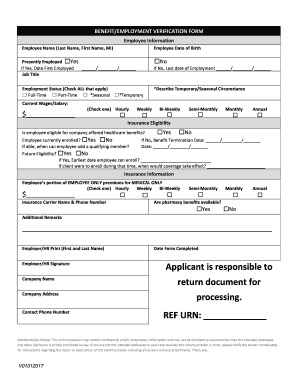

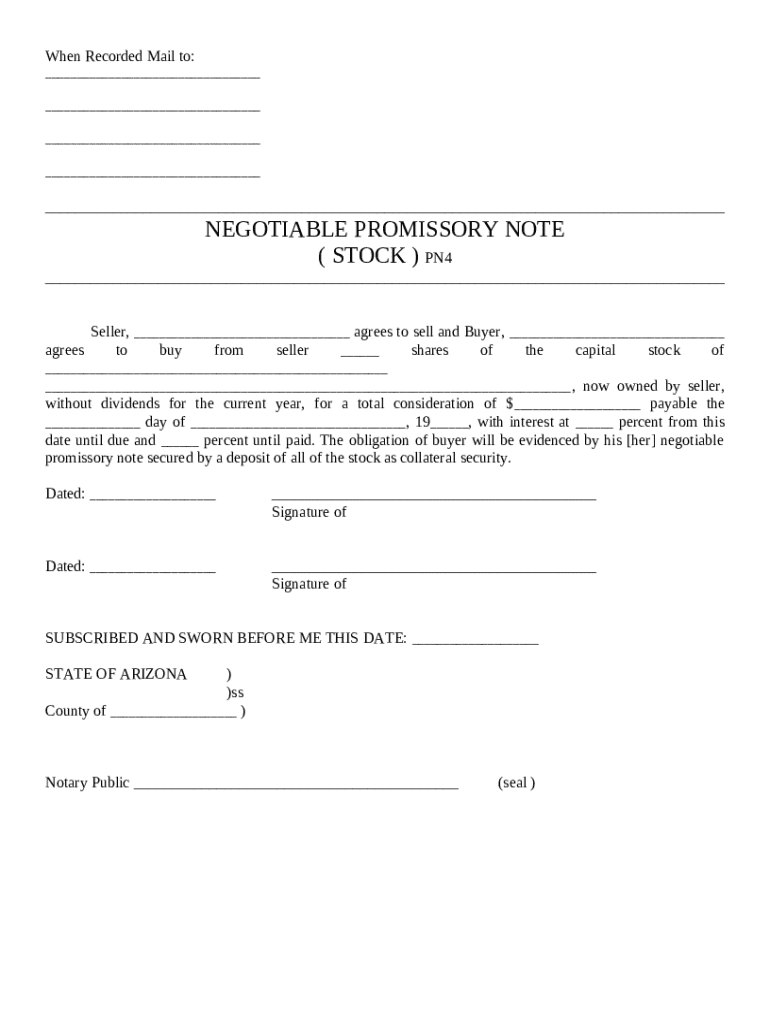

Negotiable Promissory Note for Stock - Arizona: This is a form which gives stock, in exchange for the signing of a negotiable promissory note. It is to be signed by both parties, in front of a Notary

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is negotiable promissory note for

A negotiable promissory note is a written, unconditional promise to pay a specified amount of money to the bearer or to a specific party on demand or at a certain date.

pdfFiller scores top ratings on review platforms

Does what it's suppose to do. It's easy to operate and I would highly recommend it..

I purchased PDFfiller about 2 weeks ago and use it everyday at work and some for personal use also. I highly recommend it!!

I think pdf-filler is awesome

am wanting to learn more as i'm a technically challenged 55yo

but, I work night shifts for the USPS & not likely to be able to take in classes

-offer classes anyways! :)

only thing to complain about was not being able to make text smaller to all fit and area code wouldn't fit in allotted box for some reason.

I LIKE IT. JUST NEED TO GET MORE FAMILIAR WITH IT.

I'm a little too busy right now to take a survey maybe late

Who needs negotiable promissory note for?

Explore how professionals across industries use pdfFiller.

Navigating the Negotiable Promissory Note: A Comprehensive Guide

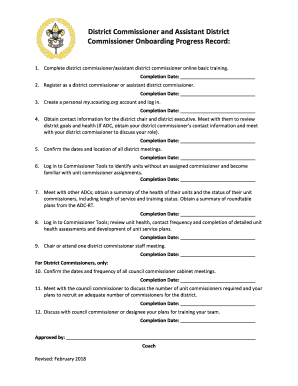

How to fill out a negotiable promissory note form

Filling out a negotiable promissory note involves completing essential fields to ensure legal enforceability and clarity. To start, include the identities of both parties and the amount being loaned, along with the agreed interest rate. Additionally, be thorough in articulating payment terms, which can prevent disputes later on.

