Last updated on Feb 17, 2026

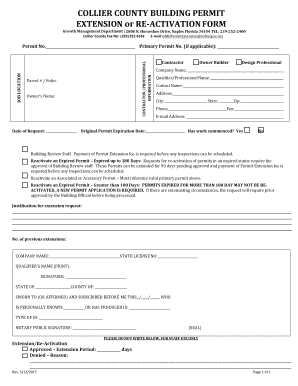

Get the free Quitclaim Deed from a Limited Liability Company to a Husband and Wife template

Show details

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantees are Husband and Wife. Grantor conveys and quitclaims the described property to Grantees. Grantees take

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is quitclaim deed from a

A quitclaim deed from a is a legal document used to transfer ownership interest in property without warranties or guarantees.

pdfFiller scores top ratings on review platforms

Worked well and helped me complete Tax forms for a non-profit

I like the program, but I really needed the ability to add Bates Numbering.

If the program would overcome some of the rather important limitations, this would

be an excellent deal for the money.

First time experience,required several redo's. Great Program, Perfect fit for my needs.

It's been great except for these pop-ups

Very grateful for the opportunity to provide my employees with professional looking W2C forms.

Not for free to send it and save to computer. Almost $7 for a year isn't bad though! But I'm not sure if i'll be using this all the time though throughout the year.

Who needs quitclaim deed from a?

Explore how professionals across industries use pdfFiller.

How to fill out a quitclaim deed from a form form

Understanding quitclaim deeds

A quitclaim deed is a legal document that allows an individual to transfer their interest in a property to another party without guaranteeing that title is clear. This type of deed is different from warranty deeds, which offer more protection to the grantee (the person receiving the property). Quitclaim deeds are commonly used in situations such as transferring property between family members, during divorce settlements, or in trust situations.

-

It is a document through which ownership rights in a property are transferred, often used when the grantor may not have complete title to the property.

-

Unlike warranty deeds, quitclaim deeds do not provide warranties about the property title, making them riskier but often faster and simpler.

-

Typical scenarios involve transfers between family members, handling estates, or correcting title issues.

Navigating the quitclaim deed process in New York

New York has specific laws governing quitclaim deeds that all parties should understand to ensure a smooth transaction. Property laws can vary significantly by county, making it essential to look into local regulations, including nuances in filing procedures and associated costs.

-

New York law requires that any deed be recorded in the county where the property is located; failing to do so may result in issues regarding ownership.

-

Different counties may have unique requirements regarding forms and fees, emphasizing the need to consult local offices or legal counsel.

Step-by-step guide to filing a quitclaim deed

Filing a quitclaim deed involves several critical steps to ensure its validity and enforceability. Each step must be followed carefully to avoid complications later.

-

You can acquire the form online or at your local county clerk's office, ensuring it meets state and county specifications.

-

The preparer's name and address must be included in the document to comply with legal requirements.

-

This refers to the value exchanged for the property; even if no money is involved, this should be indicated.

-

Both parties must sign the deed in the presence of a notary public to validate the transaction legally.

-

Once notarized, the document should be filed with the county clerk to officially record the change in property ownership.

Costs and fees associated with quitclaim deeds

Filing a quitclaim deed is generally affordable, but specific costs can vary significantly based on county regulations. Here’s a breakdown of potential fees you might encounter.

-

Most counties charge a standardized fee for filing deeds, usually ranging from $50 to $200, depending on the specifics of the document.

-

It may also be necessary to account for potential attorney fees, notary costs, and recording taxes.

-

Certain transactions, such as those involving family members, may qualify for exemptions from transfer taxes.

Exemptions from transfer tax for quitclaim deeds

In specific circumstances, quitclaim deeds may be immune to transfer tax, which can significantly reduce the costs involved in property transfers. Understanding these exemptions can provide financial relief.

-

When a quitclaim deed is used simply to affirm ownership without monetary compensation, it may not incur transfer tax.

-

Transfers made during divorce proceedings as part of asset division may also be exempt from taxes.

-

In cases where a property is reconveyed to settle a debt, there may be exemptions from the usual taxes.

-

Transfers to or from a living trust typically do not attract transfer taxes, simplifying estate planning.

Common challenges and mistakes to avoid

While filing a quitclaim deed can be straightforward, certain pitfalls can complicate the process. Avoiding common mistakes will ensure a smooth transition of property ownership.

-

Mismatched names, incorrect property descriptions, or missing signatures are common mistakes that can invalidate the deed.

-

Double-checking all entries and consulting with a legal expert can mitigate risks associated with potentially flawed documentation.

-

Seeking legal advice is prudent for complex property matters, particularly involving significant value or unique circumstances.

Utilizing pdfFiller for efficient form management

pdfFiller can streamline the quitclaim deed process, allowing users to manage their forms effectively. It offers a range of features that enhance document handling.

-

This cloud-based platform makes it easy to fill in details, edit sections as needed, and store documents securely.

-

Users can collaborate in real-time, ensuring all parties involved can view and approve documents promptly.

-

pdfFiller provides options for electronic signatures, enhancing the security and integrity of the document.

How to fill out the quitclaim deed from a

-

1.Start by obtaining a quitclaim deed template from pdfFiller.

-

2.Open the template in pdfFiller, and begin filling in the property owner's information in the designated fields.

-

3.Next, input the grantee's (new owner's) name and address, ensuring it's accurate for legal purposes.

-

4.Fill in the property's legal description, which can typically be found on the original property deed or tax records.

-

5.Include any additional details, like the date of transfer.

-

6.Review all filled details for accuracy to avoid any legal complications.

-

7.Once completed, review the document again for clarity and correctness before finalizing.

-

8.Sign the quitclaim deed, ensuring it is done in front of a notary public if required by your state.

-

9.Save the completed document, then print it out for signing and distribution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.