Get the free Straight Note for Mortgage template

Show details

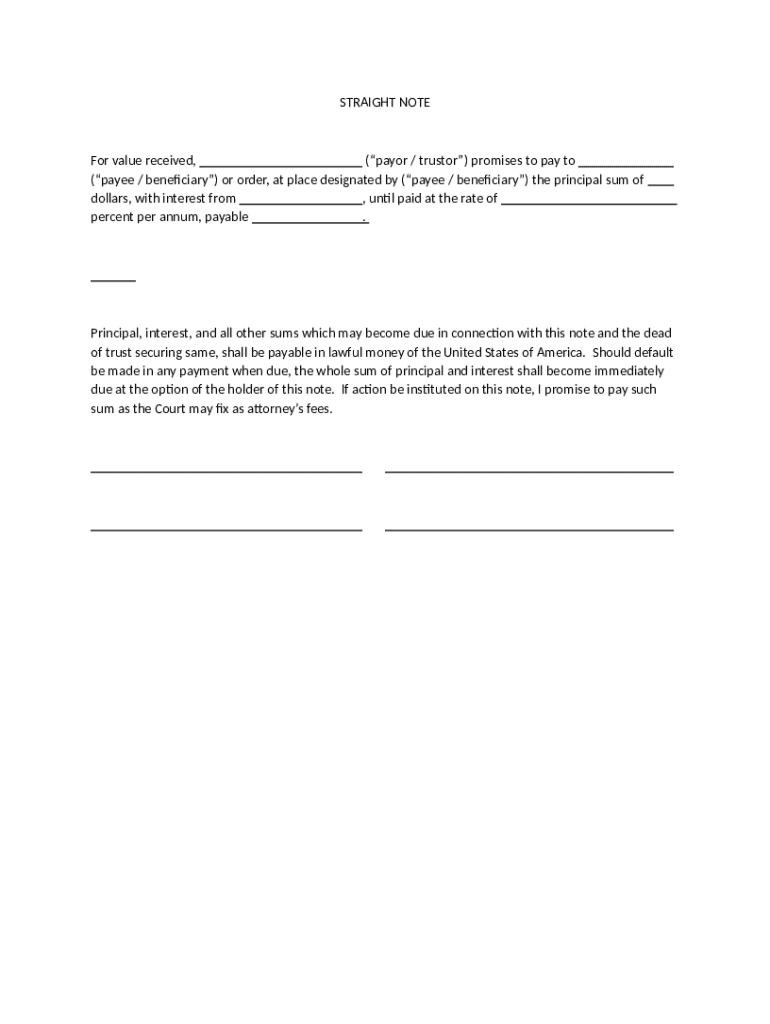

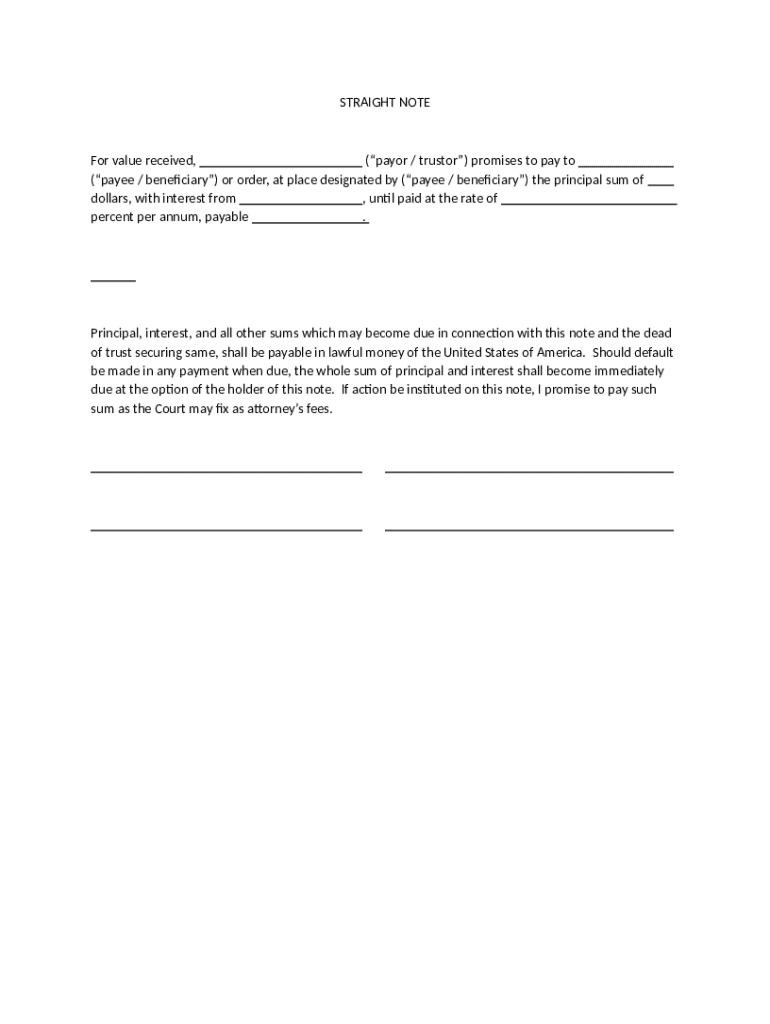

This is a sample Straight Note. Straight notes are a type of mortgage note where you make interest-only payments for a short time, and then the entire principle is due. The form may be customized

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is straight note for mortgage

A straight note for mortgage is a financial document that outlines a loan secured by real estate, where the borrower pays interest only until the principal is due at maturity.

pdfFiller scores top ratings on review platforms

While the site has merit, the format's coloration is inviting too, but the index of available functions is overwhelming.

great fir school, work and in court in pro per

Great

I had a simple edit to do. It did the job.

TOP!

so far so good. but I'd like to maximize my usage and see what all it can do.

Who needs straight note for mortgage?

Explore how professionals across industries use pdfFiller.

Straight Note for Mortgage Form Guide

A straight note for mortgage form is a crucial document for anyone involved in borrowing or lending money through real estate transactions. This guide will provide you with the necessary information and tools to navigate the complexities of this financial instrument.

What is a straight note?

A straight note is a type of promissory note used in mortgage agreements where the borrower repays the principal in a lump sum at the end of the term, along with any interest payments made throughout the loan period.

-

A financial document that outlines a loan agreement, specifying the repayment terms without amortized payments.

-

Straight notes feature a clear outline of payment expectations, allowing borrowers to understand their financial commitments.

-

Contrasts with balloon notes that require a large final payment and interest-only notes that defer principal repayments.

What are the key components of the straight note?

Understanding the essential elements of a straight note can significantly impact your investment and financial planning.

-

Recognize who the borrower (payor) and lender (payee) are in the agreement.

-

Be clear on how much money is being borrowed and what the applicable interest rate is.

-

Include details about how often payments are made and when full payment is due.

-

Define what happens if a payment is missed, including possible legal action and foreclosure.

How to fill out the straight note form?

Completing the straight note form accurately ensures that all parties understand their rights and obligations.

-

List all required fields and instructions to ensure correctness from the start.

-

Detail the fillable fields needed for a valid submission.

