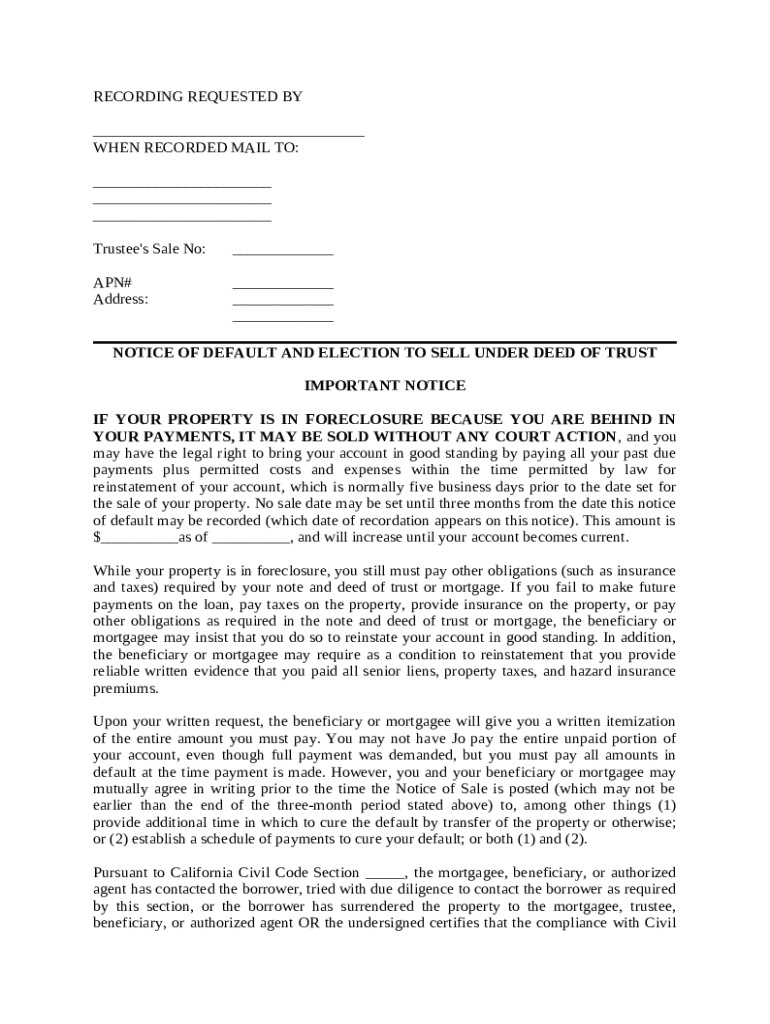

Get the free Notice of Default and Election to Sell Under Deed of Trust template

Show details

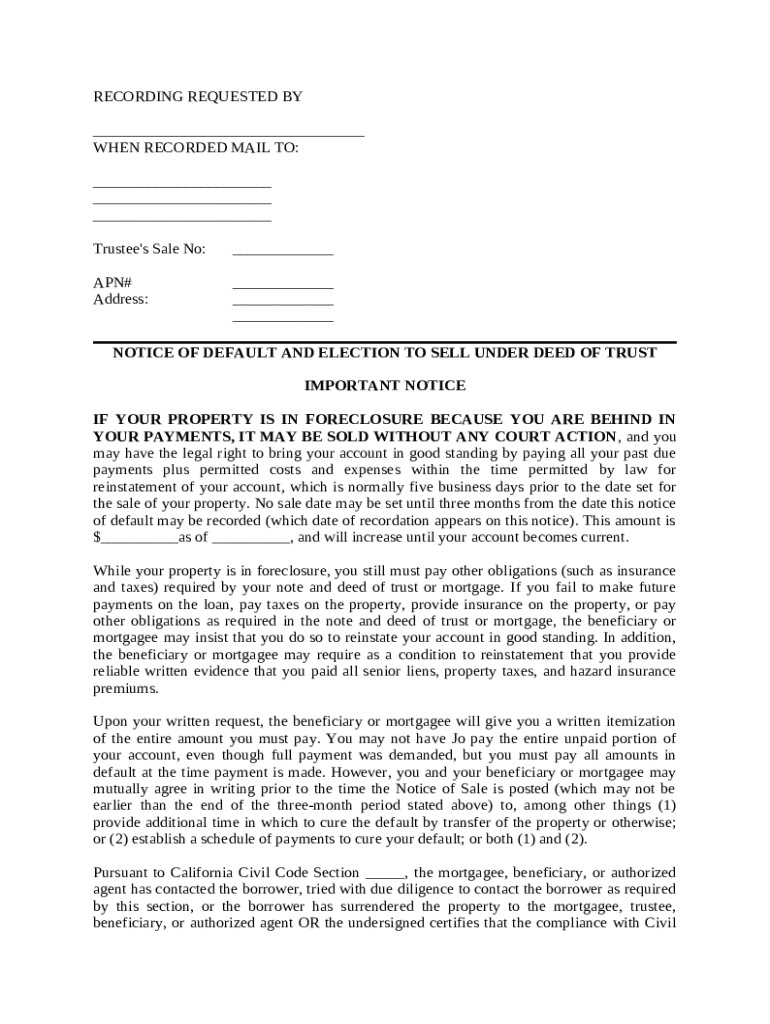

This form serves as a notice of default to the mortgagor for payments that are past due. The default notice states that while the property is in foreclosure, the mortgagor is still responsible.

