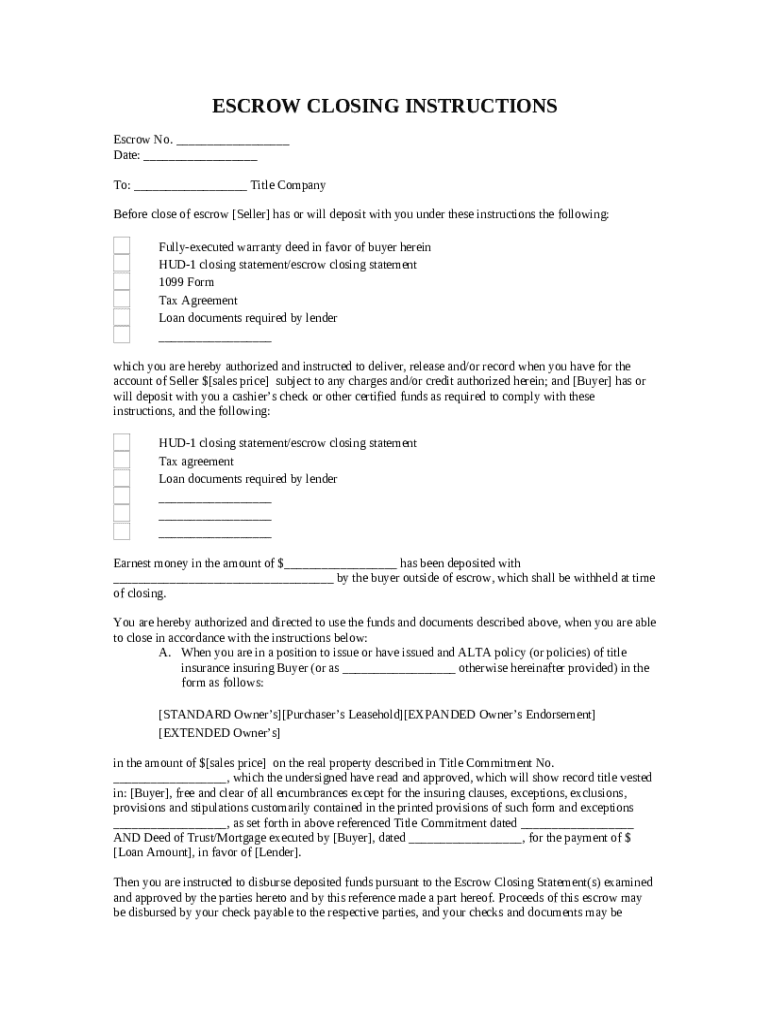

Get the free Escrow Closing Instructions template

Show details

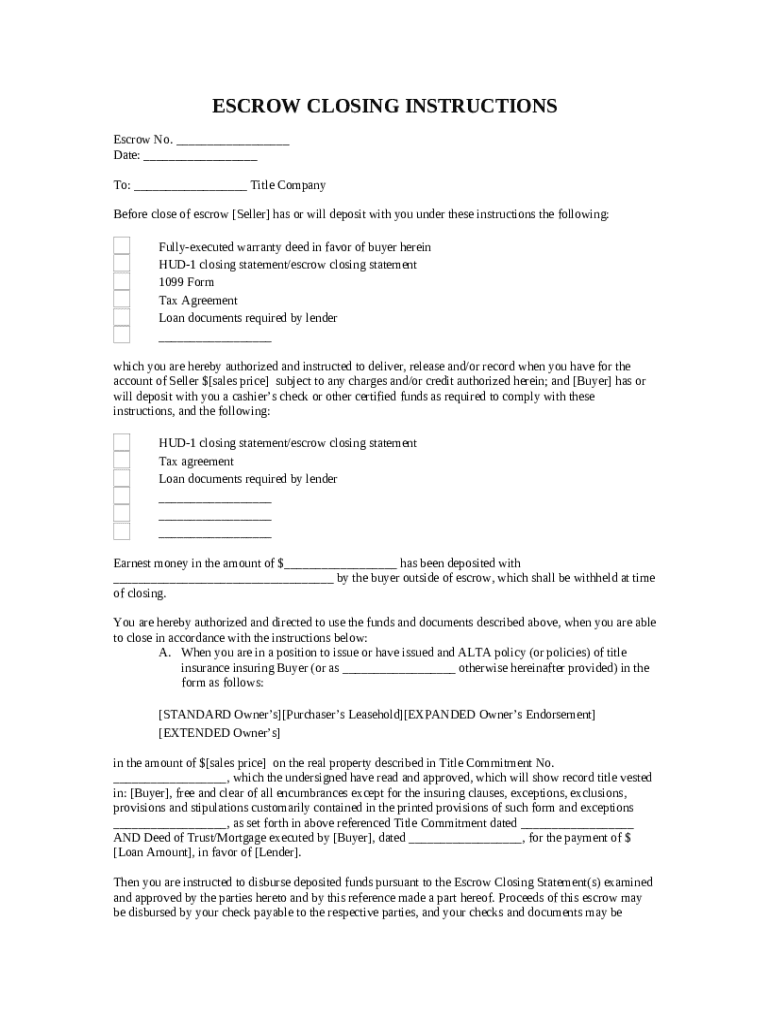

This is a sample Escrow Closing Instructions document. Escrow instructions are a consolidation of instructions from all parties involved in the sale that are needed to finalize the transaction.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is escrow closing instructions

Escrow closing instructions are detailed guidelines provided to facilitate the final steps of a real estate transaction, ensuring that all parties understand their obligations before the closing takes place.

pdfFiller scores top ratings on review platforms

very user friendly

Easier to use than I thought it would be.

