Get the free Certificate of Lien for Unsecured Property Taxes template

Show details

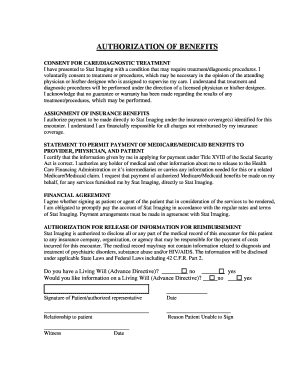

This form is for a lien for unpaid taxes. The taxes are not secured by real property such as land, these taxes are called "Unsecured." Property taxes.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is certificate of lien for

A certificate of lien for is a legal document that formally establishes a claim or lien against a property for the purpose of securing payment or performance of an obligation.

pdfFiller scores top ratings on review platforms

I used PDFfiller for my 1099 forms. Had a little bit of difficulty and needed help. It was great to get immediate assistance to resolve the issue.

Excellent website to get all your Tax Forms. Very User Friendly!!

I received chat support immediately. Elisa was friendly and knowledgeable!

fun and easy to use. Also very convienant

i would like to have a video how you use this system and how to find forms

So far so good. I haven't use all features yet.

Who needs certificate of lien for?

Explore how professionals across industries use pdfFiller.

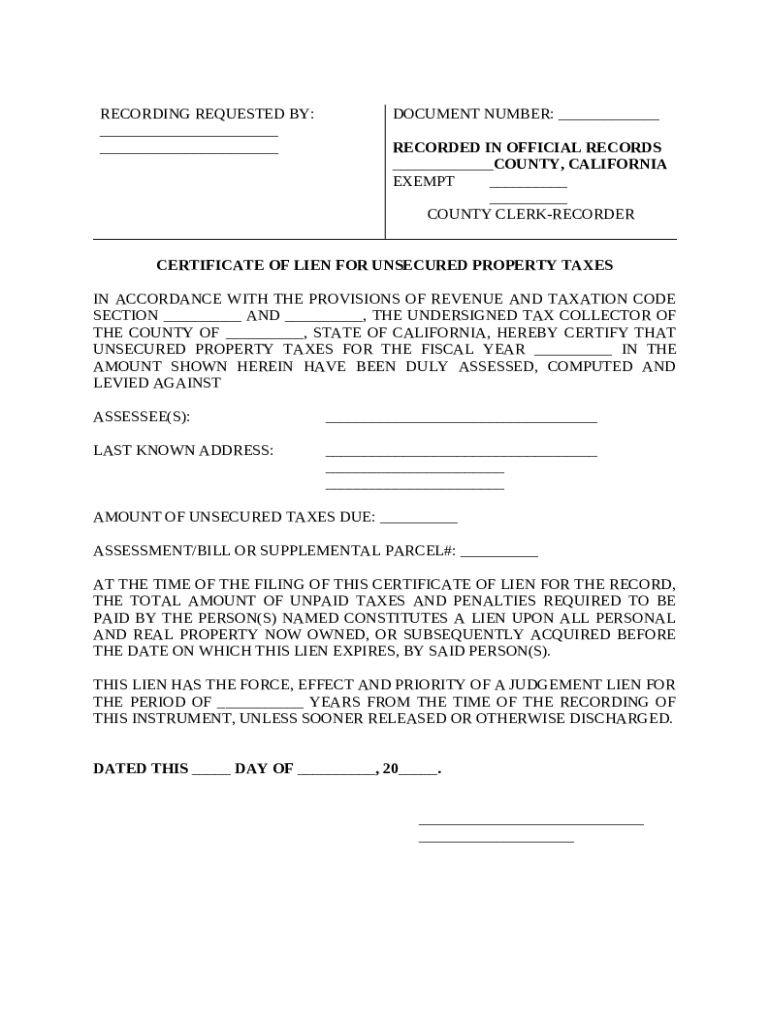

Understanding the Certificate of Lien for Unsecured Property Taxes

What is a Certificate of Lien?

A certificate of lien is a legal document that establishes a claim against a property due to unpaid debts, particularly related to taxes. This document serves as an official notice to interested parties that the property is encumbered and cannot be sold without resolving the underlying issues. In the context of unsecured property taxes, it underscores the municipality’s right to collect the owed taxes and protect its revenue.

