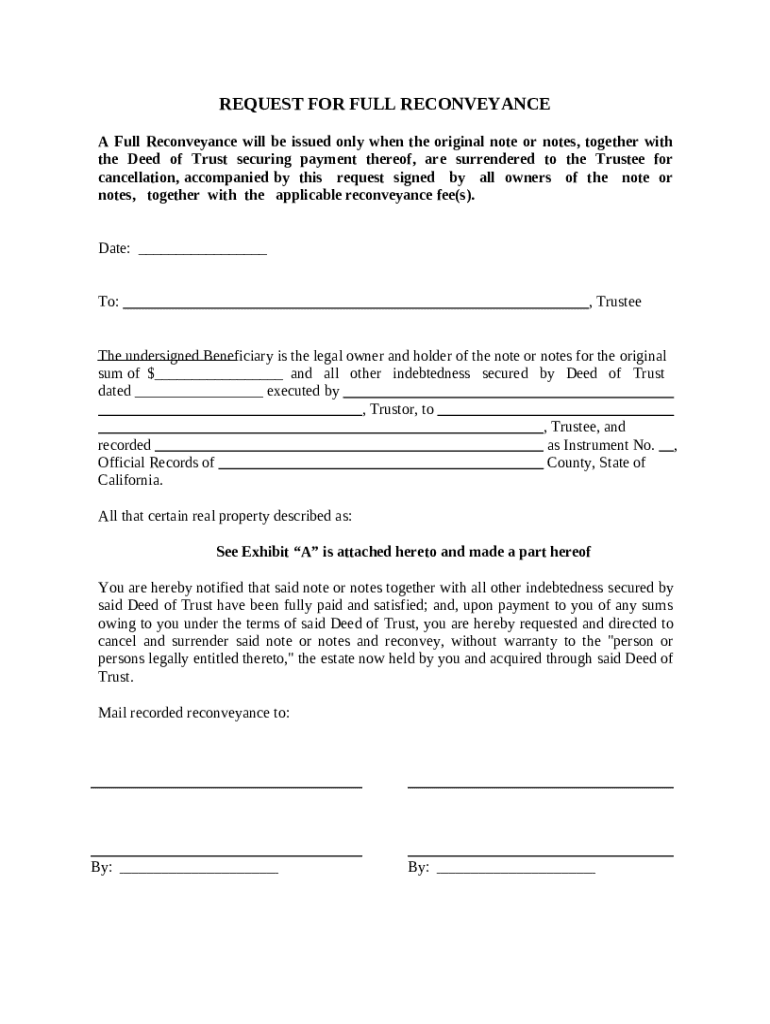

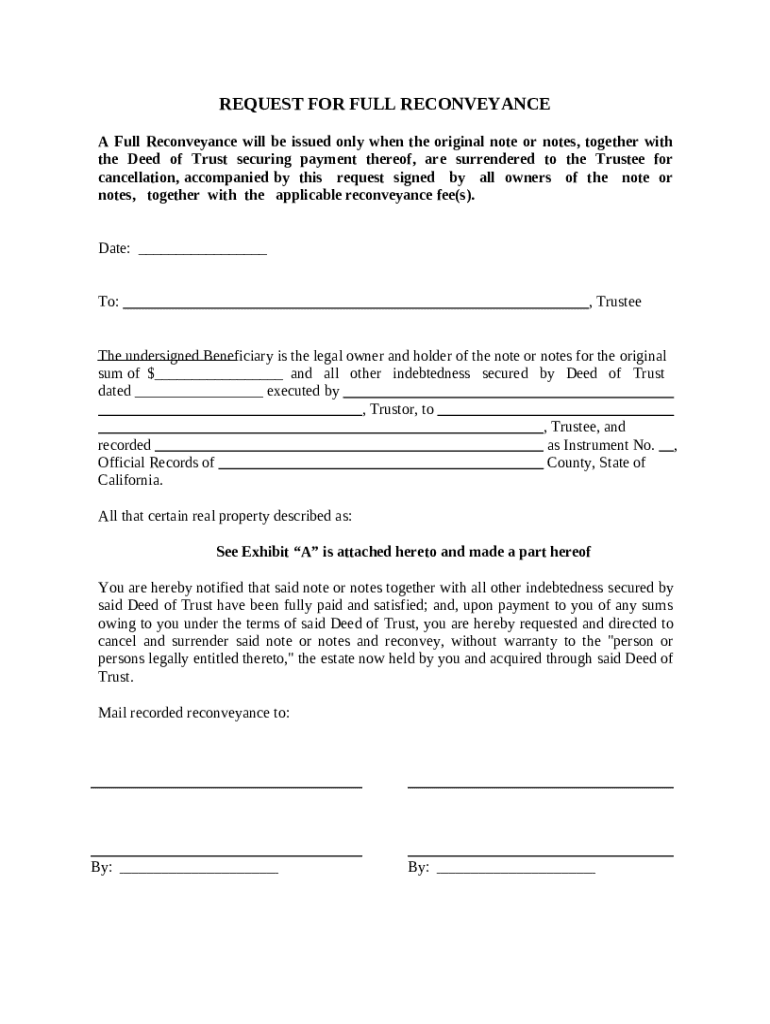

Get the free Request for Full Reconveyance template

Show details

This is a sample Request for Full Reconveyance. When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is request for full reconveyance

A request for full reconveyance is a formal document used to request the lender to transfer the title of a property back to the borrower after a loan has been paid in full.

pdfFiller scores top ratings on review platforms

NA

It has been good it is just that I have had problems with completing the billing.

