Get the free pdffiller

Show details

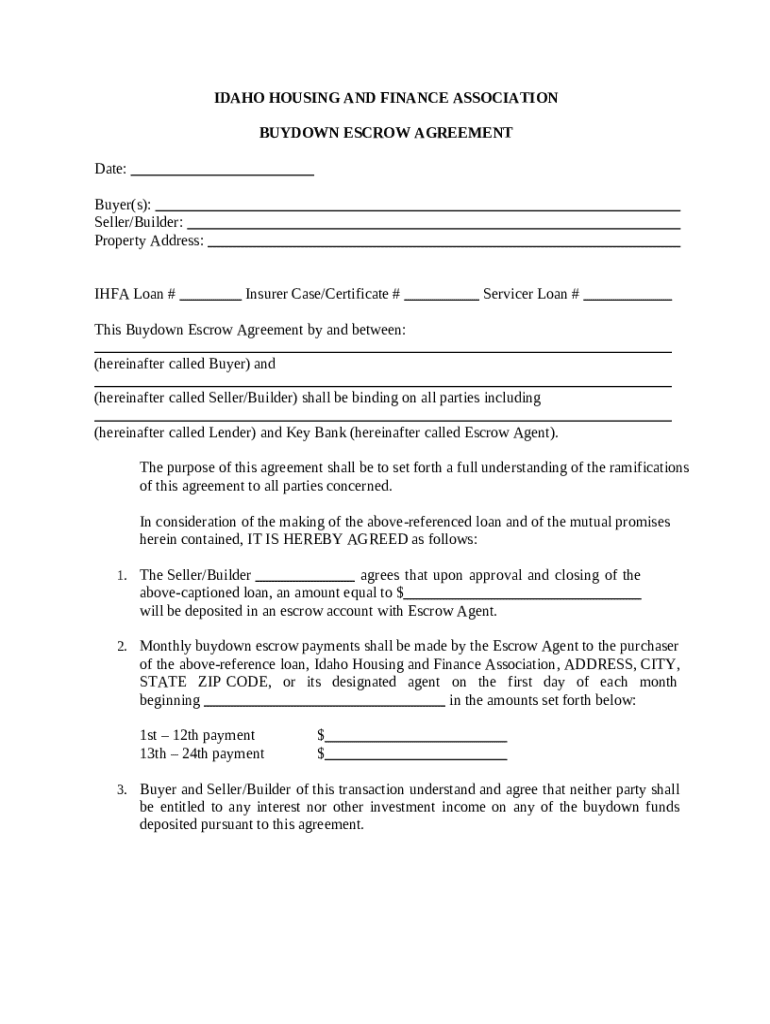

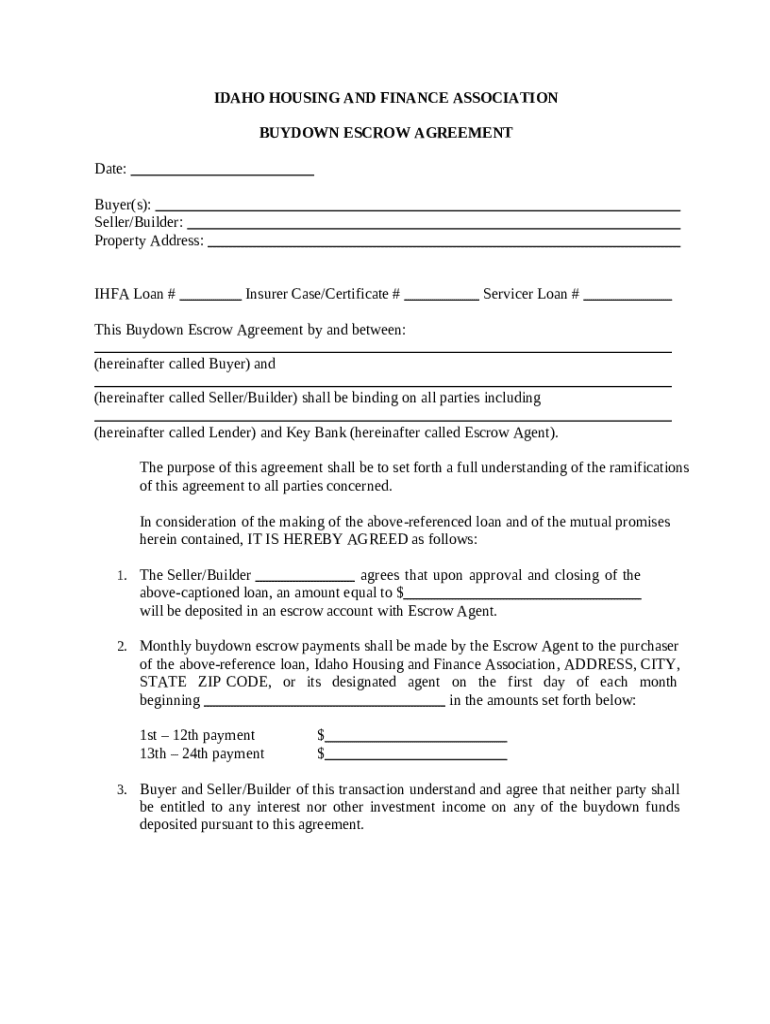

This is a sample Buydown Escrow Agreement involving a Housing and Finance Association. Typically, the seller contributes funds to an escrow account that subsidizes the loan during the first years,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is buydown escrow agreement

A buydown escrow agreement is a financial arrangement that allows a buyer to prepay a portion of their mortgage interest in exchange for a lower interest rate on their loan.

pdfFiller scores top ratings on review platforms

..

Impressive

useful

Awesome

Easy for a newby to start with the basics

SO FAR SO GOOD

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the buydown escrow agreement form

How do buydown escrow agreements work?

A buydown escrow agreement is a financial tool used to reduce the interest rate on a mortgage for a limited time, making monthly payments more affordable. Typically utilized in real estate transactions, this agreement involves setting aside funds in escrow to subsidize buyer mortgage payments. Understanding the mechanics of this document is essential for buyers, sellers, and agents involved in property sales.

What are the key components of the buydown escrow agreement?

-

The agreement should clearly define the date of execution, along with the buyer(s), seller(s), and property address.

-

Detailed loan information, including specifics about the Idaho Housing and Finance Association (IHFA) loan and any applicable loan insurers.

-

The responsibilities of the escrow agent include managing funds and ensuring all conditions of the agreement are met.

How to fill out the buydown escrow agreement form?

Filling out the buydown escrow agreement form requires attention to detail to avoid common errors. It is important to follow a step-by-step process to ensure accuracy.

-

Collect details about the property, the buyers' and sellers' information, and loan specifics.

-

Carefully fill out all sections including names, addresses, and vital financial data.

-

Double-check for any mistakes and submit the agreement to the escrow agent for processing.

What are the implications of monthly payment schedules and escrow deposits?

The monthly payment schedule established in a buydown escrow agreement is pivotal for budgeting, allowing buyers to manage their expenses effectively. It is essential to understand how these payments are calculated and the conditions under which the escrow payments are made.

