Get the free Statement of Assets and Liabilities - Asset Purchase template

Show details

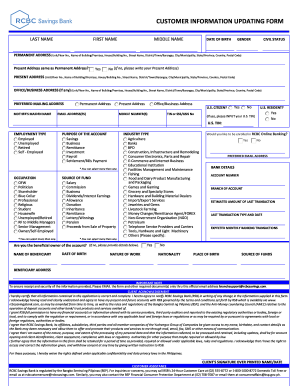

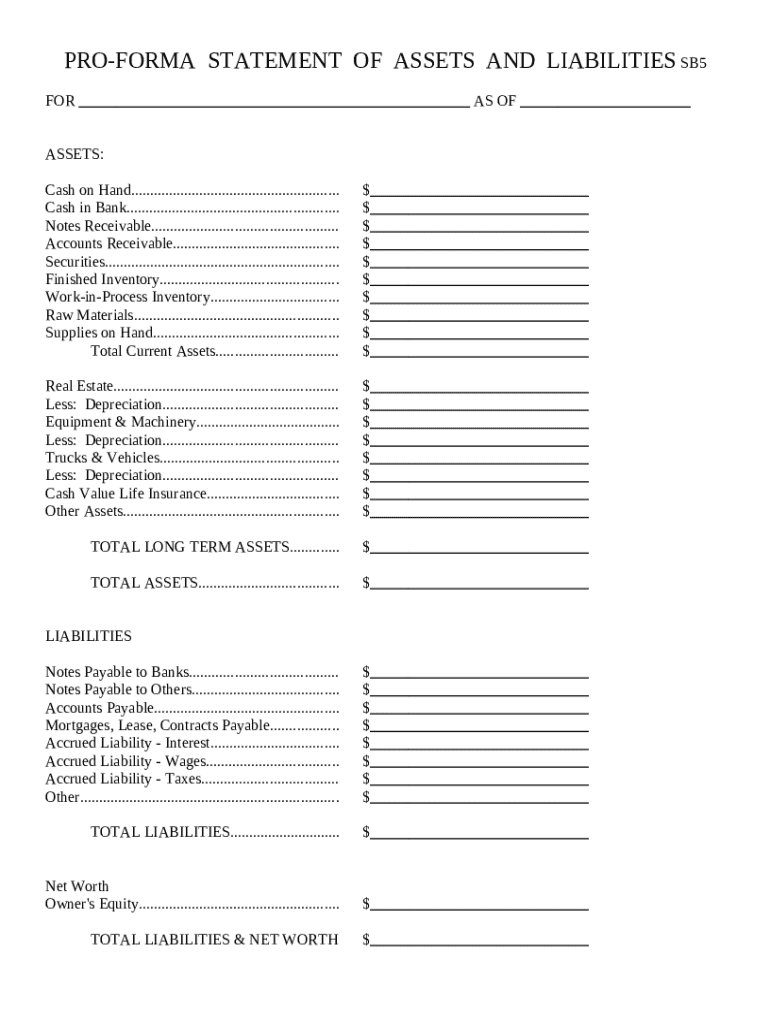

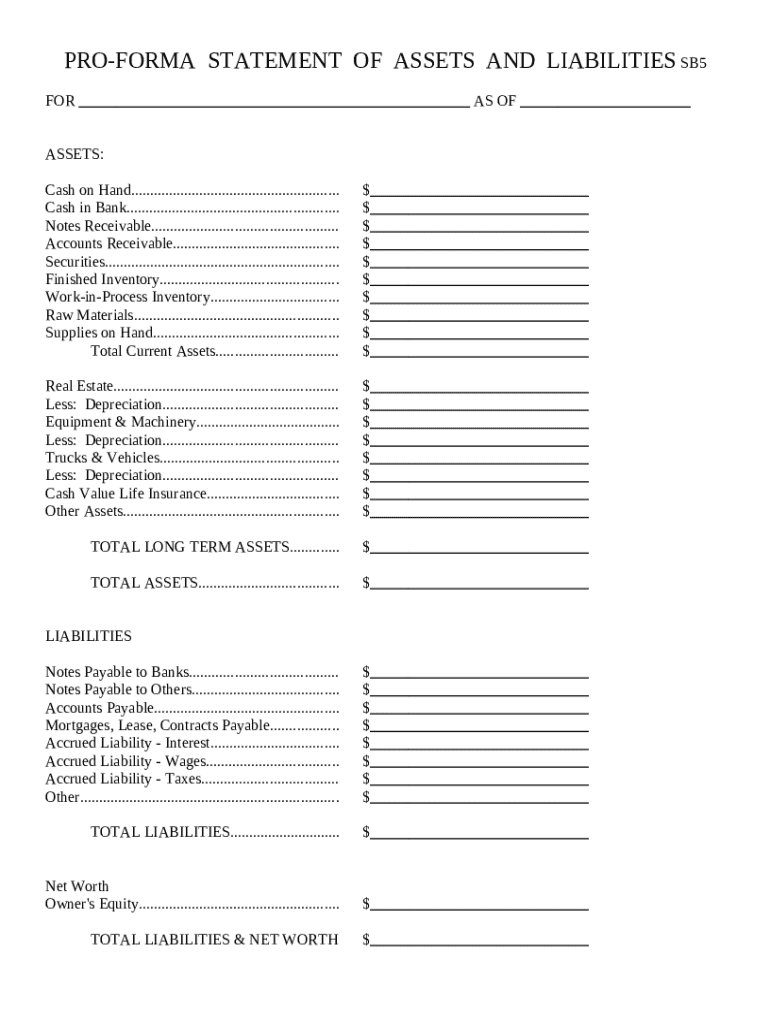

Statement of Assets; Liabilities: This is a general Statement of Assets and Liabilities for a company. It lists in detail, all assets, including real property and machinery, as well as all liabilities,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is statement of assets and

