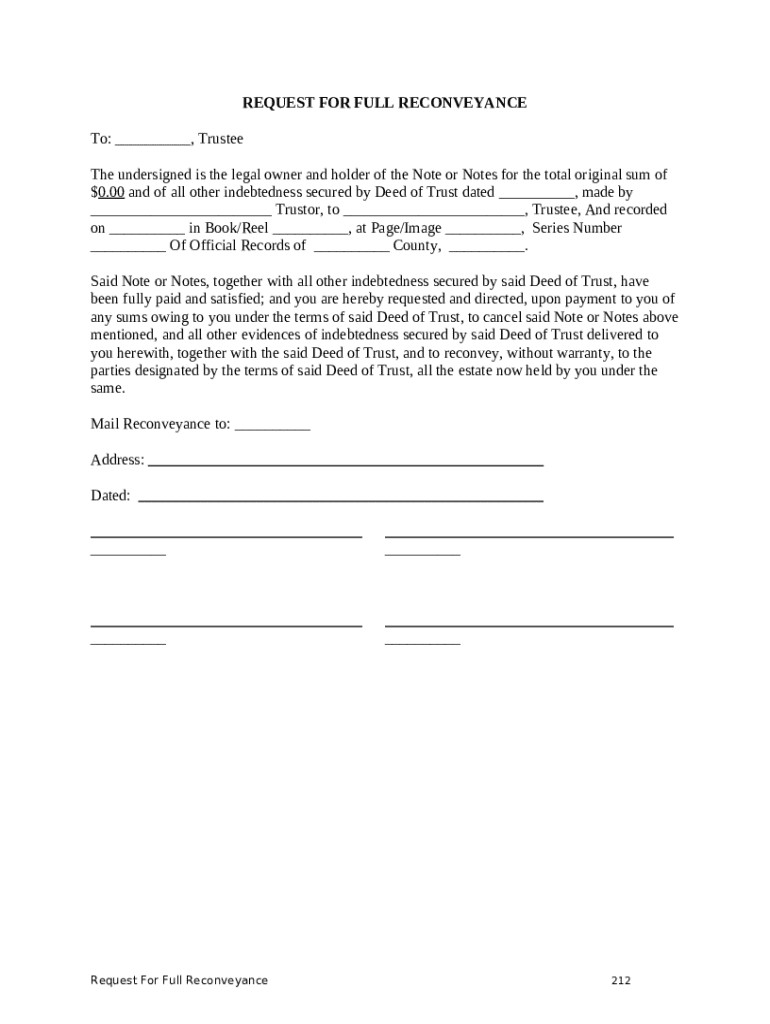

Get the free Request for Full Reconveyance template

Show details

This is a sample Request for Full Reconveyance. Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is request for full reconveyance

A request for full reconveyance is a legal document used to transfer the title of a property back to the borrower after a loan has been paid in full.

pdfFiller scores top ratings on review platforms

Very easy to use for both personal and…

Very easy to use for both personal and professional documents. Especially for someone like me who is always on the go!

works great

works great was able to edit document,email,print, create pdf, and download very easy and quickly

All around great tool!

The pdf to excel was not easy to edit

These guys refunded me with no hassle

These guys refunded me with no hassle, I am certainly coming back to use their services when I am ready.

Great app

Who needs request for full reconveyance?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Request for Full Reconveyance Form

What is full reconveyance?

Full reconveyance is the legal process through which a lender transfers the title of a property back to the borrower, confirming that the debt has been fully paid. A request for full reconveyance form is crucial for ensuring that all indicators of ownership are properly transferred. This process is essential to clear any outstanding liens against the property, allowing for a clean transfer of ownership.

-

Reconveyance specifically refers to the act of transferring a property title back to its owner after the debt secured by the property has been satisfied.

-

It is necessary when a mortgage or deed of trust has been fully paid, ensuring that the property owner has clear title free of encumbrances.

-

Completing the reconveyance process is crucial for protecting your ownership rights, facilitating the sale of the property in the future, and meeting legal requirements.

What are the essential components of the full reconveyance request?

-

The identity of the lending institution or individual holding the mortgage must be clearly stated to process the request accurately.

-

Include the Deed of Trust details for the property, including the lot number, parcel number, and legal description.

-

Documentation proving that all outstanding debts related to the mortgage have been paid is essential in the request.

-

The form should specify the address to which the reconveyance documents should be sent and details about the involved entities.

How do you fill out the full reconveyance form?

-

Before starting the form, compile necessary documents such as the original mortgage agreement, prior payment receipts, and identification.

-

Fill out the reconveyance form accurately, including all requested information to prevent delays.

-

Check if notarization is needed for the form, as many jurisdictions require it to validate the document.

-

Send the completed form to the trustee or the designated recipient, ensuring it is delivered via a trackable method.

How can you utilize pdfFiller for your request?

-

Log into pdfFiller and search for the full reconveyance template, which provides a streamlined approach to fill out the form.

-

Use pdfFiller’s editing tools to add, remove, or modify fields in the reconveyance form as needed.

-

Collaborate with stakeholders by using the eSigning capabilities, making it easy to obtain necessary signatures.

-

Once completed, store and manage your reconveyance form within pdfFiller for easy access and retrieval.

What compliance considerations should you keep in mind?

-

Different states and regions have specific laws regarding reconveyance. Familiarize yourself with them to ensure compliance.

-

Common challenges include incomplete forms and lack of required documentation, leading to delays and rejections.

-

Utilize checklists and consult legal documents to ensure all required items are included before submission.

What are common problems in full reconveyance requests?

-

Ensure all fields are accurately filled; small mistakes could lead to processing issues.

-

Requests often get rejected due to missing signatures or documents. Addressing these beforehand can speed up the process.

-

Follow up with the trustee after submission and maintain clarity in communication to facilitate a quicker response.

How to fill out the request for full reconveyance

-

1.Locate the request for full reconveyance form on pdfFiller.

-

2.Open the PDF file in pdfFiller’s editor.

-

3.Fill in the borrower's name and address in the designated fields.

-

4.Enter the lender's name and address accurately.

-

5.Include details of the loan, such as the loan number and property description.

-

6.Verify that all information is correct before submission.

-

7.Sign the document electronically if required, and date it.

-

8.Download or print the completed request for full reconveyance for your records.

-

9.Submit the form to the appropriate lender or title company as instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.