Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individ...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

It's a good program, convenient, relatively easy UI. Needing to subscribe to a function that was free for a time on the Adobe software, is an irritating feature of life in the 21st century.

I only used one form so I dont really know what else I can use it fo

While some features are good. Your singular home pkge should offer a bit more to earn five star rating. I rated just 4 stars. Erasing feature is a must to easily remove already written info, comes to mind.....

I am a brand new user and have no idea how to use the program or other documents. I downloaded it to accommodate a Security Clearance form and haven't ventured too fa

The only reason I didn't give a 5 star is because of printing problems that I had for my forms

extremely easy to use. quite helpful. a time save

Transfer on Death Deed Form Guide

Filling out a transfer on death deed form (TODD) is essential for individuals seeking to ensure a smooth transition of property to their beneficiaries. This process allows property owners to bypass probate and directly transfer property upon their death. By understanding key elements of the TODD, potential users can expedite the management and transfer of their real estate.

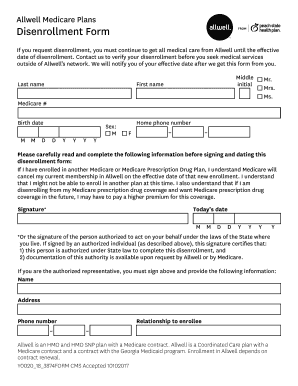

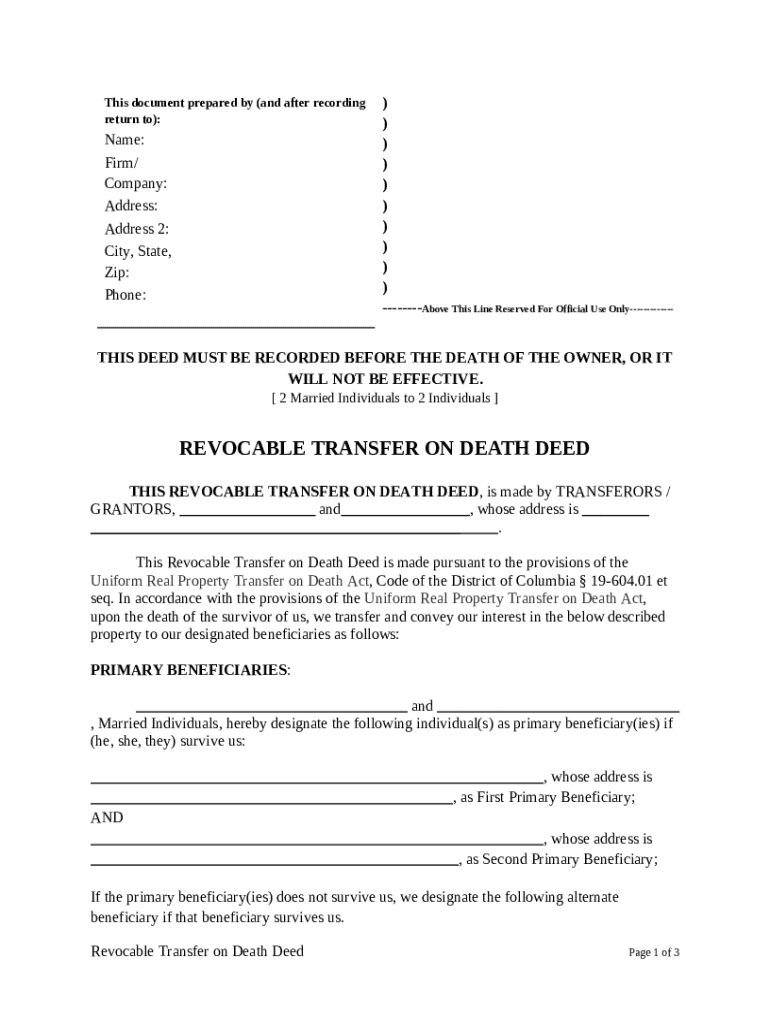

What is a transfer on death deed?

A transfer on death deed (TODD) is a legal instrument allowing property owners to transfer their real estate to designated beneficiaries upon their death. The TODD offers benefits including avoiding probate court, enhancing privacy, and enabling property owners to maintain control during their lifetime. The deed must comply with the Uniform Real Property Transfer on Death Act for legal validity.

-

The TODD serves to transfer ownership of property automatically to a beneficiary after the owner's death, eliminating the need for probate.

-

Under the Uniform Real Property Transfer on Death Act, the TODD must meet specific criteria, such as being recorded prior to the owner's death in the appropriate county office.

-

Key advantages include easy transfer of ownership, reduction in legal costs, and speedier resolution of property transfer compared to traditional methods.

What are the key components of the transfer on death deed form?

Essential components of the transfer on death deed form include data about the transferor (the property owner), legal descriptions of the property, and details regarding the designated beneficiaries. Each section must be accurately filled out to ensure the validity of the deed.

-

This section requires the full legal names and addresses of the property owner(s) transferring the deed.

-

It is crucial to include a detailed legal description of the property to avoid any ambiguity concerning the assets being transferred.

-

Both primary and alternate beneficiaries must be named, with clarity on their respective shares or conditions of inheritance.

-

Property owners should be informed of their rights to revoke or change the deed at any point before their death, provided the correct legal procedures are followed.

How do fill out the transfer on death deed form?

Filling out the TODD form correctly is crucial for the deed to be effective. Following a step-by-step approach helps ensure all necessary elements are included and accurately recorded.

-

Gather all relevant information, including property details, beneficiary names, and your personal information.

-

Fill in personal details such as names, addresses, and the specific details of the property to be transferred.

-

Clearly indicate who the primary and alternate beneficiaries will be, and ensure their details are correct.

-

Finally, ensure the document is notarized to meet legal standards of enforcement.

What interactive tools does pdfFiller offer for TODD management?

pdfFiller provides various online tools that simplify the completion, signing, and management of transfer on death deed forms. These features enhance the user experience and make document management seamless.

-

Users can easily edit TODD documents online, ensuring all necessary fields are updated without needing to start over.

-

pdfFiller allows users to electronically sign documents, which is crucial for streamlining the property transfer process.

-

Multiple parties can collaborate on the TODD management, making it simpler to communicate and finalize details.

What are common challenges related to transfer on death deeds?

While transfer on death deeds are valuable, they can also present challenges. Understanding these can help property owners navigate the process effectively.

-

It's important to recognize that the requirements for TODDs can vary by state, which may complicate the process.

-

Confusion or disputes may arise if beneficiaries are not clearly defined or if their situations change prior to the owner's death.

-

Property owners need to be aware of the proper procedures for revoking a TODD to prevent future legal complications.

What are the next steps after completing the transfer on death deed?

After filling out the TODD form, it’s critical to take the appropriate actions to finalize the process. This step ensures the transfer is recognized legally.

-

Submit the TODD form to local authorities to record the transfer, ensuring it's filed per your state’s guidelines.

-

Maintain copies of the deed and any correspondence related to it. This documentation can safeguard against future disputes.

-

Revisit the TODD as life circumstances change, such as the birth of new beneficiaries or changes in property ownership.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.