Get the free Note Secured By Deed of Trust template

Show details

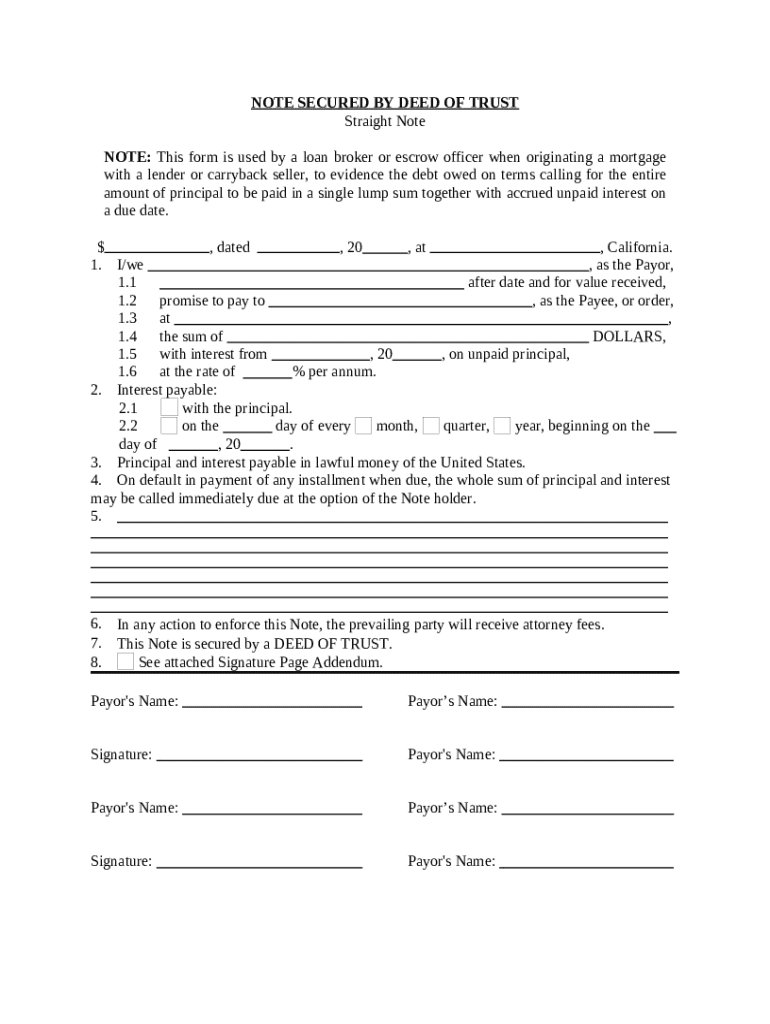

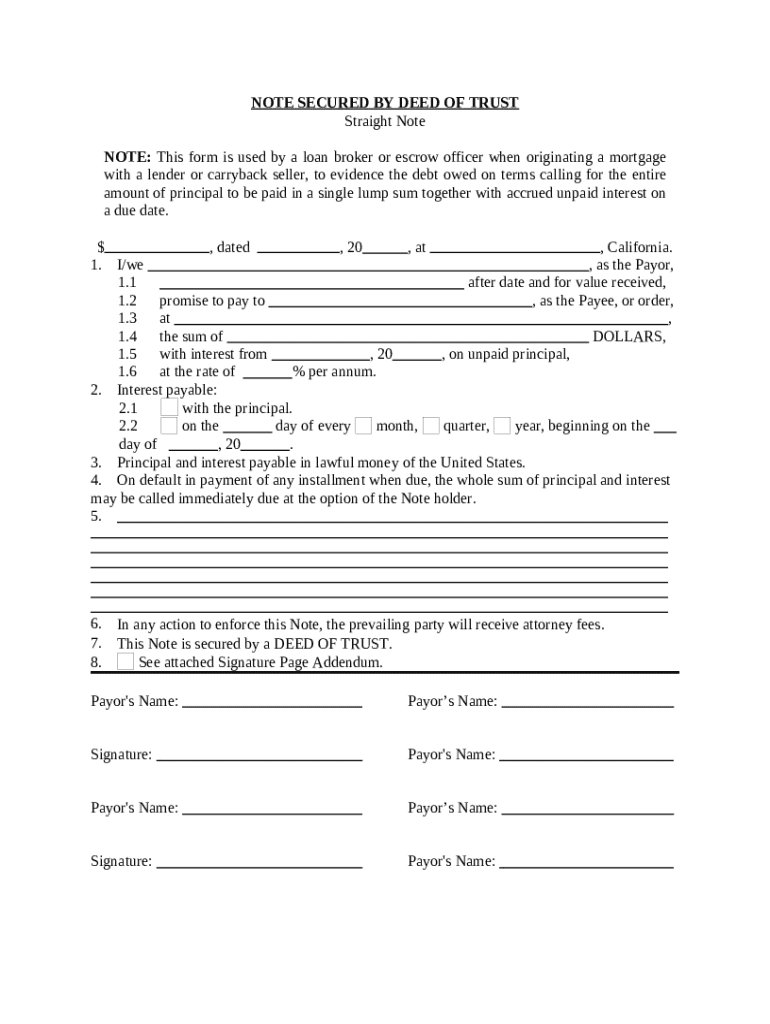

This is a sample Note Secured By Deed of Trust. A promissory note secured by deed of trust is a type of loan document that details how and when a borrower will repay money to a lender. A promissory

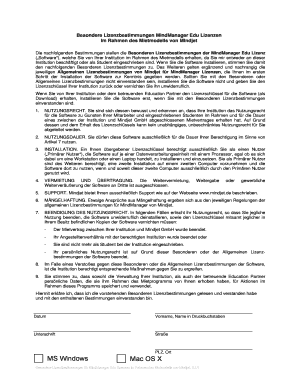

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is note secured by deed

A note secured by a deed is a financial instrument wherein a borrower pledges real property to secure repayment of a loan in the form of a promissory note.

pdfFiller scores top ratings on review platforms

Just awesome! Very useful, probably the best out there,,, Did everything i wanted!

so good , quick and easy ! everyone can use this. five stars !