Its easy.

Excellent support

The smartest online PDF tool at the best price point.

made very easy to be understood

Who needs request for full reconveyance?

Explore how professionals across industries use pdfFiller.

Request for Full Reconveyance Form Guide

How to fill out a request for full reconveyance form

Filling out a request for full reconveyance form is a systematic process that involves providing specific information about the loan and property. By following the right steps, including gathering necessary documents and understanding the format, you can ensure a smoother reconveyance process.

Understanding full reconveyance

A full reconveyance refers to the process where the trustee transfers the property's title back to the borrower after the loan has been fully paid off. This document is crucial in property transactions as it officially clears the title of any claims from the lender.

-

Full reconveyance is a formal legal process that nullifies the lender’s rights to the property title once the debt obligation is satisfied.

-

It's essential for clearing any encumbrances related to the loan, allowing the borrower to regain complete ownership and sell or refinance the property if desired.

-

A full reconveyance is necessary once the loan is paid in full, ensuring that the borrower officially owns the property free from any liens.

Key components of the full reconveyance form

The full reconveyance form includes several crucial sections that need to be filled out accurately. Missing or incorrect information can lead to delays in the reconveyance process.

-

You must provide the name of the borrower, loan number, and property address to clearly identify the reconveyance.

-

It is important to include any original loan agreements as evidence that the debt has been satisfied.

-

The trustee acts as an intermediary and ensures that all legal requirements are met during the reconveyance.

How do fill out the full reconveyance form?

Filling out the form can seem daunting, but breaking it down into manageable steps can simplify the process. Start with gathering all required documents to ensure you have everything you need.

-

Collect all necessary documentation, such as the original loan note and property documents.

-

Ensure you fill in the date correctly, identify the trustee in the proper format, and specify beneficiary details accurately.

-

Double-check all entries for completeness and accuracy to prevent any issues during submission.

What fees are associated with full reconveyance?

Costs associated with the full reconveyance process can vary depending on several factors. Understanding these fees upfront can help you budget appropriately.

-

Fees may include recording fees, administrative fees, and potential attorney fees based on your jurisdiction.

-

Contact your trustee or check local regulations to get a breakdown of the fees you may incur.

-

Typically, trustees accept checks, money orders, or electronic payments.

Where do submit my full reconveyance request?

The submission of the full reconveyance request must follow specific protocols for it to be processed efficiently. Knowing where and how to submit can prevent delays.

-

Typically, you submit it to the trustee or the company handling the mortgage for processing.

-

Ensure that you send the completed form using certified mail or a reliable courier service.

-

Keep a copy of your submission and follow up with the Trustee’s office a few weeks afterward to confirm receipt.

What common issues can arise with full reconveyance?

Problems may arise during the reconveyance process, but understanding these common pitfalls can help you avoid them.

-

Errors such as incorrect names or addresses can lead to delays, so it's vital to be meticulous.

-

Ensure all signed documents match the information in your reconveyance form.

-

If denied, carefully review the feedback provided and make necessary adjustments before resubmission.

How can pdfFiller assist with your full reconveyance needs?

Using pdfFiller can significantly streamline the process of managing and filling out the form. The platform offers intuitive tools and functionalities that enhance your experience.

-

With its user-friendly interface, pdfFiller allows for easy data entry, corrections, and edits.

-

Features such as templates, customizable fields, and automatic formatting make filling out the request a breeze.

-

You can collaborate with others in real-time and easily send documents for eSigning.

What are local compliance considerations?

Every region may have specific requirements regarding reconveyance. Understanding local laws is paramount to ensures compliance.

-

In California, the reconveyance process must follow specific legal guidelines outlined in state law.

-

Failing to comply with local reconveyance laws can lead to legal complications and unresolved property issues.

-

Recognizing the expectations of trustees can streamline the process and improve communication.

How to fill out the request for full reconveyance

-

1.Access pdfFiller and log in to your account or create a new one.

-

2.Search for 'request for full reconveyance' in the template section.

-

3.Select the appropriate template to open it for editing.

-

4.Fill in your name and contact information at the top.

-

5.Enter details regarding the property, including the address and property description.

-

6.Provide the loan information such as the loan number and the lender's name.

-

7.Ensure accuracy in the dates, especially the date when the loan was paid off.

-

8.Sign the document electronically in the designated area and include the date of the signature.

-

9.Review the document for completeness and correctness before submitting.

-

10.Save a copy for your records and download or print the final document if necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.