Get the free Authorization for Deduction from Pay for a Specific Debt template

Show details

Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

I like it very much, but let me upload more than 150 pages, than its excellent

It's pretty good, but some repeat items don't load, and a couple times it would not let me add a 3rd line in a box. It would be nice if columns of numbers could add up.

The program works well once you get used to it.

I use PDF filler almost everyday It is great asset at work

I like the fact that I can type those applications that I didn't have a way to type.

This is a great, user-friendly resource that I intend to use regularly in the course of my work

Guide to Authorization for Deduction from Form

What is the authorization for deduction?

An authorization for deduction from form is a document that allows an employer to withhold a specific amount from an employee's paycheck for reasons like debt repayment or other agreed-upon deductions. Understanding the nuances of this form is crucial for both employers and employees to ensure compliance and avoid conflicts.

-

The authorization specifies the amount and purpose of the deduction, providing clear consent from the employee.

-

There are distinctions between deductions for debts, which are legally mandated, and voluntary deductions, which might include subscriptions, insurance, or other personal choices.

-

Proper documentation of debts ensures clarity and protects both parties in the event of disputes.

What are the legal considerations for deduction authorizations?

Legal compliance is essential when using the authorization for deductions. Both federal and state laws outline stringent regulations regarding wage deductions, aiming to protect employee rights while ensuring fair labor practices.

-

Employers must adhere to the legal frameworks set by federal and state laws, which vary in terms of conditions and limits on deductions.

-

Deductions should not bring an employee's wage below the legal minimum, which could expose employers to legal repercussions.

-

Improper deductions can lead to penalties, including fines and liability for unpaid wages in some cases.

When should the authorization form be used?

Employers should know when to use the authorization for deduction form by recognizing various scenarios in which this document is essential. This not only facilitates smooth repayment processes but also safeguards employers against potential disputes with their staff.

-

In instances where an employee owes amounts for damages or loans, this form becomes crucial to formalize the agreement.

-

Situations such as unpaid advances or loss of company property necessitate the use of the authorization form.

-

Utilizing this form can protect the employee from unauthorized deductions and provide the employer with documentation that supports their actions.

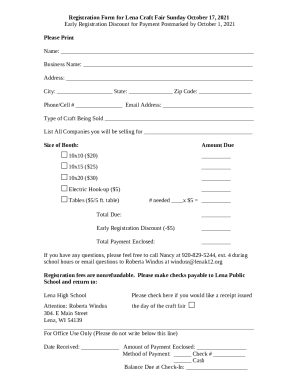

How to fill out the authorization for deduction form?

Correctly filling out the authorization for deduction form is crucial for ensuring that all necessary information is captured and that legal standards are upheld.

-

First, gather all required information, including employee details and the exact amount to be deducted.

-

Ensure to complete all relevant sections of the form, including dates, signatures, and the purpose of deduction.

-

Avoid leaving fields blank or using incorrect values, as these can lead to complications or disputes in the future.

What types of deductions can be authorized?

The authorization for deduction form covers various categories of deductions permissible under law, helping to clarify the circumstances under which deductions may be made.

-

Employers may deduct wages if an employee has lost or damaged company property, provided it aligns with the policy.

-

Repayment agreements for loans or advances given to employees need to be clearly defined in the deduction authorization.

-

Understanding the financial implications of deductions for items issued to employees is crucial for transparent payroll management.

What are employer responsibilities during the deduction process?

Employers have a duty to maintain transparency and compliance during the deduction process, which helps foster trust between them and their employees.

-

Employers should inform employees about the deductions, ensuring they understand the nature and reason for these amounts.

-

Implementing regular checks and measures can help ensure that all deductions are compliant with the law.

-

Establishing a clear communication channel regarding deductions can help alleviate misunderstandings.

How can pdfFiller help with document workflow?

Managing the authorization for deduction form can be made significantly easier by leveraging solutions like pdfFiller. This platform provides tools that facilitate the editing, signing, and sharing of documents seamlessly.

-

Users can edit the authorization forms directly within the platform, ensuring that all details are accurate and up-to-date.

-

Teams can easily collaborate on reviewing authorization requests, leading to quicker approvals and enhanced communication.

-

Utilizing pdfFiller’s organizational features helps maintain clarity and easy access to all necessary documentation.

How to maintain compliance and mitigate risks?

Implementing strategies for compliance and risk mitigation is essential for employers who utilize the authorization for deduction from form.

-

Establish strict guidelines to prevent any unauthorized deductions, protecting employee rights.

-

Conducting regular audits on deduction practices helps in identifying inconsistencies and maintaining regulatory compliance.

-

Having access to legal resources regarding deductions ensures that employers remain informed about their rights and obligations.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.