Last updated on Feb 17, 2026

Get the free Quitclaim Deed with Partial Release by Lender template

Show details

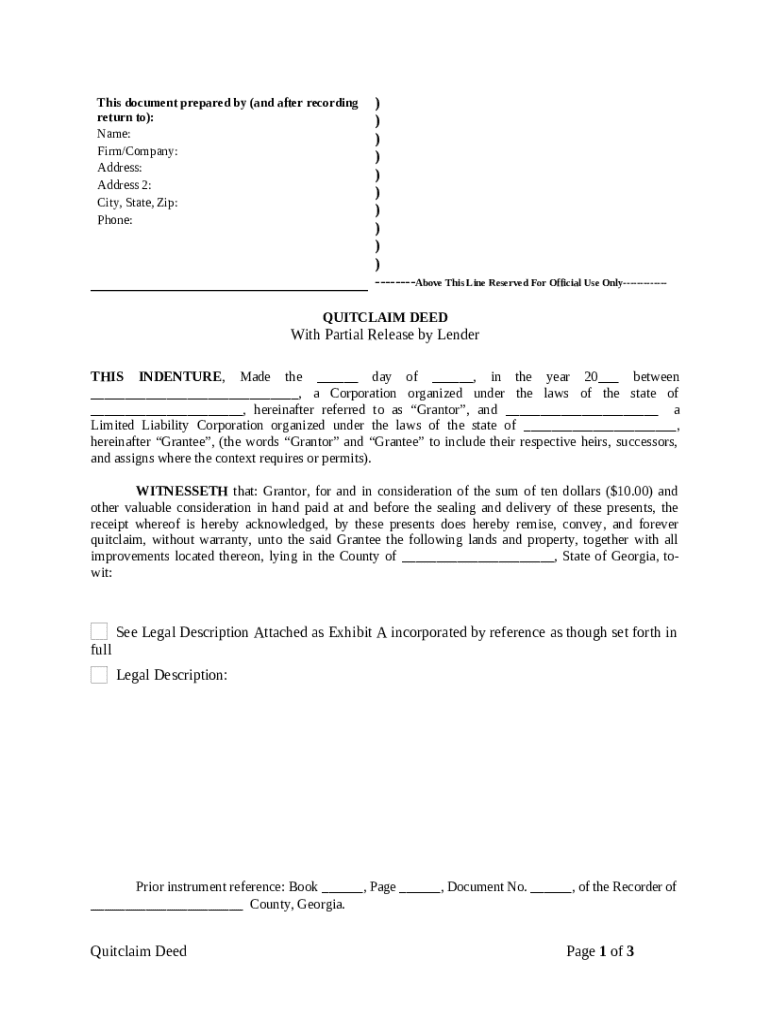

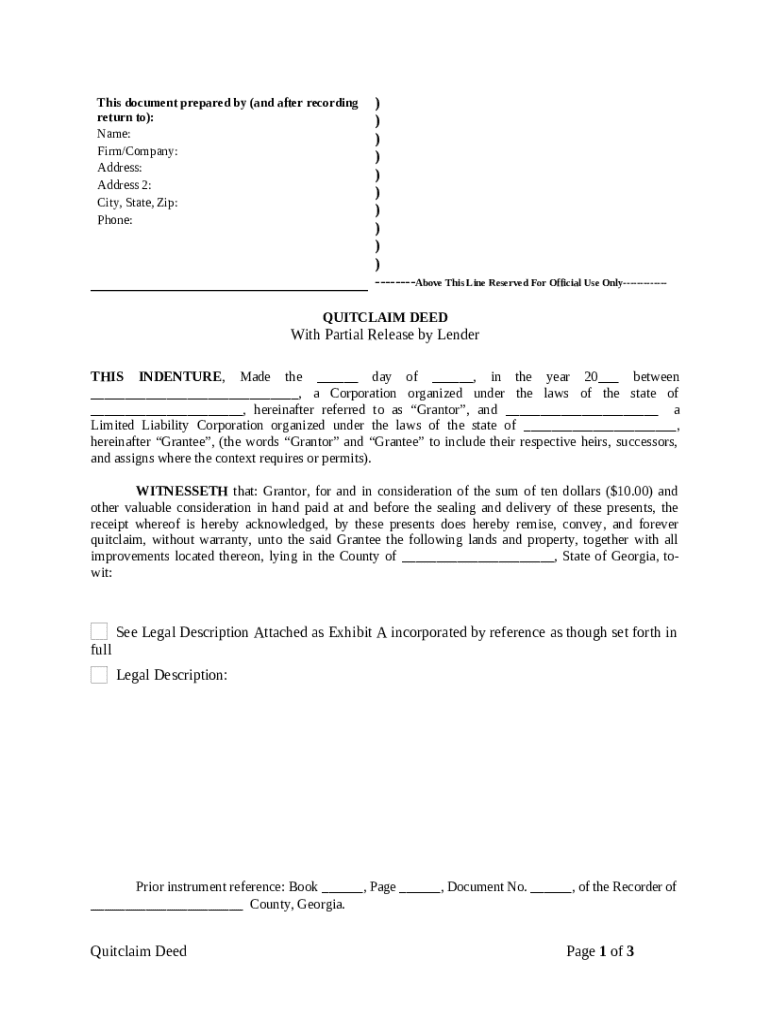

Quitclaim deeds are used to transfer a property title, or to clear a defect. In this form, the grantor releases partial ownership of his/her rights of a property to the grantee.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is quitclaim deed with partial

