Get the free A01 Registration and Filing of Foreign Judgment

Show details

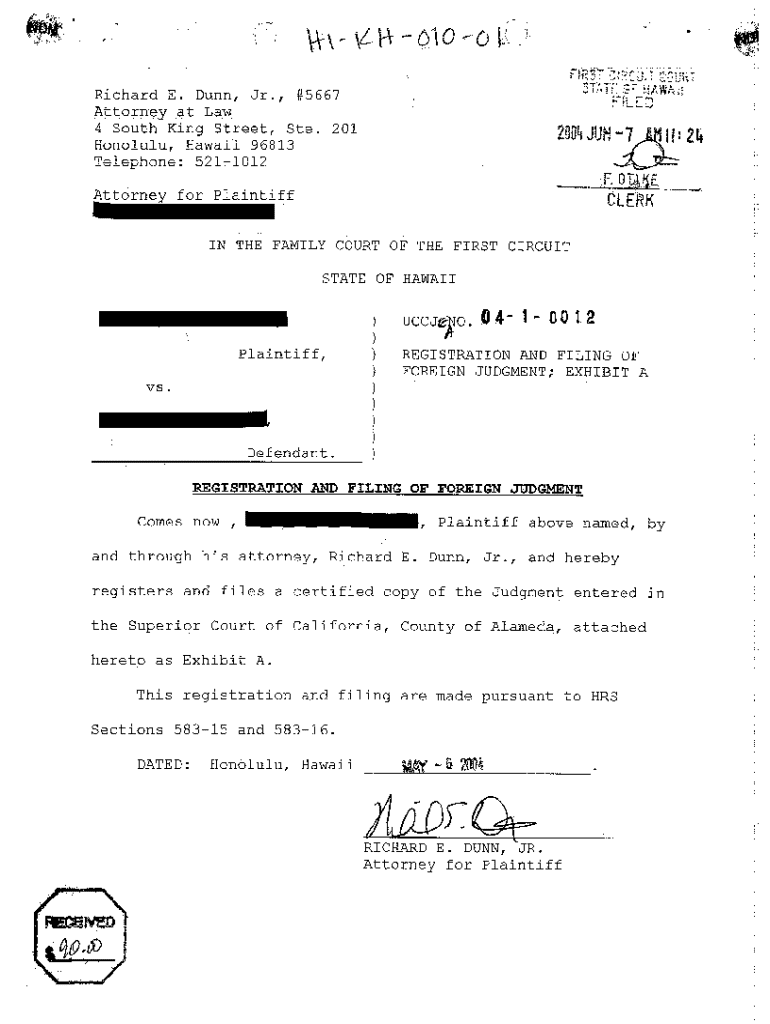

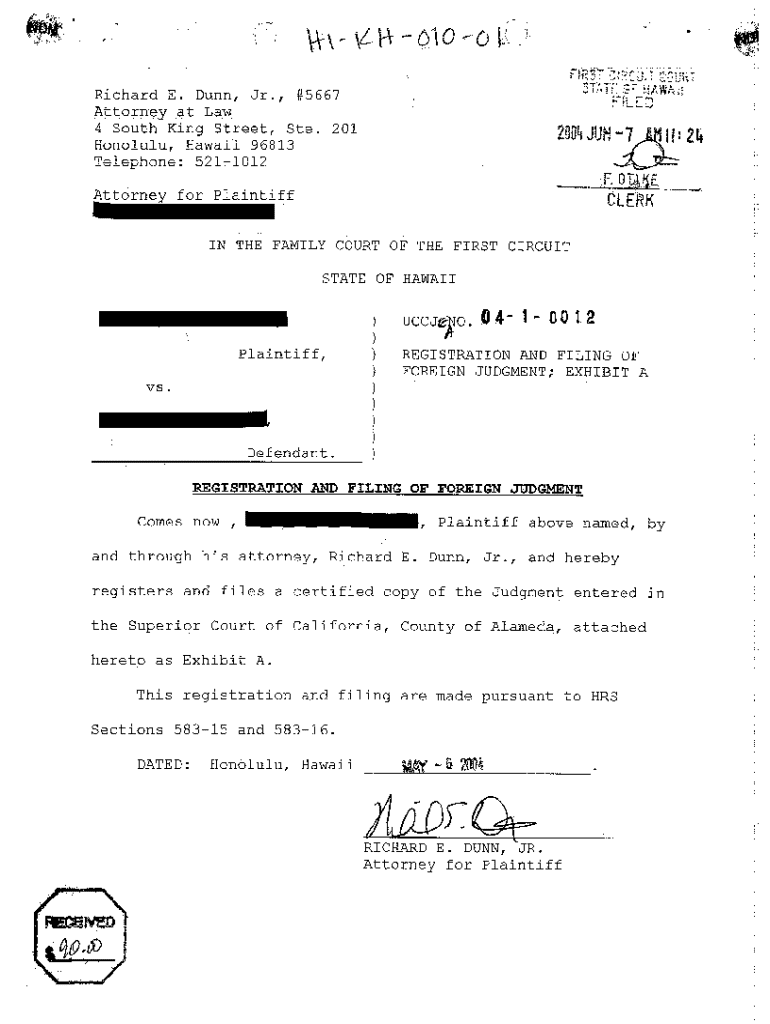

A01 Registration and Filing of Foreign Judgment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is a01 registration and filing

