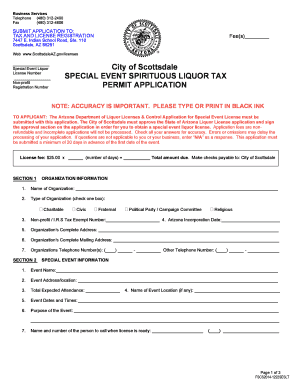

Get the free Complaint (Default of Promissory Note) template

Show details

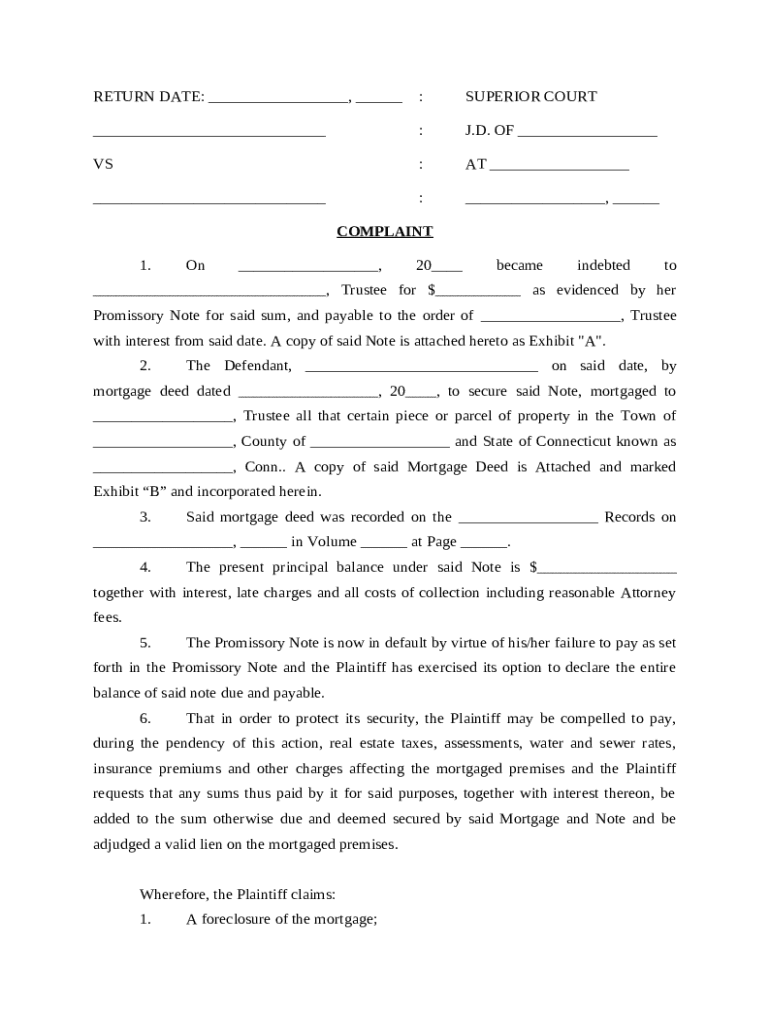

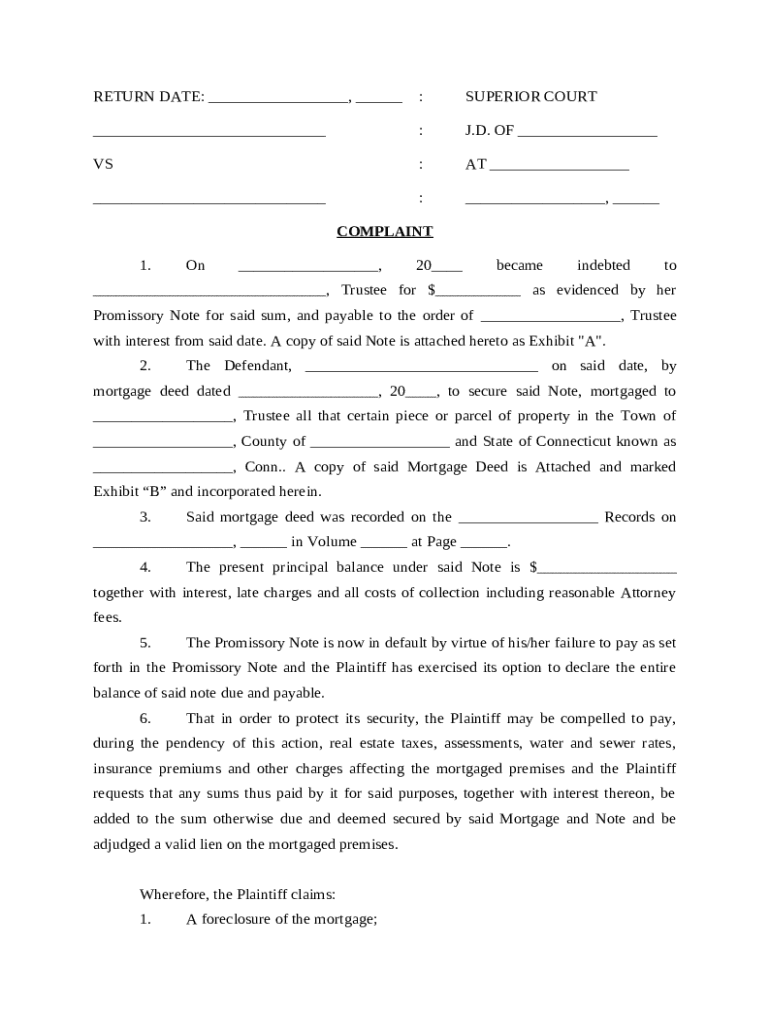

This complaint is for a payment and/or judgment regarding default in a promissory note.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is complaint default of promissory

A complaint default of promissory is a legal document used to initiate a lawsuit for non-payment of a promissory note.

pdfFiller scores top ratings on review platforms

Easy to use and perfect for what we need to do

This is excellent and extremely easy to use.

