Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wif...

Show details

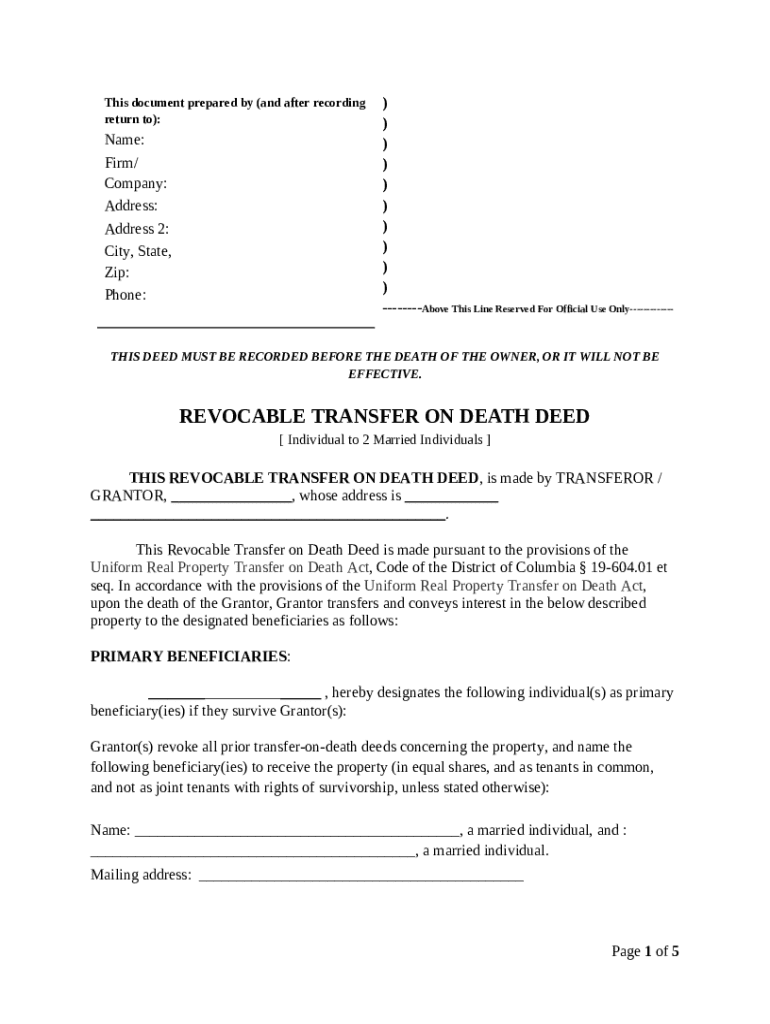

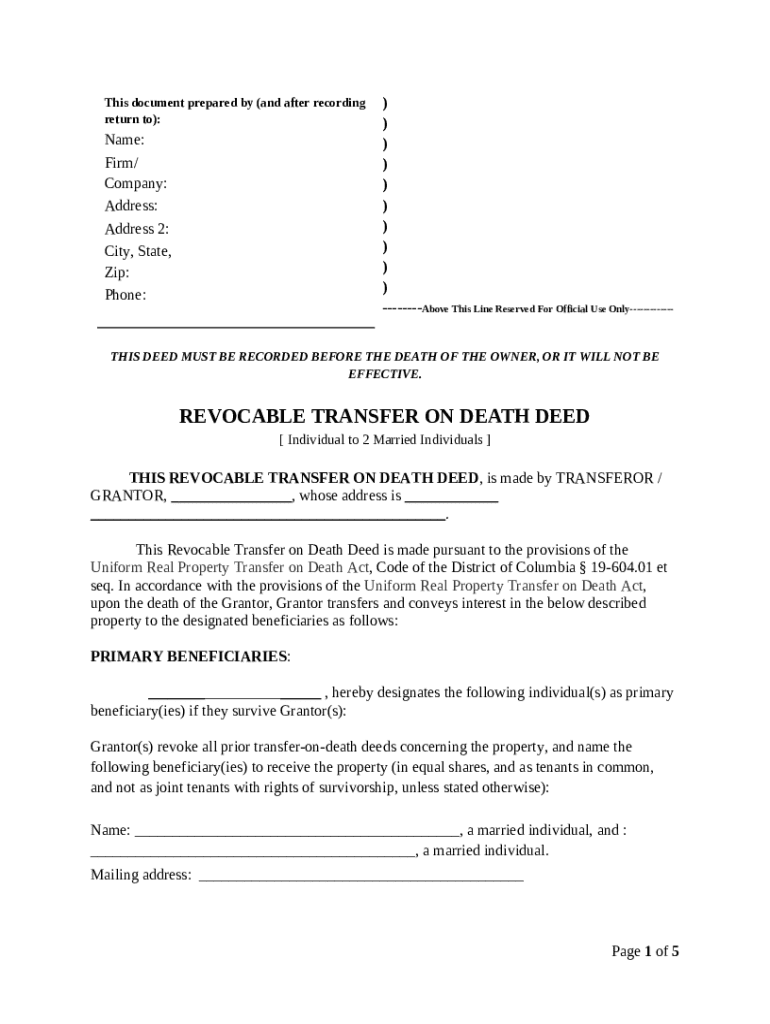

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

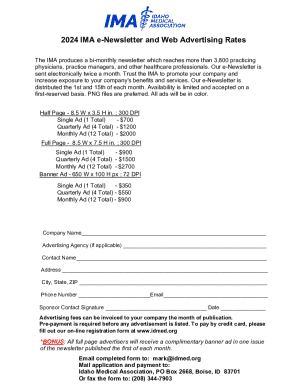

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed allows an individual to transfer real property to a beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Its good

TOP

Great service for price and for my budget ... will learn more option i can use ... but for now i need to transfer my doc in PDF for protecting if sent and this is perfect for me :) Thank you for affordable service :)

Very nice

no

Amazing

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Long-read How-to Guide on Transfer on Death Deed Form

Filling out a transfer on death deed form is essential for anyone looking to ensure their property is passed on to their beneficiaries without the complications of probate. This guide provides a comprehensive step-by-step approach to filling out this important document correctly.

What is a transfer on death deed?

A transfer on death deed (TOD deed) is a legal document that allows a property owner to transfer their real property to designated beneficiaries upon their death without going through probate. This kind of deed is significant because it allows for a seamless transfer of ownership, ensuring that loved ones receive property as intended.

-

It enables the owner to keep their property during their lifetime and automatically transfers ownership after death.

-

The deed must be recorded with the county recorder to be valid; failure to do so can invalidate the transfer.

-

Many states have adopted this act, which standardizes the procedures surrounding TOD deeds and their usage.

What are the essential components of the transfer on death deed?

-

The grantor is the property owner creating the TOD deed, while beneficiaries are the individuals designated to receive the property.

-

An accurate legal description of the property must be included in the deed to ensure clarity and reduce potential disputes.

-

The grantor can revoke the deed at any time before their death by recording a revocation document.

How can you complete the transfer on death deed form?

-

Provide all necessary personal information regarding the grantor, including full name and address.

-

Clearly list the names of the primary beneficiaries who will inherit the property.

-

It's wise to designate alternate beneficiaries in case the primary ones are unable to inherit.

-

Use the legal description of the property to avoid ambiguity.

What tools can assist in managing your transfer on death deed form?

-

