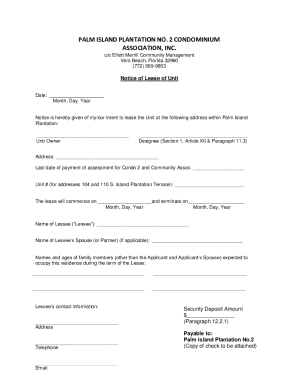

Get the free California Registration of Foreign Corporation

Show details

Includes instructions and forms required to register a non-California corporation in California.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is california registration of foreign

California registration of foreign refers to the process by which businesses incorporated outside of California register to do business in the state.

pdfFiller scores top ratings on review platforms

I found this program very user friendly. I am grateful for being able to do my tax forms and get all the information I need on this site. I would highly recommend it to anyone trying to make since of tax forms.

PDFFiller is a great tool . I would like to learn how to navigate through the site. Thanks.

It was a life saver! I have a fractured right wrist & this made my job a lot easier.

I am not computer literate, so everything is hard for me to understand. It was OK. It took some time to figure it out.

I'm a small CPA firm that only has a few W2's to file. This was a easy and quick way of doing it!

Consultant with a few part time assistants. Need something easy to use and cost effective. So far, PDFfiller has worked well.

Who needs california registration of foreign?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to California registration of foreign forms

What is California registration of foreign entities?

California registration of foreign entities refers to the process through which foreign businesses—those incorporated outside of California—register to conduct business in the state. This is crucial for legal recognition and compliance with state laws, ensuring that the foreign entity adheres to California's regulations.

-

A foreign entity is any business or organization that was established in a jurisdiction outside of California, including various forms such as limited liability companies (LLCs) and corporations.

-

Registering in California allows foreign entities to operate legally within the state, access state resources, and avoid penalties for non-compliance.

-

Entities must submit necessary documentation, including a Certificate of Good Standing, and follow either online, mail, or in-person filing procedures.

What are the prerequisites for registration?

Before starting the registration process, foreign entities need to gather specific documents and information. These prerequisites are vital, as failing to prepare adequately can lead to delays or rejections.

-

This document verifies that a foreign entity follows the legal requirements of its home state and is authorized to conduct business.

-

Filing fees can vary based on the entity type and filing method chosen. Accurate fee payment is crucial to avoid processing delays.