A quitclaim deed with partial conveys a property interest from one party to another without guaranteeing that the title is free of claims, used typically to relinquish a portion of ownership.

pdfFiller scores top ratings on review platforms

It is exactly what I have been searching for.

customer service was good and so far it seems that ive been able to accomplish what I need to

I feel this is just what I've been looking for and it's not to complicated like some of the other sites and you still don't get what your looking for . I didn't get get what I wanted on other sites. That's why I purchased for a year because this works good with my busness.

Just started using a program like this and I find it easy and not complicated to use. well done

I would prefer that the fill in templates be free of charge. The one used is great and I would hope to find another one as such. Easy to use formatting and site.

I needed some tax forms that I could not find anywhere else, and PDFfiller save the day :-)

Who needs quitclaim deed with partial?

Explore how professionals across industries use pdfFiller.

Complete Guide to Quitclaim Deed with Partial Release

How to fill out a quitclaim deed with partial release form

Filling out a quitclaim deed with partial release form involves gathering necessary information about the property, completing the form with accurate details, and submitting it to the appropriate county recorder. Ensure you also notarize the document to validate the transfer.

What is a quitclaim deed?

A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. It primarily serves to convey whatever interest the grantor has in the property, which can be particularly useful in situations like divorce settlements or family transfers.

-

A quitclaim deed transfers ownership rights without providing any proof or guarantee of the title.

-

Commonly used for transfers between family members or in divorce proceedings.

-

Unlike warranty deeds, quitclaim deeds do not promise that the property is free of debts or legal issues.

What are the key components of a quitclaim deed with partial release?

-

The grantor is the person transferring the property, while the grantee is the recipient.

-

An accurate and detailed legal description of the property being transferred is essential.

-

Consideration often refers to the value exchanged in the transfer, though it may be $0 for family transactions.

-

Understand any zoning laws that may affect how the property can be used or developed.

How do quitclaim deeds work in Georgia?

In Georgia, quitclaim deeds are governed by specific legal frameworks that dictate how property transfers should occur. It is crucial to follow the filing process with the Clerks of Court, ensuring all state-specific requirements are met for the deed to be recognized as valid.

-

Georgia law outlines the required elements for a quitclaim deed to be legally binding.

-

Submit the completed deed to the county Clerks of Court where the property is located.

-

Additional documentation or fees may be necessary, depending on the county.

What are the steps to fill out your quitclaim deed form?

-

Collect the legal names, addresses, and any relevant documents related to the property.

-

Ensure all details are accurate, including parties' names and legal descriptions.

-

Sign the deed in front of a notary public to make it legally binding.

-

File the notarized deed with the appropriate county office to make the transfer official.

What common mistakes should you avoid when using a quitclaim deed?

-

Ensure the property is correctly described to avoid future disputes.

-

Notarization is vital; an unsigned deed can render it invalid.

-

Clearly identify everyone participating in the transaction to prevent legal issues later.

What tax and financial considerations are important?

-

In Georgia, there may be transfer taxes associated with the property transfer.

-

Transfers can affect property tax assessments, so check local laws.

-

Consider potential liabilities attached to the property before proceeding.

What are the pros and cons of using a quitclaim deed?

-

Quitclaim deeds are straightforward, allowing for quick property transfers.

-

Lack of warranty means the grantee takes on risks related to title issues.

-

Best suited for intra-family transfers or situations where trust exists.

What are practical scenarios for quitclaim deeds in Georgia?

-

Often used to allocate property rights post-marriage or divorce.

-

Facilitates transfers between entities without extensive legal hurdles.

-

Commonly used when property is passed down within families.

When should you seek legal support and guidance?

-

Consult a legal professional if you're uncertain about any terms or implications.

-

Consider online legal resources or public legal services for assistance.

-

Utilize pdfFiller for easy document management and access to templates.

How can pdfFiller help with your quitclaim deed needs?

-

Easily navigate to fill out your quitclaim deed with pdfFiller’s templates.

-

Organize all your forms in one cloud-based platform for convenience.

-

Quickly complete the process with eSign capabilities that ensure legality.

How to fill out the quitclaim deed with partial

-

1.Open the quitclaim deed form on pdfFiller.

-

2.Enter the grantor's name in the appropriate field.

-

3.Fill in the grantee's name - the person receiving the partial interest.

-

4.Specify the property details including legal description and address.

-

5.Indicate the portion of the interest being conveyed, such as percentage or specific rights.

-

6.Include any encumbrances or existing mortgages, if applicable.

-

7.Sign the document in the designated area, ensuring all grantors do so if multiple are involved.

-

8.Have the document notarized to ensure its legal validity.

-

9.Save your completed document, then print or share it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.