Get the free Realty Mortgage - Residential template

Show details

Realty Mortgage - Residential: This form contains the details and duties of each party when obtaining a mortgage, or loan, for residential property. Both the Mortgagor and Mortgagee must sign this

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is realty mortgage - residential

A realty mortgage - residential is a loan secured by residential real estate used to purchase a home or property.

pdfFiller scores top ratings on review platforms

incredible pdf editing experience!

Helpful

It is user friendly ad really helpful.

great work

great great ngtrerat grat graet

Great Ap, Super Helpful.

Great, easy to use ap. So simple. Would suggest its use to others. Think i might purchase this after the 30 day free trial.

Great tool

Great tool! It really doesn't charge you when you are on trial, and you can cancel your subscription anytime.

ok so far.

ok so far. Good for the basic editing i needed.

Who needs realty mortgage - residential?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Realty Mortgage Forms

How do you fill out a realty mortgage form?

Filling out a realty mortgage form accurately is critical for the successful completion of a mortgage transaction. This guide will provide clear insights into the process and common pitfalls to avoid, ensuring you're well-prepared to manage your real estate documentation effectively.

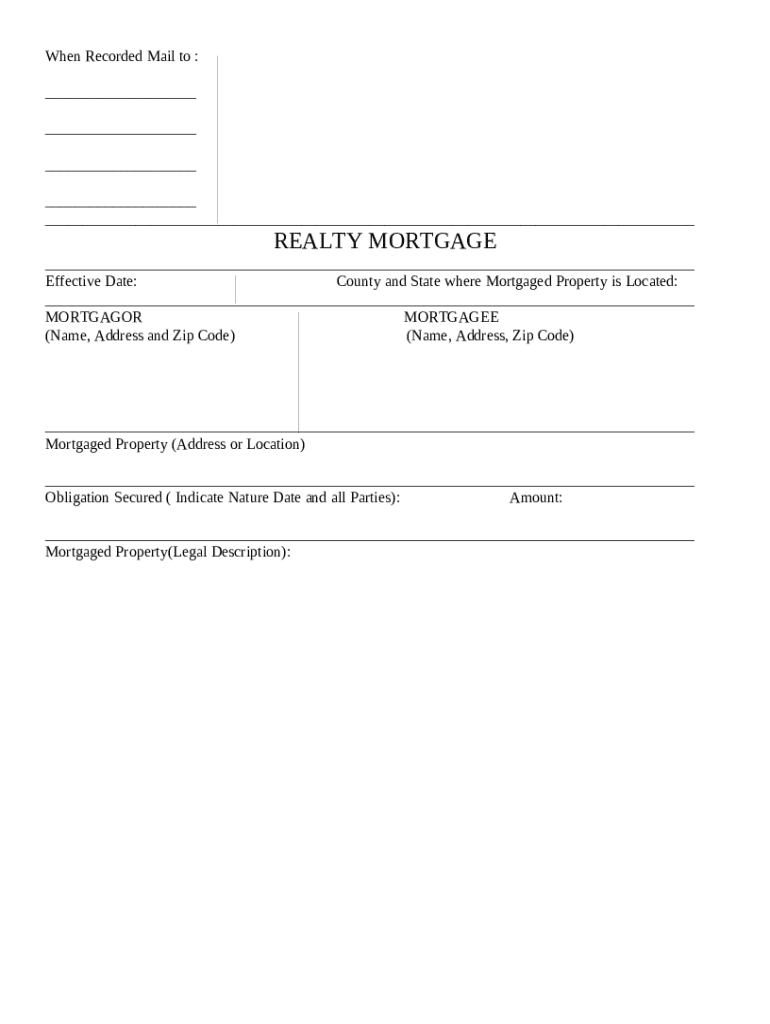

Understanding the realty mortgage form

The Realty Mortgage form serves as a legal document that outlines the relationship between the borrower (mortgagor) and the lender (mortgagee) in a real estate transaction. This form is crucial for protecting the rights and responsibilities of both parties involved.

