Get the free Promissory Note - Horse Equine s template

Show details

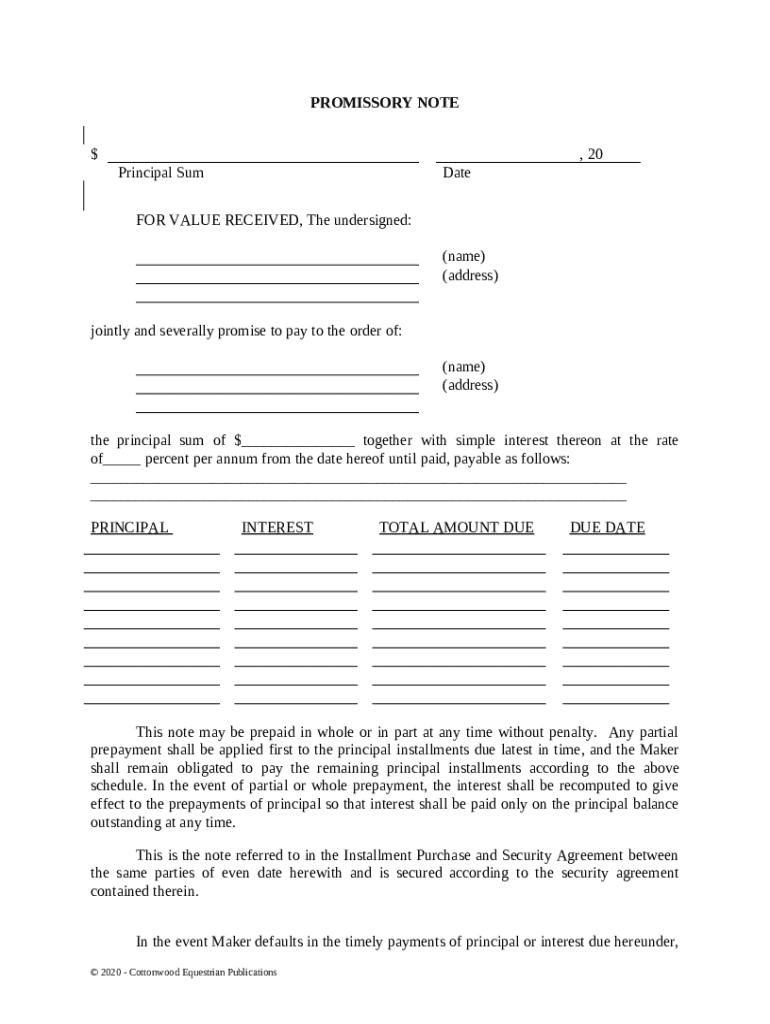

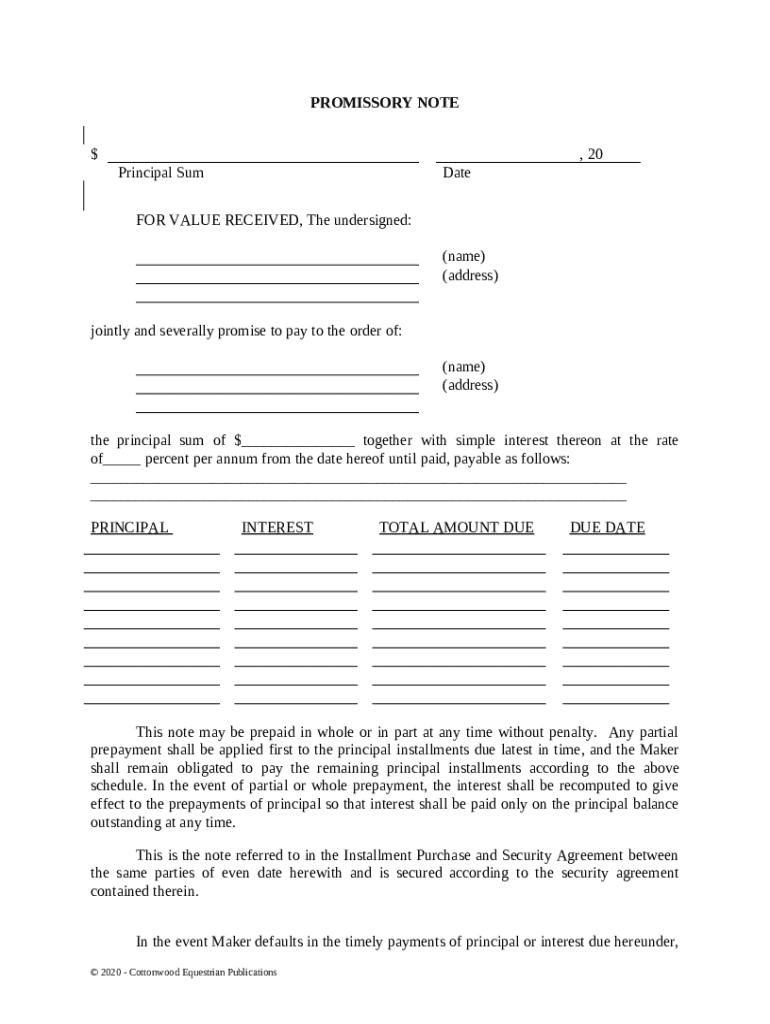

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document wherein one party promises to pay another a specified amount related to the purchase or sale of a horse.

pdfFiller scores top ratings on review platforms

Very handy - got me out of a tight corner when I had no access to a scanner.

Outstanding application so lead small business on the road to success.

Excellent Performance

very intuitive easy to use

My experience was above and beyond the standard.

VERY helpful

VERY helpful

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

How to Complete a Promissory Note

TL;DR: How do you fill out a promissory note form?

To fill out a promissory note form, gather essential information such as the principal amount, borrower and lender details, and interest rate. Clearly define repayment terms and include signatures from both parties for validity.

What are the basics of promissory notes?

A promissory note is a written promise to pay a specific sum of money to a particular person at a predetermined future date. It is crucial for both borrowers and lenders because it formalizes the terms of the loan transaction. The key components that define the note include the principal sum, interest rate, and repayment terms.

What are the key components of a promissory note?

-

The total amount being borrowed, which must be clearly stated.

-

This shows when the promissory note is officially created.

-

Names and contact information for both parties involved.

-

A clear specification of the interest charged on the loan amount.

-

Includes details on principal, interest payments, and total amounts due.

-

Conditions under which the borrower can pay the loan off early without penalties.

How do you fill out a promissory note form step-by-step?

Filling out a promissory note form requires following a structured approach to ensure compliance and clarity. Each component must be carefully entered to avoid ambiguity.

-

Clearly state the total amount being borrowed, and ensure accuracy.

-

Mark the date on which the agreement is signed.

-

Provide complete names and contact information for both parties.

-

Include the annual interest rate being charged on the loan.

-

Specify how and when payments will be made, including due dates.

-

State if the borrower has the option to pay off the loan early.

-

Ensure that both parties sign the document to validate it.

How can you manage your promissory note with pdfFiller?