Pdffiller is a life saver but not everyone will accept the electronic signature.

The directons on which button to use for what a bit confusing

User friendly and reasonable price. Must haves for the business owner!

It is a great service. It takes some time to get through the detailed forms.

Who needs complaint default of promissory?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to complaint default of promissory form on pdfFiller

When dealing with the complaint default of promissory form, it's crucial to understand the various steps and implications involved. This guide will provide you with the necessary insights to successfully navigate the complexities associated with promissory notes and defaults, particularly using pdfFiller.

-

A promissory note is a financial instrument containing a written promise from one party to pay a specific sum of money to another party. It serves as a legal document that delineates the terms of the loan between the lender and borrower.

-

Key components include the principal amount (the initial loan), interest rate (the cost of borrowing), and payment terms (how and when payments will be made). Understanding these components ensures all parties are aware of their financial obligations.

-

Defaulting on a promissory note can lead to severe consequences, including legal action and potential loss of collateral. It’s essential to be aware of these implications to mitigate risks.

What are the legal grounds for filing a complaint?

Filing a complaint is a critical step when a promissory note goes into default. It's essential to have a valid legal basis to proceed with the complaint.

-

Default typically occurs when the borrower fails to pay the agreed-upon amount within the specified timeframe. This breach of contract allows the lender to initiate legal proceedings.

-

Documentation is crucial for substantiating the complaint. Exhibit A might refer to the promissory note itself, while Exhibit B could include payment records or correspondence regarding the loan.

-

Each jurisdiction has specific laws that govern defaults on promissory notes. Understanding these laws can significantly affect the outcome of a case.

How to complete the complaint form?

Completing the complaint form accurately is vital for a successful filing. pdfFiller provides an intuitive interface to simplify this process.

-

Start by gathering all necessary information and documents. Familiarize yourself with the layout to ensure you complete each section correctly.

-

pdfFiller’s cloud-based platform allows you to fill out, save, and share your forms securely and efficiently.

-

Double-check all entries and make use of pdfFiller’s editing tools to correct any mistakes before submission.

What is the procedure for filing the complaint?

Understanding the filing process is essential for successfully submitting a complaint. Proper adherence to guidelines can avoid delays.

-

Filing procedures can vary based on local laws. Familiarity with these can streamline the process and prevent unnecessary errors.

-

Be cautious of missing deadlines, failing to include necessary documentation, or not following procedural rules, as these can lead to dismissal.

-

Post-filing, keep track of all responses and be prepared for possible court dates or mediation.

How should a defendant respond to a complaint?

The defendant has specific rights and options when responding to a complaint of default. Understanding these rights can be pivotal.

-

Responses may include admitting, denying, or contesting the allegations. It’s crucial to respond timely to prevent a default judgment.

-

The defendant can present counterclaims if they have valid complaints against the plaintiff related to the cases, such as improper lending practices.

-

Collecting paperwork such as payment receipts and communication logs can support the defense in court.

What are the legal remedies and possible outcomes of a default judgment?

A default judgment can have significant implications for both involved parties. Understanding potential outcomes prepares you for what lies ahead.

-

A default judgment occurs when the defendant fails to respond, often resulting in a rapid resolution favoring the plaintiff.

-

Depending on state laws, remedies may include foreclosure of any collateral securing the loan or seeking a deficiency judgment if the collateral does not cover the owed amount.

-

A default judgment may severely impact the defendant's credit score, making future borrowing more difficult.

How to utilize pdfFiller for document management after a default?

Post-filing, managing your legal documents is crucial, and pdfFiller's functionalities provide an efficient solution.

-

Utilize pdfFiller’s secure storage options to keep sensitive information organized and accessible.

-

The platform supports collaborative editing, allowing legal teams to review and update documents seamlessly.

-

eSigning enables quicker turnaround times for document processing, essential for maintaining momentum in legal cases.

How to fill out the complaint default of promissory

-

1.Navigate to the pdfFiller website and log into your account or create a new account if you do not have one.

-

2.Search for 'complaint default of promissory' in the document library to locate the template.

-

3.Open the form to begin editing it. You can use the text fields provided to enter relevant information.

-

4.Fill in the names and addresses of the plaintiff (the lender) and defendant (the borrower) at the top of the form.

-

5.Detail the terms of the promissory note, including the date it was signed, the amount, and any interest rates.

-

6.Describe the default situation, indicating when the payment was due and how much is owed.

-

7.Include any relevant evidence attached to the complaint, such as copies of the promissory note or payment history.

-

8.Once all fields are filled accurately, review the entire document for any errors or additional information needed.

-

9.Save the document and use the print or email options to file the complaint in the appropriate court.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.