-

It is designed to secure a loan against the mortgaged property, ensuring the lender can claim the property if the borrower fails to meet payment obligations.

-

A properly completed form ensures clarity and legal standing, preventing disputes over ownership and payment obligations.

-

The primary stakeholders are the mortgagor, who borrows funds against the property, and the mortgagee, who provides the loan.

What are the essential components of the realty mortgage form?

Understanding the critical components of the Realty Mortgage form is essential for effective use. Each part has specific implications in terms of legal standing and communication.

-

Knowing when the mortgage is recorded is vital as it establishes priority rights among creditors, ensuring your position is secure.

-

Accurate addresses ensure proper communication throughout the mortgage process, which is crucial for legal notifications.

-

This refers to when the mortgage agreement takes effect, directly impacting payment schedules and obligations.

-

Specifying the county and state helps local authorities process the mortgage correctly and can affect tax assessments.

What key fields should be included in the Realty Mortgage Form?

Identifying the parties involved is vital in a Realty Mortgage form. Clarity in these roles ensures that all legal obligations are clearly delineated.

-

Include clear definitions and roles for both the Mortgagor (borrower) and Mortgagee (lender), emphasizing their responsibilities.

-

Importance of correct names, addresses, and zip codes are critical for legal identification and to prevent future disputes.

How do you describe the mortgaged property in the form?

A precise legal description of the mortgaged property is crucial. This ensures there is no ambiguity regarding what property is secured under the mortgage.

-

Must be complete and accurate to prevent legal challenges regarding property ownership.

-

Clarifies what the mortgage secures, typically the loan amount and any additional obligations.

-

Understanding the property's worth helps avoid over-leveraging and protects both parties.

What obligations do mortgagors and mortgagees have?

Both parties have specific obligations defined in the Realty Mortgage form, which helps formalize their commitments and ensure compliance.

-

In mortgage terms, consideration refers to what each party receives from the agreement, typically the mortgage amount for the borrower and security for the lender.

-

Clarifies the conditions under which ownership of the mortgaged property is transferred or claimed.

-

This clause assures that the mortgagor has the right to mortgage the property and that the title is free of defects.

How do you fill out the Realty Mortgage form effectively?

Filling out the Realty Mortgage form requires attention to detail to avoid common mistakes.

-

Follow detailed instructions on completing each section, including necessary legal clauses and property descriptions.

-

Be aware of frequent pitfalls like incorrect information and omission of critical details.

-

Optimize the management of your document with tools for filling, editing, and eSigning with ease.

What role does pdfFiller play in managing Realty Mortgages?

pdfFiller streamlines the mortgage management process with user-friendly tools that enhance efficiency.

-

Capabilities include editing, eSigning, and collaborating on documents, all within a single platform.

-

Cloud solutions mean you can access and manage documents from anywhere, providing greater flexibility and security.

-

Ensure a seamless workflow by integrating realty mortgage forms into your broader document management strategy.

How to ensure compliance and accuracy?

Compliance with local regulations is crucial when completing a Realty Mortgage form to avoid legal repercussions.

-

Familiarize yourself with specific rules applicable in your area to ensure your documents meet all legal requirements.

-

Prior to submission, double-check all information for accuracy to prevent delays or legal issues.

-

Utilize local real estate resources and professional services if you need further assistance.

How to fill out the realty mortgage - residential

-

1.Open the PDF document for the realty mortgage - residential.

-

2.Begin by filling in your personal information including name, address, and contact details at the top of the form.

-

3.Provide information about the property being financed, including its address and legal description, in the relevant sections.

-

4.Fill out the loan details, such as the desired loan amount, term, and interest rate.

-

5.Complete the section regarding your income and employment details to demonstrate your ability to repay the mortgage.

-

6.Attach any necessary documentation, such as proof of income, credit score, and tax returns, as required by the lender.

-

7.Review all filled sections for accuracy and completeness before submitting the form.

-

8.Finally, sign and date the document where indicated, then submit it to your lender as instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.