pdfFiller provides a comprehensive platform for handling your promissory note needs. Users can access various PDF templates, customize their forms, and collaborate in real-time, ensuring that all parties are aligned throughout the process.

-

Find premade templates tailored for promissory notes on pdfFiller.

-

Modify the promissory note form to suit your specific transaction details.

-

Utilize secure electronic signatures to finalize agreements.

-

Allow multiple stakeholders to work on the document simultaneously.

-

Easily store and retrieve documents from the cloud for future reference.

What are the legal considerations for promissory notes?

Promissory notes are subject to state-specific regulations, so it’s essential to ensure compliance with local laws. Legal validity can be challenged if the document lacks key information or if the terms are not clear.

-

Different states may have unique requirements regarding these documents.

-

Confirm that all necessary information is present for enforceability.

-

Defaults on a promissory note can lead to serious financial consequences.

-

Incorrect information can render the note unenforceable.

What common mistakes should be avoided when creating a promissory note?

Understanding common pitfalls in drafting a promissory note can protect you from future disputes. It’s imperative to ensure that all the critical components are included and clearly defined.

-

Failing to include necessary details can invalidate the note.

-

Ambiguous repayment terms can lead to disagreements.

-

It is vital to ensure everyone involved understands the terms.

-

Proper signatures are essential for the document's legality.

How to fill out the promissory note - horse

-

1.Open pdfFiller and select the option to create a new document.

-

2.Search for 'promissory note - horse' in the template library.

-

3.Choose the appropriate template that suits your transaction needs.

-

4.Fill in the date at the top of the document to indicate when the note is created.

-

5.Enter the names and addresses of both parties: the borrower and the lender.

-

6.Specify the amount being borrowed for the horse transaction in the designated field.

-

7.Include the interest rate if applicable, or indicate if the loan is interest-free.

-

8.Detail the repayment schedule, stating the payment intervals and final due date.

-

9.Add any conditions or terms relevant to the sale or payment of the horse.

-

10.Review the filled-in template for accuracy and completeness before signing.

-

11.Share the document with the other party for their review and signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.