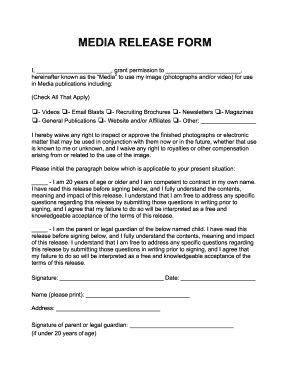

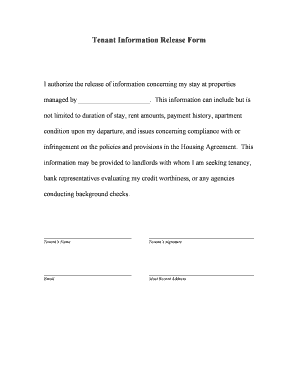

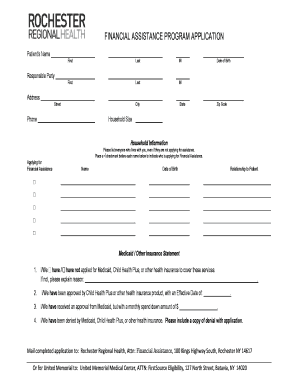

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default and

A notice of default is a formal notification sent to a borrower indicating that they have failed to meet the terms of their mortgage or loan agreement.

pdfFiller scores top ratings on review platforms

convenient and easy to use. Prices are very reasonable and a large selection of documents to choose from.

Great help to edit PDFs

IS AN EASY APP TO WORK WITH

It's awesome! Works as I expected! Thank you!

its very fast and easy to use, the features are excellent

It is easy to use and very affordable.

Who needs notice of default and?

Explore how professionals across industries use pdfFiller.

Notice of Default and Form Guide

How to effectively fill out a notice of default form

To fill out a notice of default form correctly, identify the key fields it contains, ensure your information is accurate, and pay attention to local laws. Using tools like pdfFiller can simplify this process, allowing for seamless editing and signing.

Understanding the notice of default

A Notice of Default is a formal notification that a borrower has failed to meet their mortgage payment obligations. Legally, it signifies the start of the foreclosure process, providing the borrower with information about their overdue payments and forthcoming actions.

When a lender issues a notice, it typically marks the beginning of a serious phase in the loan cycle. It's important for borrowers to recognize the components of this document and the implications it holds.

-

A formal alert indicating that the borrower has failed to pay the mortgage, possibly leading to foreclosure.

-

Understanding the timeline from receiving a notice until potential foreclosure.

-

Includes details such as amount owed, due dates, and contact information for the lender.

What interactive elements exist for notice management?

Managing a Notice of Default effectively requires the right tools. pdfFiller offers features like document editing, e-signatures, and real-time collaboration, enhancing the efficiency of handling your notice.

-

Users can modify their forms directly, making corrections as needed.

-

Allow multiple parties to review and provide input on the Notice of Default.

-

Securely save documents for easy access from any location.

What does a notice of default form entail?

Filling out the notice involves providing accurate information about the mortgage and the borrower. Each field must be filled out correctly to avoid potential legal issues or delays.

-

Typical fields include details like 'RECORDING REQUESTED BY' and 'WHEN RECORDED MAIL TO.'

-

Be clear and concise, ensuring every section reflects your current status.

-

Avoid errors like missing signatures or incorrect property details, which could derail the process.

What are the consequences of receiving a notice of default?

Receiving a Notice of Default can significantly affect your financial stability. It serves as a warning that foreclosure may be imminent if you do not address your dues promptly.

-

Foreclosure actions could commence, greatly affecting your credit score.

-

Timely responses can mitigate negative outcomes and give you options for resolution.

-

Each state has its own regulations concerning foreclosure notifications and rights, which must be understood.

How does the reinstatement process work after a notice of default?

Reinstating your mortgage is crucial if you've received a Notice of Default. This process typically requires you to pay the overdue amounts along with any additional fees to return your loan to good standing.

-

Make full payments on due amounts and seek confirmation from your lender.

-

Consider costs, as late fees and other charges can accumulate quickly.

-

Documentation and proof of payments may be necessary to validate your reinstatement request.

What compliance and legal considerations should be noted?

Legal compliance is paramount when dealing with a Notice of Default. Various state laws dictate how these notices must be managed, making it essential to stay informed.

-

Regulations surrounding Notices of Default can vary widely from one state to another.

-

Property owners must respond and act accordingly to minimize consequences.

-

It's advisable to consult with a lawyer to ensure compliance with local regulations.

What additional tools are available for document management?

In addition to filling out the Notice of Default, other tools can greatly enhance document management. pdfFiller provides many resources tailored for effective oversight and organization.

-

Leverage pre-made templates for various forms, ensuring accuracy and compliance.

-

Remain on track with your obligations through system notifications.

-

Utilize analytics to monitor document actions and responses, facilitating better decision-making.

How to fill out the notice of default and

-

1.Access pdfFiller and log into your account or create one if necessary.

-

2.Search for the 'Notice of Default' template in the search bar.

-

3.Select the template to open it in the editing interface.

-

4.Begin by filling in the borrower's name and contact information at the top of the form.

-

5.Next, enter the property address associated with the mortgage.

-

6.Indicate the loan number or account number as required.

-

7.Specify the date of default, ensuring accuracy in your records.

-

8.If applicable, include any relevant details about the payment that was missed.

-

9.Review the contents for any additional clauses or information the lender wishes to include.

-

10.Once completed, save your document and choose to print or send it electronically as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.