Get the free pdffiller

Show details

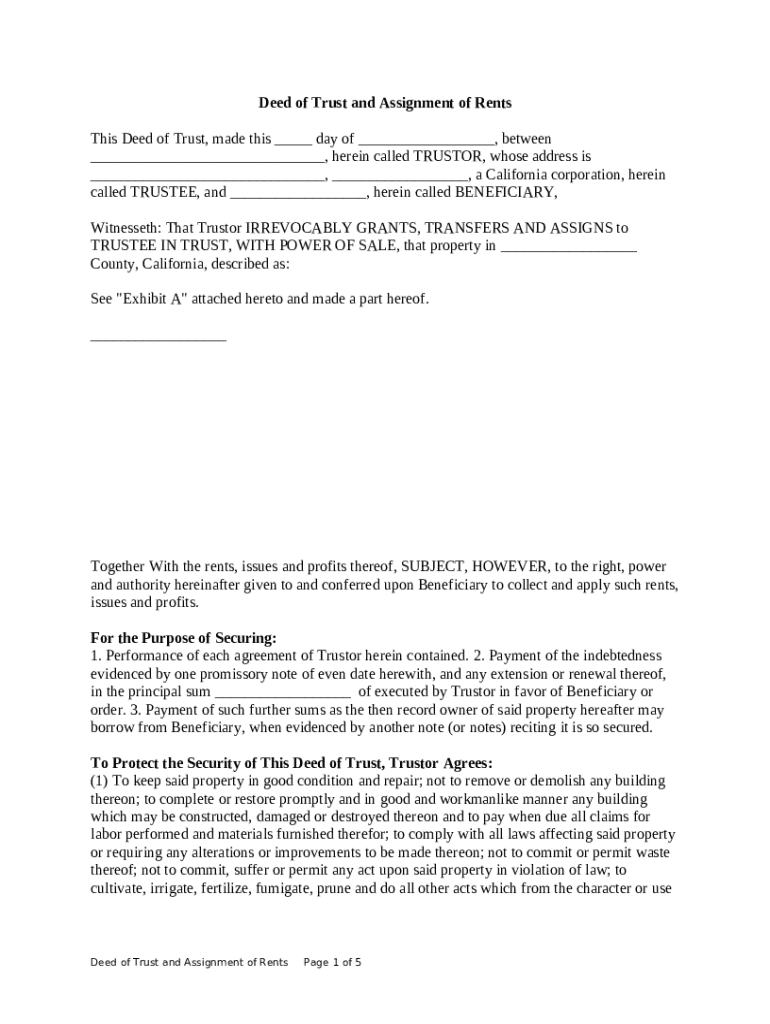

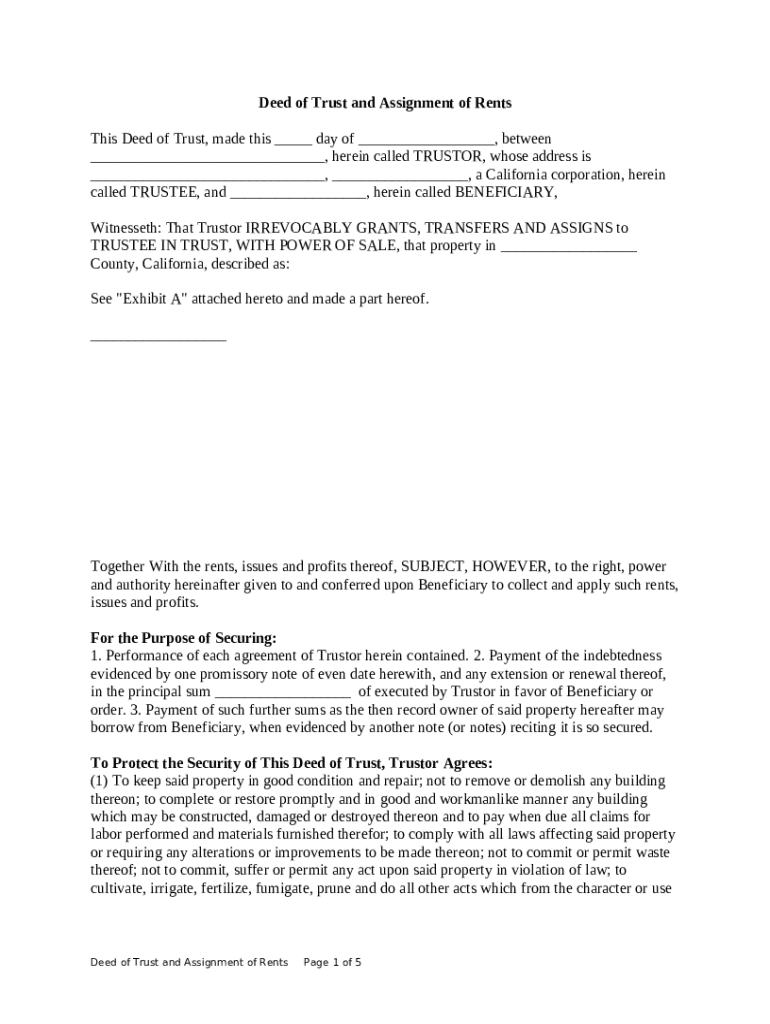

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Short Form Deed of Trust and Assignment of Rents, can be used in the transfer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of trust and

A deed of trust is a legal document that secures a loan by transferring the title of a property to a trustee until the borrower repays the loan in full.

pdfFiller scores top ratings on review platforms

This program has made my work day a lot better.

