Get the free Notice of Default and Foreclosure Sale template

Show details

This Notice is to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure

We are not affiliated with any brand or entity on this form

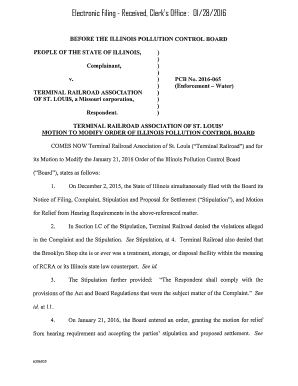

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default and

A notice of default is a formal declaration that a borrower has failed to meet the legal obligations or conditions of a loan, specifically the failure to make required payments.

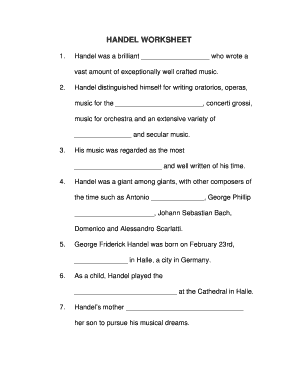

pdfFiller scores top ratings on review platforms

works well for fillilng pdf's. nice web site that automatically advances you to the next step (after you fill a pdf, it offers the option to save a particular page to pdf, print it, etc)

Had an issue that was very quickly resolved. The service is great.

I am terrible when it comes to forms and PDFfiller makes it so easy.

It has made Army PDFs (which are not user friendly) extremely easy to fill out. It easily gets a 5 star rating in my book, and I am super impressed.

Once you get to navigate the forms, it is easy & saves time.

I havent used very much but I like everything I have done so far.

Who needs notice of default and?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Notice of Default and Foreclosure Sale

How do you define a notice of default?

A notice of default is a formal announcement issued by a mortgage lender indicating that a borrower has failed to make scheduled mortgage payments. This critical document serves as the initial step in the legal process leading to foreclosure. The notice triggers a series of actions both for the borrower and the lender, hence its importance.

-

It's a legal document signaling that a borrower is in default due to missed mortgage payments.

-

It officially starts the countdown to possible foreclosure, compelling the borrower to act.

-

Mortgagor is the borrower; Mortgagee is the lender. An Assignment of Mortgage involves transferring the mortgage from one lender to another.

What are the components of a notice of default?

The notice of default includes several critical pieces of information that must be accurately documented. These details not only facilitate legal procedures but also inform the borrower of their current status regarding their mortgage obligations.

-

This section should clearly outline the mortgage's original execution date, terms, and any changes over time.

-

It needs to specify where the notice is filed and any relevant identification numbers for the mortgage.

-

This outlines specific missed payments, dates, and other declarations that substantiate the default.

How can you use a fillable form structure for the notice of default?

Digital tools allow homeowners and lenders to manage notice of default forms efficiently. Utilizing platforms like pdfFiller enhances the process by providing templates that are editable and user-friendly.

-

These forms can be customized and filled out directly online, reducing paperwork.

-

Essential fields capture all necessary details ensuring the form is complete and accurate.

-

pdfFiller provides intuitive editing tools that simplify the process of completing and updating your forms.

What are the steps for completing the notice of default?

Completing the notice of default accurately is crucial for its legality and readability. These steps guide you through a successful completion.

-

Collect all relevant documents related to your mortgage and payments.

-

Detail your mortgage information, including the lender's name, loan number, and any other essential references.

-

Double-check all entries for accuracy to avoid delays in processing.

Where do you submit the notice of default?

Submitting the completed notice of default is a critical next step in the foreclosure process. It ensures that you are compliant with local legal requirements.

-

Typically, this form is filed at your local county recorder's office or a designated online platform.

-

Requirements can vary by state or region, make sure to check local laws.

-

Adhere to specified timelines for filing to avoid any legal repercussions.

What are the consequences of ignoring the notice of default?

Ignoring a notice of default may lead to serious consequences, affecting not only financial stability but also long-term credit health.

-

The borrower may face significant financial burdens, including the potential loss of their home.

-

A default may severely damage the borrower's credit score, limiting future borrowing options.

-

Foreclosure can have lasting effects, potentially complicating homeownership for years to come.

How does the foreclosure process follow a notice of default?

Once a notice of default is issued, the foreclosure process begins, following a structured timeline that varies by jurisdiction.

-

Typically, there are specified periods the borrower has to bring the account current or risk foreclosure.

-

Property auctions provide a final opportunity for the borrower to reclaim the property, but if unattended, it may be sold to the highest bidder.

-

Homeowners may have options for reinstatement or alternatives to foreclosure, depending on local laws.

How can pdfFiller assist with document management?

pdfFiller streamlines the process of creating, editing, and managing documents such as the notice of default. The advanced document management tools help users navigate complex paperwork effortlessly.

-

The platform provides e-signature capabilities, making it simpler to finalize important documents.

-

Users have access to a variety of templates designed specifically for real estate transactions.

-

Secure sharing options ensure sensitive information remains confidential while facilitating collaboration.

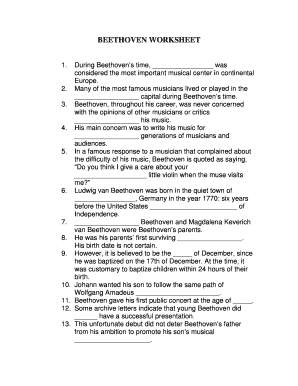

How to fill out the notice of default and

-

1.Open pdfFiller and upload your ‘notice of default’ template or create a new form from scratch.

-

2.Begin by entering the personal information of the lender at the top of the document, including their name, address, and contact details.

-

3.Next, fill in the borrower's information, including their full name, address, and any other relevant details.

-

4.Specify the loan details, including the date the loan was issued, the total amount, and the specific terms that have not been fulfilled.

-

5.In the default section, clearly state the reasons for default, including missed payment dates and amounts due.

-

6.Provide any applicable remedies or actions the borrower can take to remedy the default situation, if applicable.

-

7.Lastly, review all entered information for accuracy, then save and download your completed notice of default for distribution or filing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.