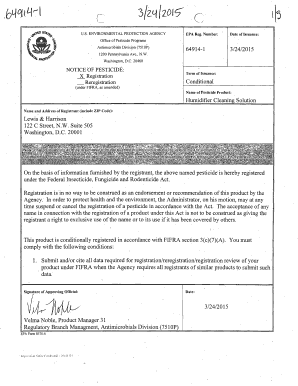

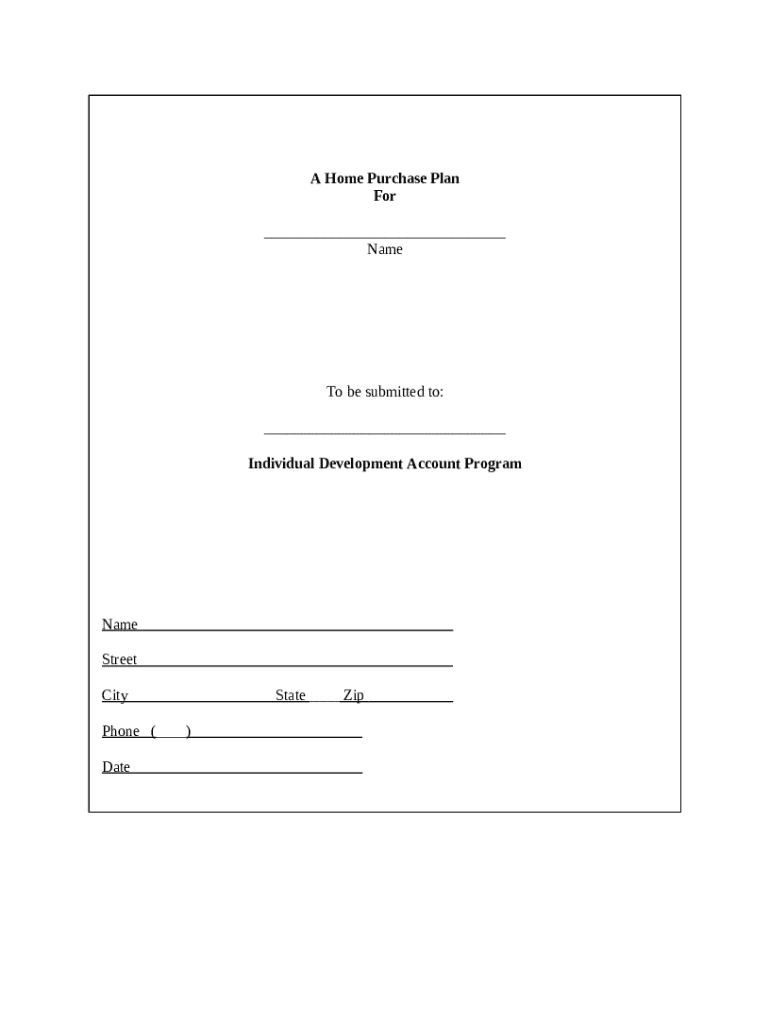

Get the free Home Purchase Plan - Individual Development Account Program template

Show details

This is a sample Home Purchase Plan. This Home Purchase Plan includes an Individual Development Account Program to determine affordability for the individual.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is home purchase plan

A home purchase plan is a structured strategy outlining the steps and resources needed to acquire a property.

pdfFiller scores top ratings on review platforms

I took away one star because this is not an intuitive program at all. I have spent hours trying to figure out very simple tasks but once I figured it out it everything went very smothly.

It does what I desperately need right now...no time to learn more

I just got started and have encountered only one problem thus far.

Great so far, but there is no "undo" button, which is making some things difficult.

Came through for the forms that I needed. Highly recommend it.

It is the best PDF editor I have come across, great utility and features

Who needs home purchase plan?

Explore how professionals across industries use pdfFiller.

Home Purchase Plan Form Guide

How to fill out a home purchase plan form

To successfully fill out a home purchase plan form, start by collecting your financial details, including income, expenses, and credit history. Understand the purpose of the form and the necessary documentation that supports your home-buying efforts. Utilize tools for tracking and managing these documents efficiently.

Understanding the home purchase plan form

A home purchase plan form serves multiple purposes, primarily to outline your financial capability and plan for buying a home. It acts as a foundation, ensuring you're prepared for homeownership by evaluating your finances and goals. Central to many government programs, such as the Individual Development Account Program, this form can facilitate your purchasing journey.

-

Document financial information to support home purchase applications.

-

Access various programs designed to assist potential homebuyers.

-

Provide an organized summary of your financial situation.

Part One: How much can you afford?

Understanding your financial capability is critical when purchasing a home. To determine this, you'll need to accurately assess your total monthly income versus your recurring monthly expenses. By creating a detailed picture of your finances, you can realistically see what you can afford.

-

Sum total income from all sources including wages, bonuses, and dividends.

-

Include necessary expenses like rent, utilities, and insurance.

Creating a monthly budget and spending plan

A monthly budget provides insights into your spending habits. Categorizing your finances allows for better management and forecasting, giving you a clearer view of what you can allocate towards a mortgage.

-

Identify necessary expenses such as housing, family needs, transportation, and leisure activities.