-

It is a formal document that indicates a claim on property, ensuring the rightful collection of debts.

-

These liens arise from unpaid property taxes that are not secured by a mortgage, creating a direct obligation for the property owner.

Why do we need a Certificate of Lien in Debt Collection?

The certificate of lien plays a pivotal role in the tax collection process, ensuring municipalities can effectively reclaim revenue. It acts as a protective measure for local governments against property owners who neglect their tax obligations, facilitating the proper funding of public services. Furthermore, having a lien on property can significantly affect ownership rights and responsibilities.

-

Helps municipal governments to legally secure outstanding taxes to maintain budget and services.

-

Ensures that funds owed for taxes are collected before a property's sale or transfer.

-

Property owners can face severe consequences, including the loss of their property if debts remain unpaid.

What are the Key Components of the Certificate of Lien Form?

Understanding the components of the certificate of lien form is critical for ensuring accurate and compliant completion. Each section must be filled out meticulously as it comprises essential information required for proper processing by local authorities.

-

Identifies who is submitting the lien request, often a government entity.

-

A unique identifier for the lien that facilitates tracking and referencing.

-

Details about the official responsible for the documentation in your local office.

-

Includes information about the property owner and the specific amount owed in taxes.

-

Mistakes in this section can lead to processing delays or legal disputes.

How to Fill Out the Certificate of Lien Form?

Filling out the certificate of lien form requires a careful approach to ensure all details are accurate and complete. It is essential to follow a systematic method to avoid errors that could jeopardize the filing process. Starting with clear instructions for each required section on the form is vital.

-

Follow clear guidelines provided by local tax authorities on how to complete your certificate.

-

Ensure to submit the completed form to the county clerk for proper recording and legality.

-

Be aware of specific state or local requirements that may affect how you fill out the form.

What are the Implications of the Lien on Property?

The imposition of a lien has serious repercussions for both property ownership and financial responsibilities. Understanding these consequences helps property owners appreciate the urgency of resolving unpaid taxes and maintaining their properties free of financial encumbrances.

-

A lien can limit the owner's ability to sell or refinance the property until the debt is resolved.

-

Liens usually carry a priority that can last for several years, which may affect future transactions.

-

Continued neglect can result in foreclosure, legal action, or other severe outcomes.

How to Manage Your Certificate of Lien with pdfFiller?

Managing your documents efficiently is crucial when dealing with legal forms like the certificate of lien. pdfFiller provides several tools to streamline the process, allowing for easier edits, signatures, and collaboration on the required documents.

-

The platform allows users to upload, edit, and store documents securely in the cloud.

-

With pdfFiller's intuitive interface, users can seamlessly complete their certificates without hassle.

-

The cloud functionality allows users to retrieve and manage their lien forms from any device.

What are Common Mistakes to Avoid When Filing Your Certificate of Lien?

Avoiding common pitfalls when filing your certificate of lien is essential for a smooth process. Awareness of frequent errors can save time and ensure compliance with all legal requirements.

-

Common mistakes include missing signatures, incorrect amounts, or improper document formatting.

-

Before submission, review your form against your records to confirm accuracy.

-

Incorrect submissions can lead to penalties or delayed action on the lien.

How to fill out the certificate of lien for

-

1.Open the PDF file of the certificate of lien on pdfFiller.

-

2.Begin by entering your name and contact information in the designated fields at the top of the document.

-

3.Provide the property owner's details, including their name and address, in the appropriate section.

-

4.Fill out the legal description of the property, ensuring it is complete and accurate to avoid any disputes.

-

5.Indicate the total amount owed in the field labeled 'Amount of Lien'.

-

6.Specify the date by which payment is due, if applicable, in the provided space.

-

7.Attach any supporting documents that may be required, such as invoices or contracts, using the 'Attachments' feature.

-

8.Review the document carefully to ensure all information is correct and complete.

-

9.Sign the certificate of lien at the bottom to validate it, making sure to date it as well.

-

10.Save your completed document and download it to your device or submit it as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.