Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust template

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer real estate property directly to a beneficiary upon their death, avoiding probate.

pdfFiller scores top ratings on review platforms

It could be easier to confirm manual typing.

I absolutely LOVE how professional this makes my forms look.

Anne in customer support was outstanding, she was patient, calm, informative and extremely helpful. I had lost work that I had spent hours on and couldnt find what I had done wrong, Anne patiently worked through it with me and I found the document, without her I would have cried, literally, as I had worked the whole of the night on the document and it looked like i had lost it all. Anne should be commended for her high level customer service. She is a definate asset to your organisation.

im very pleased its easy and offers great useful forms

Very easy to use; I wish the instructions to complete forms were more detailed.

This program does a nice job providing me with the basic tools I need to make professional quality PDFs for my office and school needs.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the transfer on death deed form

A Transfer on Death Deed (TODD) allows property owners to pass their real estate directly to designated beneficiaries without going through probate. This process is straightforward, making it an attractive option for those seeking efficient ways to manage their property transfers after death.

What is a transfer on death deed?

A Transfer on Death Deed is a legal document that enables property owners to designate one or more beneficiaries who will automatically inherit the property upon the owner's death. Unlike a will, which must go through probate, a TODD can simplify the transfer of ownership, avoiding lengthy legal processes.

-

The primary purpose of a TODD is to provide a mechanism for transferring real estate to heirs while bypassing probate.

-

Using a TODD can significantly save time and legal fees, providing heirs with quicker access to the property.

-

A TODD is less complex and potentially less costly than wills or trusts, making it an appealing choice for many property owners.

What are the pre-recording requirements for the deed?

Before using a Transfer on Death Deed, property owners must meet certain eligibility criteria. It is crucial that the deed is recorded while the owner is still alive to ensure a valid transfer.

-

Only owners of real property can execute a TODD, which must be executed according to state laws.

-

Recording the deed promptly is essential. If not recorded before the owner's death, the deed becomes void.

-

Most forms require reserved lines for official use, which ensures the document is properly recognized for legal purposes.

How do you fill out the deed form?

Completing a Transfer on Death Deed requires the inclusion of specific personal information about the property owner and the beneficiaries. It's important to accurately designate who will inherit the property.

-

Name, address, and contact details of the property owner must be clearly stated.

-

Primary and alternate beneficiaries should be specified to ensure a clear line of inheritance.

-

Legal descriptions of the property must be accurate to prevent disputes over ownership.

What are primary beneficiaries and their designations?

Primary beneficiaries are the individuals or entities designated to inherit the property upon the owner’s death. Understanding how to designate these beneficiaries is crucial to ensure the transfer occurs correctly.

-

A primary beneficiary is the first in line to receive the property, with the designated right to it.

-

Owners can designate a trustee or a trust as a beneficiary, which may be beneficial for managing estate assets.

-

It’s essential to consider whether the primary beneficiary will survive the owner; if not, alternate beneficiaries must be listed.

What are the alternatives and contingencies?

It is vital for property owners to consider what happens if their primary beneficiary predeceases them. The TODD should include provisions for alternate beneficiaries to ensure a clear transfer of ownership.

-

Including alternate beneficiaries within the deed provides a safety net if the primary beneficiary is unavailable.

-

In the event that the primary beneficiary does not survive, the deed outlines who next in line will inherit the property.

-

Failing to designate beneficiaries may lead to the property being stalled in probate, causing family disputes.

What legal considerations come with the deed?

Understanding the legal framework surrounding Transfer on Death Deeds is crucial for grantors (the property owners) and grantees (the beneficiaries). Non-compliance with local regulations can invalidate the deed.

-

Most states have adopted this act, providing a uniform approach to the TODD, which simplifies the process.

-

Grantors must ensure compliance with all requirements, while beneficiaries must understand their right to inherit.

-

Not adhering to local laws could lead to complications, including possible challenges to the deed's validity.

How can you revoke a transfer on death deed?

Property owners retain the right to revoke their Transfer on Death Deed at any time before their death. Understanding the process of revocation is vital should circumstances change.

-

The ability to revoke is a key feature of the TODD, allowing flexibility in estate planning.

-

Owners must follow specific procedural steps to formally revoke their TODD, often requiring additional documentation.

-

Documentation must be filed with the appropriate local authority to ensure the revocation is legally recognized.

What are the steps for filing and recording the deed?

Filing and recording the transfer on death deed is essential for its legal recognition. Following the correct process ensures the intention of the property owner is honored.

-

The deed must be filed according to specific steps outlined by local jurisdictions, often involving filling out specific forms or applications.

-

Requirements vary by location, so property owners must check their local regulations for the exact process and requirements.

-

Property owners should be aware of any filing fees associated with recording the deed which can vary widely.

How does PDFfiller assist with managing your deed?

PDFfiller provides a comprehensive platform to help users seamlessly fill out, edit, and sign their Transfer on Death Deed. This tool makes estate planning more accessible to individuals.

-

PDFfiller’s user-friendly interface allows for easy editing and signing of the deed, streamlining the process significantly.

-

Involving multiple stakeholders is simplified, increasing clarity and collaboration among those involved in the estate.

-

Users can safely store their documents in the cloud for easy access and management, ensuring they are readily available whenever necessary.

How to fill out the transfer on death deed

-

1.Access pdfFiller and log in to your account.

-

2.Select the option to create a new document and choose 'Transfer on Death Deed' template from the available options.

-

3.Fill in your full name and address as the Grantor in the designated fields.

-

4.Provide the legal description of the property you wish to transfer; ensure accuracy to avoid legal issues.

-

5.Add the beneficiary's full name and their relationship to you in the respective fields.

-

6.Review the document for accuracy and completeness; ensure all required information is present.

-

7.Sign the document in the presence of a notary public to make it legally binding; this step is crucial for validity.

-

8.Submit or print the completed transfer on death deed for your records and follow your local regulations for filing, if necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

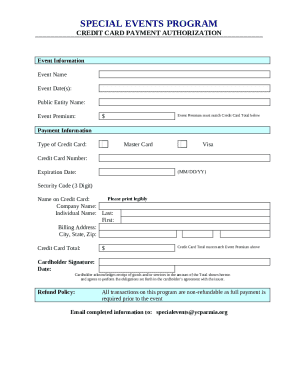

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.