-

Use a worksheet to maintain clarity on spending and budget adherence.

Hidden costs of owning a home

The costs of homeownership extend beyond just mortgage payments. Many new homeowners fail to anticipate additional expenses that can significantly impact their budget, making it crucial to account for these hidden costs.

-

Ongoing costs that may increase annually depending on your local tax rates.

-

Regular upkeep needed to maintain your property, such as landscaping and repairs.

-

Homeowners insurance and any relevant homeowner association fees.

Know your rights as a homebuyer

Understanding your legal rights as a homebuyer is essential in protecting yourself throughout the purchasing process. Familiarize yourself with local consumer protection laws, ensuring your voice is heard and your interests are safeguarded.

-

Be aware of various consumer rights laws during home transactions.

-

Consider local real estate boards or legal assistance for inquiries.

Financing your home: shopping for a loan

Choosing the right financing option is one of the most significant decisions in the home buying process. By understanding the types of loans available and how to evaluate different loan offers, you can make a financially sound decision.

-

Explore various financing options such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), and government-backed loans.

-

Learn how to assess rates, terms, and fees from multiple lenders.

Exploring home buying programs

Government and nonprofit organizations often offer assistance to first-time homebuyers, helping make the process more affordable. By researching available programs, you can identify potential benefits that align with your financial situation.

-

Consider homebuyer education programs, down payment assistance, and grants.

-

Understand the criteria needed to qualify for various assistance initiatives.

Finding a realtor: the right fit for your needs

Finding the right realtor can ease the home buying process and reduce stress. A knowledgeable realtor can advocate for you and provide valuable insights into the local market.

-

Look for experience in your desired area or property type.

-

Prepare questions about their experience, strategy, and how they serve your interests.

The house hunt: shop for your new home

When searching for a new home, consider both your needs and wants. Taking the time to prioritize these can help you make informed and satisfying decisions.

-

Clarify what is non-negotiable in your new home versus what you would like to have.

-

Assess schools, distance to work, and neighborhood amenities.

Evaluating the home: what to look out for

Evaluating a home is a crucial step to avoid costly repairs in the future. Pay attention to structural integrity, major systems, and aesthetic aspects that could incur future expense.

-

Inspect the roof, foundation, electrical systems, and plumbing.

-

Consider hiring an inspector to get a thorough review of the property.

Making an offer and negotiation tips

When you're ready to make an offer, it’s critical to present a competitive bid. Understanding negotiation tactics can also help you succeed in securing the home at a favorable price.

-

Research comparable sales to inform your offer amount.

-

Consult with your realtor to devise effective negotiation approaches.

Getting a home inspection

A home inspection is a critical step that assesses the property's condition. It's vital to understand what to expect and how to interpret the results to ensure you know your investment.

-

An inspector evaluates the home's condition and provides a report.

-

Discuss findings with your realtor to understand implications for negotiations.

Insuring your home: homeowners' insurance essentials

Securing appropriate homeowners' insurance is fundamental for safeguarding your investment against unforeseen events. Understanding different policies will help you choose the right coverage.

-

Protects your home and belongings from damages and liabilities.

-

Explore coverage options such as dwelling, personal property, and liability.

Navigating the closing process

The closing process can seem overwhelming, but understanding the steps can ease your concerns. Familiarity with common documents and procedures will help you navigate this final stage in the home buying process.

-

Review all necessary documents including the Closing Disclosure and loan agreement.

-

Ensure all required paperwork is complete before the closing date.

Part Two: Supporting documentation for your home purchase plan

To finalize your home purchase, you'll need to gather essential documents well in advance. Keeping these organized will streamline the buying process and ensure compliance with lender requirements.

-

Collect items such as bank statements, proof of income, and tax documents.

-

Submit all documents required for loan pre-approval and closing.

What documents will you need?

In preparing for your home purchase, understanding what documentation to gather is vital. This ensures you're not only compliant with lender requests but also organized

-

Include pre-approval letter, closing documents, and a first-time homebuyer’s certificate.

-

Use file systems or digital tools to store documents securely.

Using pdfFiller for streamlined document management

Once you have your documents ready, using pdfFiller helps manage your home purchase form effectively. This platform enables you to fill out, sign, and share your documents securely from anywhere.

-

Easily edit and complete forms online, eliminating paperwork hassle.

-

Access, collaborate, and store your documents without the stress of physical paperwork.

How to fill out the home purchase plan

-

1.Open the PDF file of the home purchase plan on pdfFiller.

-

2.Review the document to understand the sections you need to complete.

-

3.Begin with your personal information, including your name, address, and contact details at the top of the form.

-

4.Fill in the financial sections accurately, detailing your income, savings, and any existing debts that could affect your purchase.

-

5.If applicable, specify the type of property you are interested in, including location, size, and price range.

-

6.Consider adding any special requirements or preferences regarding the home, such as number of bedrooms, outdoor space, etc.

-

7.Review your completed entries for accuracy, ensuring all information is current and correctly entered.

-

8.Once satisfied with the details, save your document within pdfFiller to retain your progress.

-

9.Print or digitally sign the document as needed before submitting it to relevant parties.

-

10.Finally, keep a copy for your records and follow up with any necessary next steps after submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.