It has been simple to use and effective in achieving the results I want.

I wish I didn't have to pay. I would have found another free site, like going to SSI site, but I had already filled in all the blanks and it was so time consuming that it wasn't worth the effort. I will cancel as soon as I get the bill.

It has made both of my jobs more convenient to keep records and email forms

Very easy to understand and very helpful, it also save the information even if the computer log out for a minute. Thank you

Who needs note secured by deed?

Explore how professionals across industries use pdfFiller.

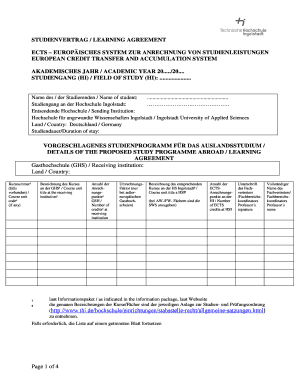

How to Use the Note Secured by Deed Form

Filling out a note secured by deed form is crucial for ensuring the legal security of a loan transaction. This form outlines the agreement between the borrower and the lender, detailing the repayment schedule and specific terms. Understanding how to utilize this form effectively can protect your rights and clarify obligations.

What is a note secured by deed of trust?

A note secured by a deed of trust is a financial document that outlines the terms of a loan secured by real estate collateral. It serves the dual purpose of ensuring repayment while providing a legal claim to the property in the event of default. This mechanism is often used by loan brokers and escrow officers during property transactions.

-

Loan brokers utilize this form to facilitate transactions, ensuring that proper documentation is in place for securing loans using real estate as collateral.

-

Escrow officers use the note secured by deed to ensure transparency during the closing of real estate deals, managing all legal agreements effectively.

What are the key components of the note secured by deed form?

Understanding the essential elements of this form is vital to creating a legally binding agreement. Various mandatory fields must be completed.

-

Key information like the names of the payor and payee, along with payment sums and interest rates, are required to complete the form.

-

Detailed descriptions of repayment schedules and interest rates need to be included to avoid ambiguities.

-

It is essential to outline the terms surrounding defaults to define the rights of each party involved.

How do you fill out the note secured by deed of trust?

Completing the form can be straightforward if you follow specific guidelines. Understanding how to fill in the required fields correctly can save time and reduce errors.

-

Follow clear steps to ensure each component of the form is completed correctly and conforms to legal expectations.

-

Utilize the interactive tools available on pdfFiller to assist in accurately filling out the form without missing any critical sections.

-

Double-check all information for accuracy and completeness to prevent any legal challenges in the future.

What should you consider when signing and finalizing your document?

Signatures are pivotal in validating legal documents. Knowing what constitutes a valid signature can shield you from potential disputes in the future.

-

Ensure that all parties sign the document to validate the agreement, as unsigned documents hold little weight legally.

-

Explore the features of pdfFiller that facilitate eSigning and document verification for a seamless process.

-

Check if notarization is necessary based on regional regulations to ensure the document's legality.

How can you manage your note document post-filling?

Properly managing your note document after filling it out is essential for future reference and agreements. Utilizing software can optimize this process.

-

Use pdfFiller to store your completed forms securely while allowing for easy access when needed.

-

Leverage collaborative tools to share documents and track changes with stakeholders to maintain transparency.

-

Establish a procedure for modifying documents as circumstances change, ensuring relevance and accuracy.

What are common pitfalls in using the form?

Errors in completing the form can lead to significant issues down the line. Awareness of these pitfalls can improve success rates.

-

Identify frequently made errors during form completion which can lead to misunderstandings or disputes.

-

Understand strategies for managing defaults and disputes as outlined in the terms of the note.

-

Always consider obtaining legal advice for complex agreements to avoid pitfalls.

What resources are available on pdfFiller?

(pdfFiller) provides various resources to aid users in managing their documentation seamlessly. Exploring these can enhance your experience.

-

Access a comprehensive suite of document management tools designed to simplify the business process.

-

Look for templates and guidelines on similar forms to expedite the process of document creation.

-

Engage with customer support options for troubleshooting and assistance regarding any issues.

How to fill out the note secured by deed

-

1.Open the note secured by deed template on pdfFiller.

-

2.Enter the borrower's full name and contact information at the top of the document.

-

3.Fill in the lender's name and address in the designated section.

-

4.Specify the loan amount clearly in both numerical and written form.

-

5.Include the interest rate applicable to the loan for accuracy.

-

6.Define the payment schedule, including due dates and amounts.

-

7.Detail the legal description of the property being used as collateral.

-

8.Ensure all parties involved review the terms and conditions included in the document.

-

9.Collect signatures from both the borrower and lender at the bottom of the form.

-

10.Save and download the completed document for both parties’ records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.