Not the easiest program to navigate. A few otherproblems

I've tried others, but PDFFiller is the best I've used.

I had some trouble at first (yesterday), but support was able to help. Now things are going smoothly on my end. It still remains to see how my signers interact with PDF Filler.

So far, so good. Nice feature that long ago MS in word offered something similar. If marketed correctly, it should be very successful - God willing.

at times its complicated and doesn't produce a clear copy when editing, but okay for blank documets

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Deed of Trust and Forms

Filling out a deed of trust form involves understanding its components, determining the correct parties, and accurately documenting essential details. Follow our comprehensive guide to ensure your deed of trust is completed correctly.

What is a deed of trust?

A deed of trust is a legal document that secures a loan to real property by transferring the title to a neutral third party, called a trustee, until the loan is paid in full. Its purpose is to provide security for the repayment of a debt, ensuring that the lender has a claim against the property in case of default.

-

It serves as an agreement between the borrower, lender, and a trustee to outline the terms of a secured transaction.

-

Includes details such as the parties involved, property description, loan terms, and the trustee's role.

-

While both secure a loan with real estate, a deed of trust involves three parties, whereas a mortgage only has two.

Who are the key parties involved in a deed of trust?

The parties involved in a deed of trust include the trustor, who is the borrower; the trustee, who holds the title on behalf of the lender until the obligation is fulfilled; and the beneficiary, who is typically the lender. Each party has distinct roles and responsibilities that affect the transaction.

-

The trustor must make payments on the loan as outlined in the agreement.

-

The trustee has the authority to foreclose on the property if the trustor defaults.

-

Beneficiaries have the right to receive payments from the trustor and to enforce the deed’s terms.

How to determine the parties to the deed of trust?

Choosing the right parties for the deed of trust is crucial for legal validity. The trustor, trustee, and beneficiary must be properly identified to avoid disputes or complications.

-

Parties should be compliant with local laws, have the legal capacity to enter contracts, and be able to fulfill their roles.

-

In California, all parties must adhere to state regulations regarding the execution of a deed of trust.

-

Ensuring accurate names, addresses, and identification numbers prevents legal issues later.

What are the best practices for drafting a deed of trust?

Drafting a deed of trust requires attention to detail and clear communication of terms. The document must present all relevant information clearly to minimize misunderstandings.

-

Include loan amount, interest rate, property description, and identification of all parties.

-

Use straightforward, legal terminology to ensure all parties understand their obligations.

-

Using pdfFiller templates allows for easy customization and saves time.

How do you use pdfFiller for completing a deed of trust?

pdfFiller provides a user-friendly platform that simplifies the process of filling out legal documents like a deed of trust. It enables you to edit fields easily, ensuring all necessary information is included.

-

Visit pdfFiller’s homepage, search for 'deed of trust', and select the relevant template.

-

Follow the prompts to input specific details into the form.

-

Utilize the eSign feature to securely sign the document online.

What is the process for getting signatures notarized?

Notarization is crucial for validating a deed of trust as it ensures that the signatures are genuine and the signers acted voluntarily. Here’s how you can ensure proper notarization.

-

Notarization helps prevent fraud and confirms the identities of the parties involved.

-

You can find a notary via the National Notary Association or local banks.

-

Ensure that all signatures are obtained in the presence of the notary to avoid complications.

How do you record the deed of trust?

Once all signatures are collected, the next step is to record the deed of trust at the County Recorder’s Office. This step is vital as it makes the deed a public record.

-

Submit the completed deed along with any required fees and forms to your local County Recorder.

-

Recording fees vary by county, so check your local regulations for specifics.

-

Always retain a copy for your records to verify ownership and terms.

What happens after recording the deed of trust?

After the deed of trust is recorded, both trustors and beneficiaries must adhere to the responsibilities outlined in the document. Failure to do so can lead to legal ramifications.

-

Once recorded, all parties are legally bound by its terms.

-

The trustor must make timely loan payments and maintain the property.

-

Ensure all maintenance and improvements comply with the deed’s terms to prevent violations.

Conclusion and next steps for managing a deed of trust

In conclusion, a deed of trust is a pivotal document for securing real property loans. Utilizing tools like pdfFiller can streamline the drafting and management process, making it easier for individuals and teams to navigate through legal requirements efficiently.

-

Understand and follow all steps from drafting to recording the document.

-

Leverage pdfFiller’s features to manage all your legal documents seamlessly.

-

Always ensure compliance with local laws to protect all parties’ interests.

How to fill out the pdffiller template

-

1.Start by accessing pdfFiller and uploading the deed of trust template you wish to fill out.

-

2.Review the document carefully to understand the required inputs.

-

3.Begin filling in the borrower's information at the top of the form, including name, address, and contact details.

-

4.Next, provide the lender's information in the designated section, including their name, address, and contact information.

-

5.Specify the loan amount that the borrower is obtaining and ensure that this is accurately reflected in the relevant section.

-

6.Complete the property description, including the full address and legal description as required by local law.

-

7.Fill in the terms of the loan, such as interest rate, payment schedule, and maturity date to ensure clarity.

-

8.Designate a trustee by providing their name and contact information, who will hold the title until the loan obligation is fulfilled.

-

9.Review the entire document for accuracy and completeness, making sure all signatures and dates are correctly included.

-

10.Finally, save the completed document and print it for all parties to sign in the necessary legal capacity.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.