Understanding the negotiable promissory note

A negotiable promissory note serves as a written promise from one party (the borrower) to pay a specific amount to another party (the lender) under agreed conditions. Unlike non-negotiable notes, which can only be transferred with the payee's consent, negotiable promissory notes can be transferred freely. The legal implications of such notes include enforceability in court as binding agreements.

What are the key components of a negotiable promissory note?

-

Clearly state the names of the borrower and lender to avoid confusion.

-

Describe the quantity and value of the loaned amount, ensuring it's precise.

-

Specify the interest rate and detail the schedule for payments.

-

Indicate any collateral securing the note to protect the lender in case of default.

How can you fill out the negotiable promissory note?

Filling out each field properly in a negotiable promissory note is crucial for its validity. Begin with recording the borrower and lender details accurately. Carefully articulate the loan amount, interest calculations, and payment terms to prevent any ambiguity.

-

Ensure to specify where the document is to be sent after signing.

-

Accurately fill in the full legal names of all parties involved.

-

Outline how and when payments are to be made.

-

Specify any collateral backing the loan, if applicable.

How to edit and customize your negotiable promissory note with pdfFiller

Utilizing pdfFiller allows for easy customization of your negotiable promissory note. The platform’s editing tools enable you to make necessary adjustments efficiently, including adding digital signatures, which are essential for legal compliance.

-

Easily modify fields and sections of your note to tailor it to your specific needs.

-

Ensure legality by incorporating digital signatures that comply with state regulations.

-

Engage your team in the editing process for better accuracy and agreement.

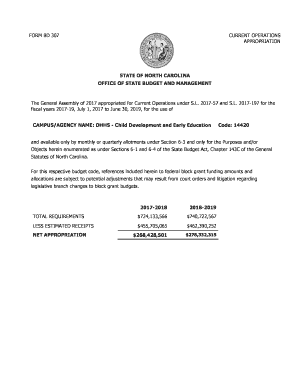

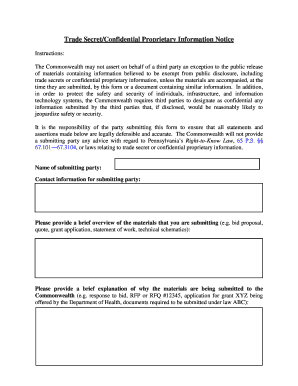

What are state-specific considerations for promissory notes?

Regulations regarding promissory notes can vary significantly from state to state. Understanding these differences is essential for compliance and validity, including awareness of usury limits that may restrict interest rates.

-

Consult your state's regulations to ensure your note adheres to local laws.

-

Be informed about limits on interest rates to avoid legal complications.

-

Familiarize yourself with your state’s notarization requirements to ensure enforceability.

How to ensure legal validation and notarization requirements?

Notarization enhances the enforceability of a negotiable promissory note. The presence of a notary ensures that all signatures are verified, thus reducing doubts about the document’s authenticity.

-

Notarized documents are generally more credible and binding in court.

-

Locate a notary public and present your completed document for signature.

-

Ensure to include the notary's signature, seal, and any required information.

What are common mistakes to avoid when drafting a negotiable promissory note?

Many individuals make mistakes that can render a negotiable promissory note invalid. Understanding common pitfalls can help ensure your document stands up legally.

-

Neglecting to fill in all necessary fields can void the document.

-

Errors in these areas can lead to disputes and potential litigation.

-

Failing to include collateral information might increase risk for the lender.

How to finalize and manage your negotiable promissory note?

Once your negotiable promissory note is filled out, it's essential to store it securely. pdfFiller offers functionalities to store and access your documents online, helping you keep track of payments and manage reminders efficiently.

-

Use pdfFiller’s cloud-based solution for easy access and secure storage.

-

Set reminders for payments to ensure timely compliance with the terms of the loan.

-

Regularly review and update your document as situations change to maintain relevance.

How to fill out the negotiable promissory note for

-

1.Begin by opening the negotiable promissory note template on pdfFiller.

-

2.Enter the date at the top of the document to indicate when the note is created.

-

3.Fill in the full name and address of the borrower, ensuring accurate contact details.

-

4.Next, enter the lender's full name and address in the corresponding section.

-

5.Specify the principal amount being loaned, ensuring it's clearly stated in both numeric and written forms.

-

6.Outline the interest rate applicable to the loan, if any, as well as how it will accrue.

-

7.Determine and indicate the repayment schedule, including due dates and payment frequency.

-

8.Include any terms related to late payments or penalties for defaulting on the loan.

-

9.Finally, ensure both lender and borrower sign the document to legitimize the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.