-

Buydown payments are determined based on the interest rate reduction and the principal amount of the mortgage.

-

Escrow payments usually occur at the beginning of each month, dependent on the agreement terms.

-

Consideration of interest income generated from escrow funds and potential tax obligations is crucial.

What are the provisions for property sales and escrow funds?

In the event of a property sale, the terms laid out in the buydown escrow agreement play a significant role in determining the fate of escrow funds. It is vital to understand how any unused buydown funds will be managed once the property changes hands.

-

A property sale may require re-negotiation of the terms in the escrow agreement.

-

New owners may inherit unused buydown funds, and specific conditions dictate their use.

-

Always consult legal strategies in real estate transactions to adhere to state laws and regulations.

What additional resources are available for assistance?

For individuals navigating the complexities of a buydown escrow agreement, seeking expert help can be invaluable. Resources like pdfFiller offer interactive tools and professional support to streamline the document management experience.

-

Trained professionals can provide guidance and ensure all paperwork is filled out accurately.

-

pdfFiller integrates tools for seamless editing, signing, and document management from anywhere.

-

Personalized assistance is available through pdfFiller’s customer service to help resolve unique queries or issues.

How to fill out the pdffiller template

-

1.Download the buydown escrow agreement template from pdfFiller.

-

2.Open the PDF file in pdfFiller using the upload feature.

-

3.Review each section of the agreement, starting with the parties' information: enter the names, addresses, and contact details of both the buyer and seller.

-

4.Fill in the property details by providing the address and legal description of the property involved in the transaction.

-

5.Specify the terms of the buydown, including the amount to be escrowed and the duration of the buydown period.

-

6.Enter the details of any financing involved, including the lender's name and loan information, to clarify the financial arrangement.

-

7.Review and confirm all entries for accuracy, ensuring that there are no missing or incorrect details.

-

8.Sign the agreement electronically using the signature tool in pdfFiller.

-

9.Save the completed agreement and share or print it as needed for all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.