NA

Good for vacation

It is very easy to use. No issues at all.

Fast and easy

Who needs escrow closing instructions template?

Explore how professionals across industries use pdfFiller.

Essential Guide to the Escrow Closing Instructions Form

What are escrow closing instructions?

An escrow closing instructions form is a critical document that outlines the agreement between the buyer, seller, and escrow agent regarding the terms of the transaction and how the closing process will be executed. These instructions are essential in real estate transactions as they help facilitate communication and ensure that all parties understand their responsibilities.

-

They provide a structured process for closing, helping reduce confusion and disputes.

-

They serve as a guide to meet legal requirements and maintain an organized procedure.

-

Each party's roles are defined to clarify expectations and obligations in the transaction.

What are the components of the escrow closing instructions form?

Understanding the components of the escrow closing instructions form is vital for ensuring a smooth transaction. Each section serves a specific purpose, which helps all parties align with the transaction's expectations.

-

This unique identifier is crucial for tracking the closing process and can be obtained from the escrow agent.

-

Fill in the current date to ensure the document is timely and relevant.

-

Select a title company that will handle the title search and insurance processes, maintaining clear communication.

-

Detail the financial contributions required from both the Seller and Buyer to finalize the transaction.

-

Specify what documents are necessary for closing, including warranty deeds, loan documents, and tax agreements.

How do you fill out the escrow closing instructions form?

Filling out the escrow closing instructions form accurately is critical to avoid pitfalls during the transaction. Following a step-by-step guide ensures the form is completed correctly.

-

Follow the provided instructions closely, ensuring each field is filled in as required.

-

Double-check for missing signatures or incorrect details to prevent delays in closing.

-

This tool allows for easy filling, editing, and signing of PDF documents, streamlining the process.

What instructions should you follow for escrow closing?

Specific instructions are vital for managing the closing, ensuring that all parties act per the agreed terms. Clear guidelines streamline the process and minimize confusion.

-

Clarify timing and conditions under which funds should be deposited into escrow.

-

Define under what circumstances documents will be recorded or released to the appropriate parties.

-

Outline key types of title insurance and eligibility criteria necessary for the transaction.

-

Detail potential title restrictions that may affect ownership or use of the property.

How to manage and track your escrow process?

Managing your escrow closing process efficiently can save time and ensure compliance with all parties involved. Using innovative tools can enhance communication and tracking.

-

This platform allows users to monitor progress and modifications to documents in real-time.

-

Ensure that all stakeholders can access necessary information while maintaining data security.

-

Stay updated on deadlines for documentation and other requirements to keep the transaction on schedule.

What are common issues and resolutions during the escrow process?

Encountering issues during the escrow process can be common; however, understanding how to address them is essential. Knowing the potential challenges helps buyers and sellers navigate their transactions smoothly.

-

Miscommunications and discrepancies in documentation are common, potentially causing delays.

-

Effective communication and documentation are key to resolving misunderstandings swiftly.

-

Consult available resources for assistance with document-related issues throughout the process.

What is the conclusion on utilizing an escrow closing instructions form?

To ensure a successful transaction, utilizing an escrow closing instructions form accurately is paramount. Digital assistants like pdfFiller simplify completion, editing, and signing processes, enhancing efficiency.

-

Correctly filling out the form minimizes risks and ensures smooth transactions.

-

Utilizing eSignature features of pdfFiller save time and make collaboration easier than traditional methods.

-

Prepare necessary documents, communicate clearly with all parties, and stay informed about the closing timeline.

How to fill out the escrow closing instructions template

-

1.Open the PDF containing the escrow closing instructions in pdfFiller.

-

2.Begin by entering the transaction date at the top of the document.

-

3.Fill in the buyer's full name and contact details in the designated fields.

-

4.Input the seller's full name and contact information next to the buyer's details.

-

5.Specify the property address and legal description in the appropriate sections.

-

6.Detail the closing date agreed upon by both parties.

-

7.List any necessary contingencies that must be met before closing.

-

8.Provide information on the escrow deposit amount and payment due dates.

-

9.Include a clear outline of any closing costs to be covered by each party.

-

10.Review all entries for accuracy and completeness before submitting the document.

-

11.Once confirmed, save the completed instructions, and share them with all involved parties as necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.