Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust tem...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to designate a beneficiary to receive their real property upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

I have been surprised at how 'user…

I have been surprised at how 'user friendly' pdfFiller is. It is easy to download forms from my computer and I appreciate that.

perfect editor

perfect editor

I love it

I love it! I've been using PDFiller for my business for over two years. You will be surprised all the advantages it has to offer for documents. Enjoy!

Works as described!

Works as described!

I am very happy with this network

I am very happy with this network. Thank you.

thank you very much

that was so helpful, thank you

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

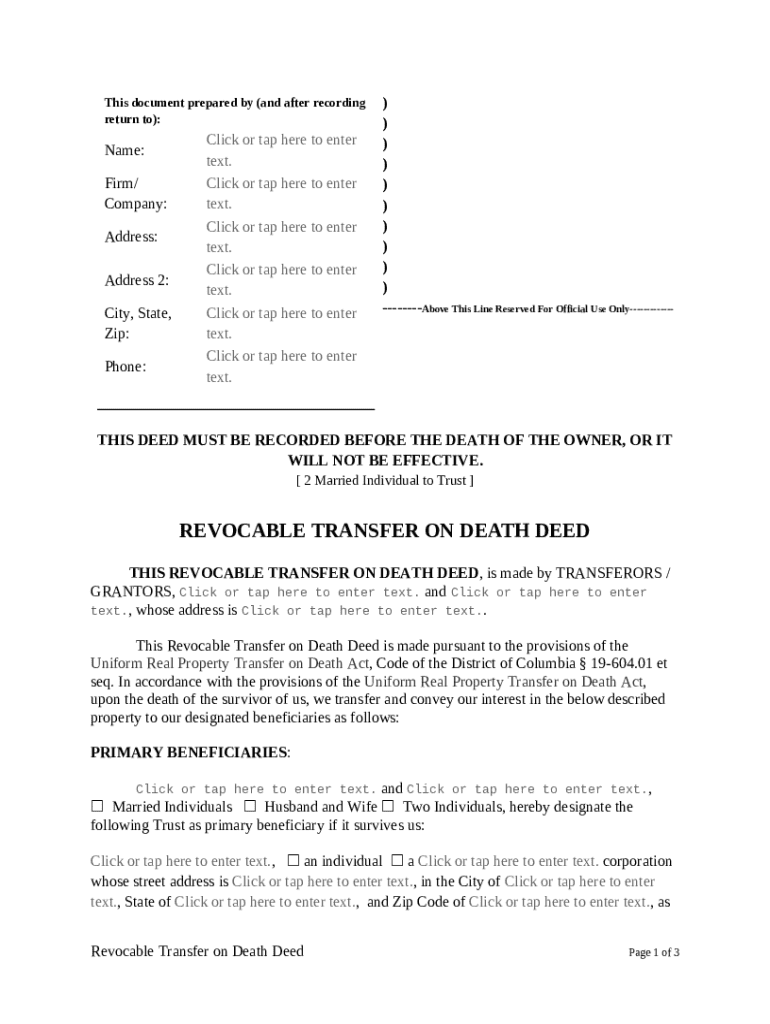

Comprehensive Guide to Filling Out the Transfer on Death Deed Form

What is a Transfer on Death Deed?

A Transfer on Death Deed (TOD deed) is a legal document that enables property owners to designate one or more beneficiaries who will inherit the property upon the owner's death, bypassing probate. This simple form allows the owner to maintain full control over the property during their lifetime, making it essential to record it properly before death.

Why is recording important?

Recording a Transfer on Death Deed is crucial because it establishes the legal rights of the beneficiaries and ensures the deed's validity. Without recording it properly, there is a risk that the property will be subject to probate, contradicting the owner's intent to transfer the property seamlessly to their loved ones.

What is the Uniform Real Property Transfer on Death Act?

The Uniform Real Property Transfer on Death Act provides a consistent legal framework for states to follow concerning Transfer on Death Deeds. This act specifies the requirements for creating, recording, and revoking a TOD deed, ensuring that property transfers are handled uniformly across jurisdictions and simplifying the process for individuals.

How can pdfFiller help?

pdfFiller is a versatile tool that allows users to create and manage documents efficiently, including the Transfer on Death Deed form. Its cloud-based platform allows for easy PDF editing, e-signing, and collaboration, making it ideal for individuals and teams looking for a comprehensive document solution.

What are the benefits of using pdfFiller?

-

pdfFiller features an intuitive interface that helps users navigate document management effortlessly.

-

Access your documents from anywhere, ensuring flexibility and convenience for managing important forms.

-

Easily share documents with others for signing or feedback, streamlining the approval process.

Step-by-step instructions for completing the Transfer on Death Deed

Filling out the Transfer on Death Deed form involves several essential steps to ensure validity and clarity.

-

Gather details such as the property address, owner's information, and beneficiary names.

-

Ensure that the grantor's and beneficiaries' names and addresses are accurately recorded.

-

Clearly specify primary and contingent beneficiaries, understanding the implications of each.

-

If designating a trust, include the full name and details of the trust.

-

Provide complete property information, including city, state, and zip code, to avoid ambiguity in the deed.

What are the key sections of the Transfer on Death Deed form?

-

Correctly naming all grantors is critical to establishing ownership rights.

-

Some jurisdictions may require witnesses or notarization for validity; ensure compliance with local laws.

-

Include accurate city, state, and zip code information to maintain the legal clarity of the transfer.

Post-completion steps: What to do after finishing the deed?

-

File the Transfer on Death Deed with the local recording authority to ensure it is legally effective.

-

Keep a copy of the recorded deed for personal records and provide copies to beneficiaries.

-

Organize and store all documents related to the deed for ease of access in the future.

Managing changes and revocations

Circumstances may arise that necessitate changes to your Transfer on Death Deed. Understanding the process for amending or revoking the deed is crucial to maintaining accuracy and ensuring the deed reflects your current wishes.

-

Follow your state's required procedures for making amendments or formally revoking the deed.

-

Communicate any changes or revocations to your beneficiaries to prevent confusion or disputes.

-

Regularly review your deed to ensure it aligns with your current intentions and family dynamics.

How to fill out the transfer on death deed

-

1.Obtain the transfer on death deed form from pdfFiller.

-

2.Open the form in pdfFiller and enter your complete name and address in the designated fields.

-

3.Provide a clear description of the property being transferred, including its address and legal description if available.

-

4.Specify the name of the beneficiary who will receive the property upon your death; ensure their full name and relation to you are accurately filled in.

-

5.Include any additional provisions or instructions if necessary, such as alternate beneficiaries.

-

6.Review all entered information for accuracy to avoid legal issues later.

-

7.Sign the deed in the presence of a notary public to validate the document.

-

8.Submit the completed and signed deed to your local county recorder's office to ensure it is officially recorded.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.