-

Highlight frequent errors individuals make when completing these forms such as missing signatures.

What is the signing and notarization process?

Proper execution of the document is vital for its legal standing.

-

A signed note legally binds both parties to the agreement.

-

A notary public verifies the identities of the signatories to prevent fraud.

-

Different regions may have specific regulations that need to be followed during this process.

How to manage your straight note?

Management is crucial for maintaining the integrity and security of your financial agreements.

-

Always keep your note in a safe place to avoid loss or damage.

-

Utilize pdfFiller's cloud-based tools for secure editing and signing of documents.

-

Ensure all stakeholders have access to the necessary documents for transparency.

Where to record the straight note?

Recording the straight note formalizes the agreement and protects the lender's interests.

-

This is typically where you will submit your document for public record.

-

Identify what paperwork you'll need to present for recording.

-

Be aware of any associated costs and how long the process may take.

What to expect after completing the straight note?

Understanding what happens next can help in navigating possible issues.

-

Gain insights into the rights and expectations after signing the agreement.

-

Learn about the legal steps that may be taken if payments are not made as agreed.

-

Ensure that both parties maintain copies for their records and future references.

What interactive tools are available on pdfFiller?

Utilizing available tools can streamline your document management process.

-

pdfFiller's platform allows users to organize and manage documentation efficiently.

-

Leverage tools to alter documents as needed for your unique situation.

-

Enable your team to work together on form completion and review seamlessly.

How to fill out the straight note for mortgage

-

1.Open the straight note document in pdfFiller.

-

2.Begin by entering the borrower's full legal name in the designated name field.

-

3.Fill in the property address where the mortgage will be secured.

-

4.Specify the loan amount in the appropriate section.

-

5.Indicate the interest rate for the mortgage loan clearly on the form.

-

6.Set the maturity date, which is when the principal is due.

-

7.Complete any additional sections regarding late fees or prepayment options, if applicable.

-

8.Provide any required co-borrower information if there are multiple parties on the note.

-

9.Review all entered information for accuracy before saving.

-

10.Finally, save the document or print it out to sign the note.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.