pdfFiller allows for easy editing and signing of documents directly within the platform, streamlining the process.

-

Teams can collaborate effectively on the document with feedback mechanisms to ensure accuracy.

-

Access your documents from anywhere, making it convenient to manage your transfer on death deed form.

What considerations should be made before filing the transfer on death deed?

-

Failure to record the deed can result in the property going through probate, which may delay the transfer.

-

Be aware that changes in familial or personal relationships may require updates to the beneficiaries listed.

-

Property laws related to TOD deeds can differ significantly by state, so consult local statutes.

What steps should be taken after completing the transfer on death deed?

-

File your completed deed with the appropriate county recorder's office to make it legally binding.

-

Filing fees can vary and it's advisable to check with the local authority for specific amounts.

-

Always confirm that the county has accepted and properly recorded the deed to avoid future issues.

How to ensure your transfer on death deed is executed properly?

-

Double-check all details in the document to prevent errors that could complicate the transfer.

-

Consider consulting a legal expert to ensure that your deed aligns with applicable laws.

-

Execution of this deed often comes with time constraints, particularly if circumstances change.

Why is it important to stay informed on future changes regarding transfer on death deeds?

-

Laws and regulations can evolve, so staying informed helps in maintaining compliance.

-

Utilize resources such as legal journals or estate planning websites for updates.

-

Leverage features available on pdfFiller for editing and managing documents as changes occur.

How to fill out the transfer on death deed

-

1.Visit pdfFiller and log in to your account or create a new one if necessary.

-

2.Search for 'transfer on death deed' in the template library.

-

3.Select the appropriate template for your state or jurisdiction.

-

4.Open the template and fill in the required fields: your name, address, and the legal description of the property.

-

5.Designate the beneficiary by providing their name and relationship to you.

-

6.Include a statement confirming that the transfer occurs at death.

-

7.Date and sign the document in the presence of a notary public.

-

8.Save the completed document and print it out for signing.

-

9.Consider recording the deed with your local county recorder's office to ensure it is legally binding.

-

10.Keep a copy of the executed deed in a safe place and provide a copy to the beneficiary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.