Last updated on Feb 17, 2026

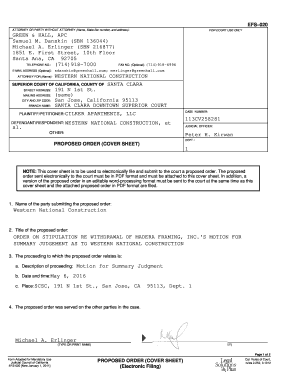

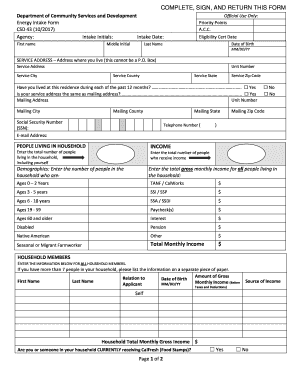

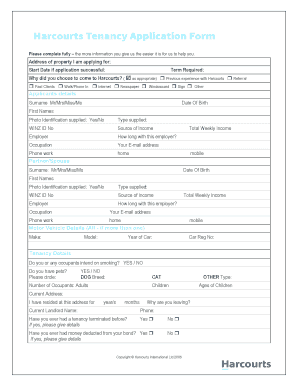

Get the free Subordination Agreement template

Show details

It is a contract in which a junior creditor agrees that its claims against a debtor will not be paid until all senior indebtedness of the debtor.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subordination agreement

A subordination agreement is a legal document that establishes the priority of lien claims against a property in the event of foreclosure or sale.

pdfFiller scores top ratings on review platforms

I used it now for 2 forms. I like that It does everything for me..saves the document, converts to another format if I need it and easy to email out or print.

Me parece una herrramienta adecuada para la función que se pretende conseguir. Me resulta muy práctica.

Easy to use, although I feel like I'm not getting the most of it. A webminar would really help me explore PDFfiller's features.

I'm very happy I have finally found a program that works with e-signature. Thank you !

VERY CONVENIENT. ALL FORMS ARE AVAILABLE

I really like being able to fill out forms from agencies that don't offer fillable forms.

Who needs subordination agreement template?

Explore how professionals across industries use pdfFiller.

Understanding and Utilizing the Subordination Agreement Form

How do you define a subordination agreement?

A subordination agreement is a legal document that establishes the priority of a lien on a property, typically involving a mortgage. It is used to clarify the relationship between various loans and their respective lenders regarding the rights to repayment in case of default. The purpose of such agreements in real estate transactions is crucial for ensuring that lenders understand their position relative to others with liens on the property.

-

A subordination agreement reorders the priority of existing and future debts related to a property.

-

These agreements are vital in refinancing situations, allowing new loans to take precedence over existing ones.

-

Used frequently during real estate transactions, particularly when a second mortgage or a new lender is involved.

What are the key components of a subordination agreement form?

A well-structured subordination agreement form includes several critical components to ensure clarity and enforceability. These components identify the parties involved, detail the financial agreements at hand, and define the terms of subordination, ultimately aiming to prevent any legal disputes between lenders.

-

The form should clearly outline who the owner, lender, and any assignees are, eliminating confusion about roles.

-

Include specifics regarding the loan amount, interest, and terms inherent in the original mortgage.

-

A thorough description of the property affected helps in establishing exact terms related to the subordination.

-

All terms specifying how the agreement alters the priority of debts must be explicitly included.

How do you fill out the subordination agreement form?

Filling out a subordination agreement form correctly is essential to ensure legal protection and clarity among involved parties. Follow a systematic approach to collect necessary information before signing the agreement to avoid delays or rejections later.

-

Collect critical details such as Tax Map numbers and Parcel Numbers to reference the specific property.

-

Clearly list the names of all involved parties and specify their roles, which adds legal clarity.

-

Provide clear information about the existing mortgage, including amounts and payment schedules.

-

Clearly outline the terms of any new mortgage to be secured by this agreement.

-

Ensure all parties sign and date the agreement, making it fully legally binding.

How can pdfFiller assist with your subordination agreement needs?

pdfFiller offers various features to streamline the process of creating and managing a subordination agreement. With user-friendly editing tools, cloud-based document management, and e-signature capabilities, pdfFiller makes it easier for individuals and teams to collaborate effectively.

-

Easily customize your subordination agreement with an intuitive editing interface.

-

Engage multiple stakeholders in the editing and signing process with built-in collaborative features.

-

Access and manage all your documents securely from anywhere with a reliable cloud system.

What common challenges arise with subordination agreements?

Navigating the complexities of subordination agreements can be challenging due to various state laws and potential pitfalls during filing. It’s vital to understand these challenges to avoid issues later in the process.

-

Different states have unique regulations governing how subordination agreements must be executed.

-

Common errors can lead to rejection of the agreement or legal complications.

-

If contested, you may need legal assistance to protect the integrity of your agreement.

What are best practices for submitting a subordination agreement?

Ensuring a smooth submission process for your subordination agreement can greatly influence its acceptance. Adhering to best practices can streamline this process and improve compliance rates.

-

Prepare a comprehensive checklist to ensure all documentation and signatures are present.

-

Double-check names, addresses, and legal terms to minimize the likelihood of rejection.

-

Familiarize yourself with the steps following submission to know what to expect.

How to fill out the subordination agreement template

-

1.Open the subordination agreement template on pdfFiller.

-

2.Enter the date at the top of the document.

-

3.Provide the names and contact information of the parties involved in the agreement.

-

4.Specify the property address that is subject to the agreement.

-

5.Write down the details of the first loan, including lender information, loan amount, and terms.

-

6.Input the details for the subordinate loan(s), clearly indicating their priority status.

-

7.Attach any required supporting documents, such as existing loan agreements.

-

8.Review all entered information for accuracy and completeness.

-

9.Sign and date the document where indicated, ensuring all parties have done the same before finalizing.

-

10.Download or share the completed subordination agreement as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.