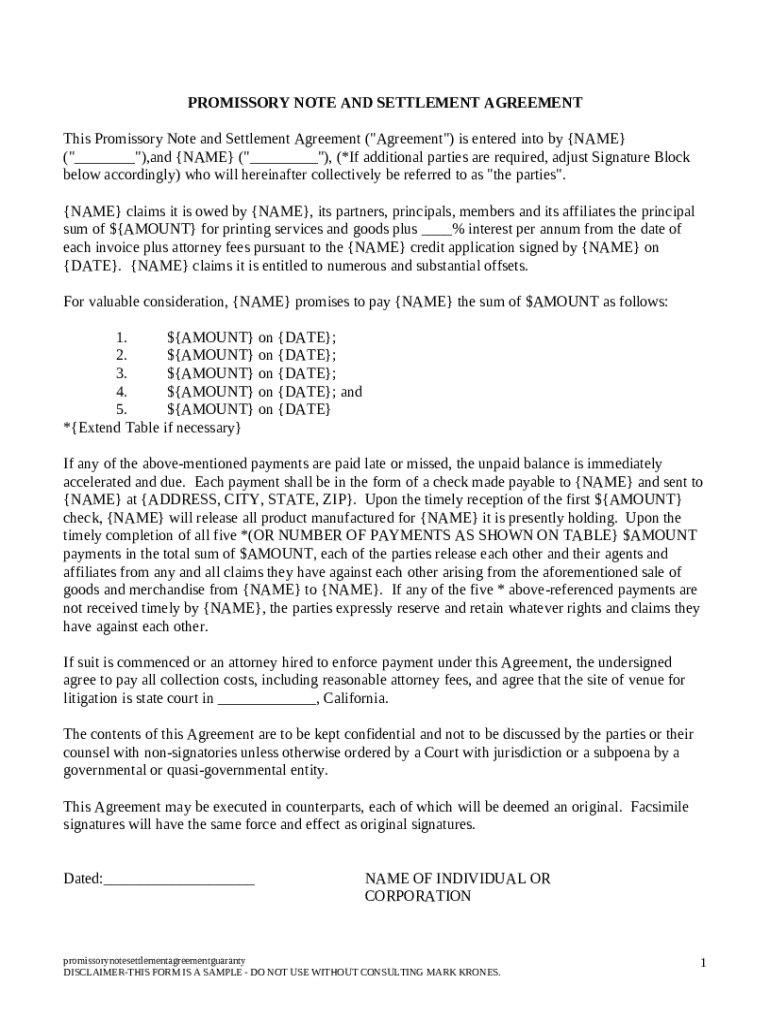

Get the free Promissory Note and Settlement Agreement template

Show details

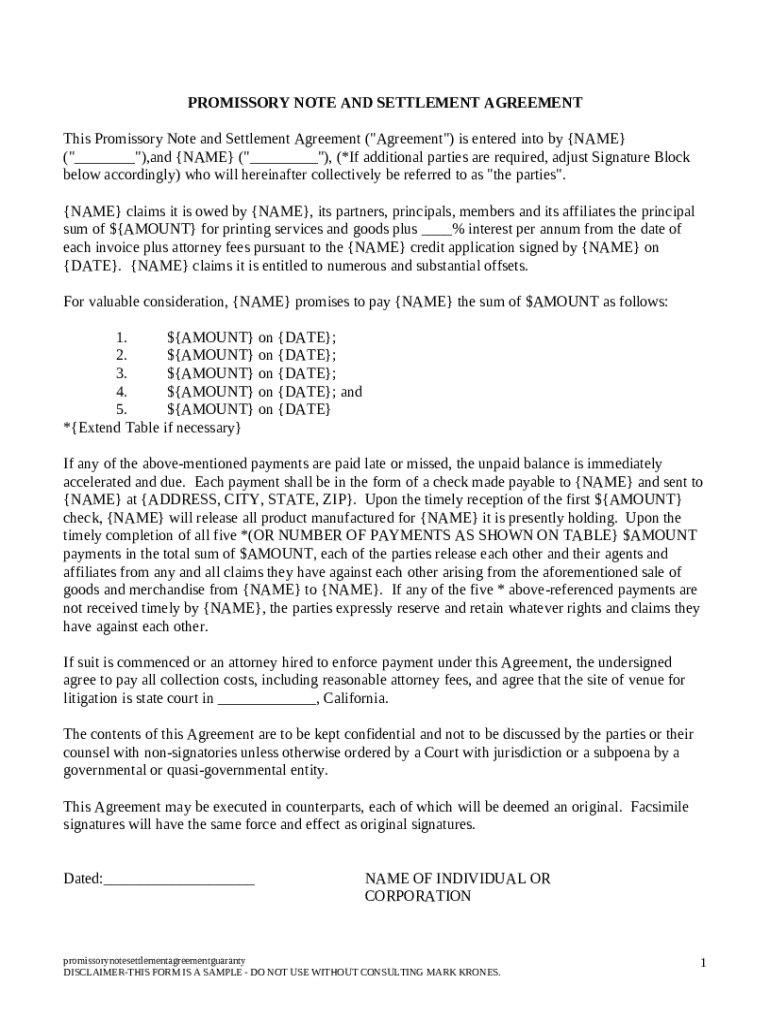

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note and settlement

A promissory note and settlement is a legal document that outlines a borrower's promise to repay a loan under specified terms and includes a settlement agreement regarding any related issues.

pdfFiller scores top ratings on review platforms

Should have ability to make initials in all squares calling for such

good

It is very easy i a! Very pleased with the service thank you for making things simple and easy

Can work without pdfFiller

I just started using it, but seems to work well!

I used PDFfiller to create a registration form for VBS for my church. It was easy to do!

Who needs promissory note and settlement?

Explore how professionals across industries use pdfFiller.

How to fill out the promissory note and settlement

-

1.Start by obtaining a blank promissory note template from pdfFiller or a trusted source.

-

2.Enter the names and addresses of the borrower and lender accurately in the designated fields.

-

3.Clearly specify the loan amount in the appropriate space, ensuring numbers and words match for clarity.

-

4.Outline the interest rate, if applicable, detailing whether it is fixed or variable and how it will be calculated.

-

5.Indicate the repayment schedule, including due dates and the total number of payments or term of the loan.

-

6.Include any prepayment penalties or conditions if applicable, ensuring it's clearly stated in the note.

-

7.Add sections for any collateral involved in the loan, if necessary, and describe the collateral in detail.

-

8.Once all information is entered, review the document for accuracy and completeness to avoid legal issues later.

-

9.Use pdfFiller's tools to electronically sign the document or prepare it for printing and physical signatures.

-

10.Finally, ensure both parties receive a signed copy of the finalized document for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.