-

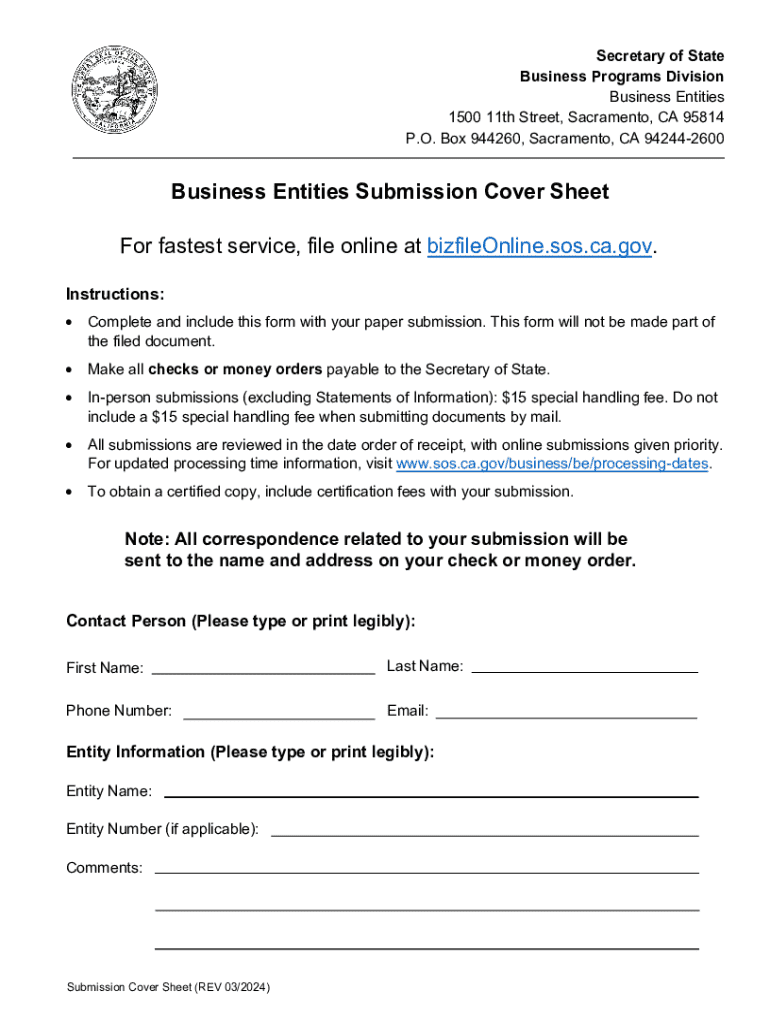

The submission cover sheet must include precise information about the entity, including its name, type, and address, to ensure correct processing.

How can file online for California registration of foreign forms?

Filing online is often the fastest method for registering. California's online filing portal provides a streamlined approach to submit documents and payment—all from your computer.

-

Visit the California Secretary of State's website and navigate to the online business registration section to initiate your filing.

-

Be sure to input all required information accurately, as errors can result in processing delays.

-

Include scanned copies of the Certificate of Good Standing and any other required forms for submission.

-

Choose your payment method and ensure transaction confirmation to proceed with your registration.

What are the steps for filing by mail?

If you prefer traditional methods, filing by mail is still an option. It requires careful adherence to submission guidelines to avoid processing issues.

-

Begin by downloading the necessary forms from the California Secretary of State’s website and filling them out completely.

-

Include a check or money order for the required filing fee in your submission packet.

-

Double-check the mailing address to ensure timely delivery and processing of your application.

What should know about in-person submission?

For those who prefer personal interaction, in-person submission is an option. This method allows for immediate feedback and assistance.

-

Locate the nearest office of the California Secretary of State for business filings, usually found in major cities.

-

Ensure you have all required documents, including your Certificate of Good Standing and completed forms.

-

Some locations may charge expedited fees for faster processing, so inquire beforehand.

What are common registration mistakes to avoid?

Mistakes during the registration process can lead to delays or denials. Awareness of potential pitfalls is critical to ensuring a smooth filing process.

-

Failing to complete the cover sheet can lead to immediate rejection or delays.

-

Any inaccuracies in this vital document can compromise the registration process.

-

Thoroughly understand the fees associated with your submission to avoid unexpected costs.

How can check the status of my submission?

Staying informed about your submission status is essential for timely planning and compliance. California provides tools for verifying the progress of your registration.

-

Use the California Secretary of State website's online portal to check the submission status of your application.

-

Processing times can vary based on whether you filed online, by mail, or in person, with online typically being the fastest.

-

Opt in for notifications to stay updated on any changes or requirements during the registration process.

What does managing your registered foreign entity involve?

After successfully registering, ongoing management is vital for compliance and continued business legality in California.

-

Registered foreign entities are subject to annual filings and taxes in California, and understanding these obligations is crucial.

-

Always keep your contact information and business details up-to-date to avoid missed communications from state authorities.

-

Familiarize yourself with renewal timelines and requirements to maintain good standing with California officials.

How to fill out the california registration of foreign

-

1.Obtain the California registration of foreign form, typically available on the California Secretary of State’s website or through pdfFiller.

-

2.Complete the form by entering the foreign corporation's name, state of incorporation, and the business address in California.

-

3.Provide information about the corporation’s officers and directors, including names and addresses.

-

4.Attach a certified copy of the corporation's articles of incorporation or a similar document from the home state.

-

5.Include the name and address of the registered agent in California who can accept legal documents on behalf of the business.

-

6.Check to ensure all fields are completed accurately to avoid delays.

-

7.Submit the completed form either online via pdfFiller or by mailing it to the appropriate state office, along with any required fees.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.