A statement of assets is a financial document that lists an individual or organization's assets, liabilities, and overall financial position at a specific point in time.

pdfFiller scores top ratings on review platforms

EXCELLENT CUSTOMER SERVICE

Very quick, efficient and courteous customer service. My elderly mother subscribed to this service and couldn't remember why. I explained the situation via emails with Customer Support and they refunded the annual subscription fee after I verified a few details. I really appreciated their understanding and quick response. Now...I have to go unplug my mom's computer. :-)

Great HELP

Karen was great help to me. I was looking for a file for 2 years. With her help I was finally able to find it. She was patient and knowledgeable. Thank you Kara!!!!

Excellent service.

POSITIVE

POSITIVE THE BEST.

Great experience

perfect

very clear. I am very satisfying

Who needs statement of assets and?

Explore how professionals across industries use pdfFiller.

Creating a Statement of Assets and Liabilities (Pro-forma)

What is a Statement of Assets and Liabilities?

A statement of assets and liabilities is a financial document that gives an overview of what an individual or organization owns and owes. It serves as a critical tool in assessing financial health, as it outlines assets such as cash, investments, and property, alongside liabilities like loans and debts. Understanding how to fill out this form is essential for effective financial management.

Knowing how to create this document is vital not only for personal finance but also for businesses and organizations. By regularly updating this statement, you ensure that all asset management and liability management aspects are in check, which directly impacts your net worth.

What is the purpose of the statement of assets and liabilities?

The primary purpose of this statement is to track assets and liabilities, providing a snapshot of an entity's financial status. It allows individuals and organizations to evaluate their financial position over time, making it easier to plan for future needs.

-

It helps in understanding your overall net worth by balancing what you own against what you owe.

-

Tracking these figures enables you to maintain fiscal responsibility and transparency.

How to get started with pdfFiller?

pdfFiller offers a user-friendly environment for creating and editing various documents, including the statement of assets and liabilities. To get started, visit their website and log into your account or create one if you haven't done so yet.

-

Locate the statement form within the pdfFiller templates for easy access and customization.

-

Use the intuitive interface to manage your documents and find what you need quickly, streamlining the creation process.

What to include in the assets section?

The assets section is crucial as it lists everything of value owned. Proper categorization ensures accuracy and clarity when calculating personal or organizational net worth.

-

Physical cash available for immediate use, which should be reported accurately.

-

Include all funds available in checking and savings accounts.

-

Loans to others that will provide income when paid back.

-

Money owed to you for services rendered or products sold.

How to complete the liabilities section?

Accurate reporting of liabilities is as important as assets, as it gives a complete picture of one’s financial standing. Different liability types should be outlined clearly in this section.

-

Loans that you must repay, excluding mortgages.

-

Outstanding bills for products or services received.

-

Debt incurred from a home purchase that needs to be accounted for.

How do you calculate total assets and liabilities?

Accurate totals ensure a reliable assessment of financial health. You can easily sum your assets and liabilities using basic arithmetic skills or available tools in pdfFiller.

The total of assets should match the total reported in the liabilities section and helps in ascertaining the net worth, which is a central aspect of personal finance.

What is net worth and why is it important?

Net worth is defined as the difference between total assets and total liabilities. This figure is essential for understanding your financial landscape, as it indicates overall financial health.

By calculating your net worth using the assets and liabilities defined previously, you can make informed financial decisions and plan for the future.

How to edit and eSign the document on pdfFiller?

Once your statement is filled out, pdfFiller provides features to edit, save, and electronically sign your document. Using the eSigning tool, you can ensure the document is secure and legally binding.

-

Use the editing features to make necessary changes before finalizing the document.

-

Follow the step-by-step guide to sign your statement electronically.

How to store and manage your document?

Storing and managing your statement securely is crucial for future reference and audits. pdfFiller ensures that your documents are stored safely in the cloud.

-

All documents are stored safely within your pdfFiller account.

-

You can share the document directly with stakeholders or team members from the platform.

What are common mistakes to avoid?

Mistakes in compiling your statement could lead to misrepresentations of financial health. Being aware of common pitfalls can enhance accuracy.

-

Failing to include all assets can inaccurately inflate liabilities.

-

Neglecting certain debts can result in a misleading net worth.

What are recommended practices post-filing?

Maintaining your statement of assets and liabilities is a continuous process. Regular updates ensure that your financial picture is accurate and reflective of your current situation.

-

Periodic reviews and updates of your statement are essential for accurate tracking.

-

Maintain comprehensive records for future reference and compliance needs.

How to fill out the statement of assets and

-

1.Open pdfFiller and upload the statement of assets template.

-

2.Begin by entering your personal information, including your name, address, and contact details.

-

3.List your assets in the designated section, such as cash, real estate, and investments, with their current values.

-

4.Next, input your liabilities like loans or debts in the corresponding section, providing detailed amounts owed.

-

5.Calculate your net worth by subtracting your total liabilities from your total assets and input that value.

-

6.Review the document for accuracy, ensuring all information is complete and correctly formatted.

-

7.Once finalized, save your document and choose your preferred export option to download or share.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.