A01 registration and filing is the process of officially submitting a request for an application or a legal document, typically regarding intellectual property rights.

pdfFiller scores top ratings on review platforms

its nice and working fine

Great app..easy to use and saved me a…

Great app..easy to use and saved me a lot of headaches during a move when I didn't have access to a printer.

Good experience

Good experience. Worked great.Thanks

Maybe early for feedback but so far it…

Maybe early for feedback but so far it has worked well.

it makes everything easy to us

It was tough,but I think I got through it. Nice to know that I can contact help if I need it. This might work better than Adobe verison. it's more affordable.

Who needs a01 registration and filing?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the A01 registration and filing form

How to efficiently fill out a A01 registration and filing form

Filling out an A01 registration and filing form is crucial for compliance. Being accurate in completion not only assures adherence to regulations but also streamlines future processes. To avoid delays, follow our detailed guide below.

What is the A01 registration and filing form?

The A01 form serves as a fundamental document for specific registration requirements. Primarily, it collects essential information from entities wishing to register or file with governmental authorities.

-

To register entities for tax and compliance purposes.

-

The form includes identification details, business structure information, and financial data.

-

Accurate entries facilitate legal adherence, avoiding potential penalties.

Who should use the A01 form?

The A01 form is applicable to individuals and businesses aiming to formalize their registration status. This ensures compliance with local regulations.

-

Available for both individuals and corporate entities planning to register.

-

Filing for a new business or updating existing registration information.

-

Particularly essential in Norway for tax compliance and business operations.

How do fill out the A01 form step-by-step?

Completing the A01 form involves several critical phases, each integral to an accurate filing.

-

Begin by entering your name, address, and other personal identifiers accurately.

-

Detail financial positions including income, assets, and liabilities as required.

-

Ensure all necessary attachments are included with your submission.

How does pdfFiller enhance the A01 form editing process?

pdfFiller simplifies the editing and signing process of the A01 form significantly by providing easy-to-use tools.

-

Users can modify form elements seamlessly to reflect accurate information.

-

Ensures compliance with regulations through legally binding signatures.

-

Facilitates multiple stakeholders to work on the same document effortlessly.

What are the best practices for managing your A01 registration and filing form?

Managing your A01 form efficiently can save time and reduce errors in future submissions.

-

Keep forms accessible by saving them securely in the cloud.

-

Make use of tools to monitor the status of your submissions effectively.

-

Maintain an organized system for updating and managing different form versions.

When should you submit the A01 form?

Timely submission of the A01 form is paramount to avoid penalties.

-

Be aware of specific deadlines established by the Norwegian Tax Administration.

-

Identify risks such as fines or complications in registration processes.

-

Organize your filing schedule proactively to ensure timely submissions.

What role does the Norwegian Tax Administration play?

The Norwegian Tax Administration is both a resource and regulatory body for filing the A01 form.

-

They manage compliance, helping users understand registration processes.

-

Offer documentation and support that assists users in filling forms correctly.

-

Methods to reach out for further assistance include various communication channels.

What are common mistakes to avoid when using the A01 form?

Awareness of common mistakes can streamline the A01 registration process significantly.

-

Ensure accuracy in all personal and financial information to avoid complications.

-

Review and correct all errors before submission to prevent rejection.

-

Utilize pdfFiller's toolkits to avoid prevalent issues through its editing features.

How can you follow pdfFiller for updates?

Stay informed about the A01 form and related updates by joining pdfFiller's online community.

-

Join forums and groups to connect with fellow users for shared knowledge.

-

Sign up for tips and updates regarding document management trends.

-

Follow discussions and announcements through various social media platforms.

How to fill out the a01 registration and filing

-

1.Open the pdfFiller website and sign in to your account.

-

2.Navigate to the 'Forms' section and search for 'A01 registration and filing' form.

-

3.Select the form from the search results and click on it to open.

-

4.Fill in the required fields such as applicant name, address, and registration type. Ensure all details are accurate and complete.

-

5.Attach any necessary supporting documents by using the 'Upload' feature. Review the file formats accepted.

-

6.Check the form for any additional fields that may need completion, such as descriptions or claims related to your registration.

-

7.Once all information is filled in, review the entire form for accuracy before final submission.

-

8.Click the 'Submit' button to send your completed form to the appropriate authority.

-

9.Keep a copy of the confirmation receipt and any reference numbers for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.