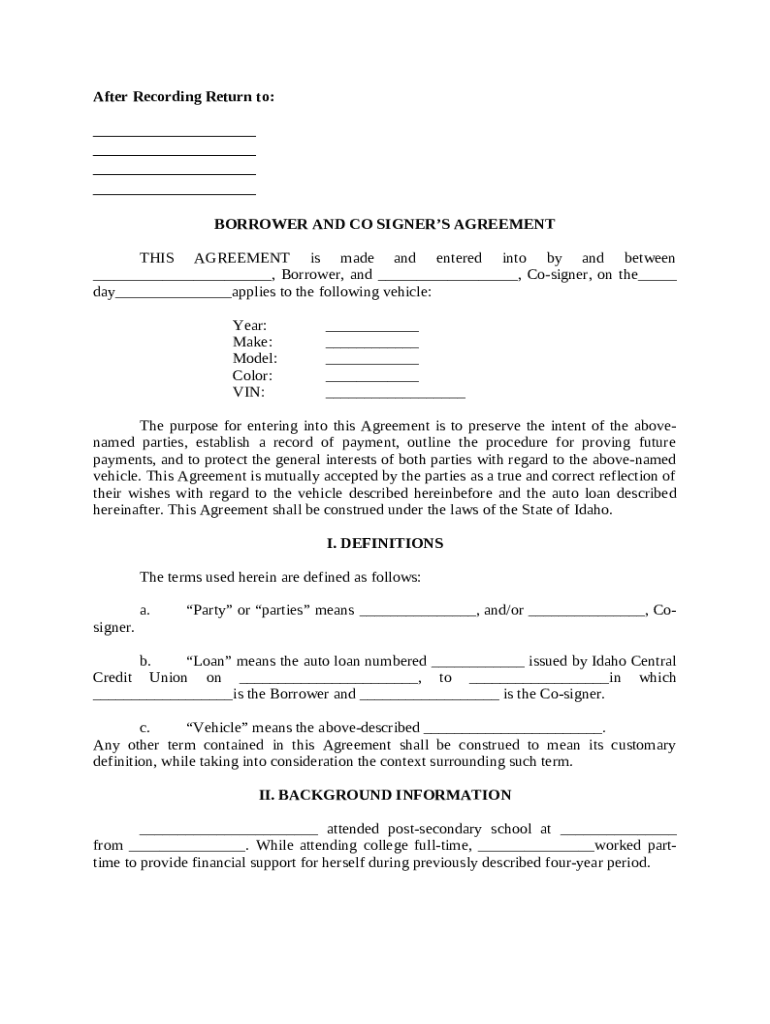

Get the free Borrower and Co Signer's Agreement template

Show details

This form relates to a vehicle purchase. The co-signer agrees to repay the loan if the primary borrower fails to do so.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is borrower and co signers

A borrower and co-signers document outlines the responsibilities and terms among parties involved in a loan agreement.

pdfFiller scores top ratings on review platforms

Worked for what I needed and allowed me to save in any desired format.

This is a great tool. I would love to learn more.

I USE IT TO EDIT/REVISE LEGAL FORMS.

Just what I needed at the time. Thank you.

I love that it is so simple to use! It makes my work easier.

excellent, simple and easy to use

Who needs borrower and co signers?

Explore how professionals across industries use pdfFiller.

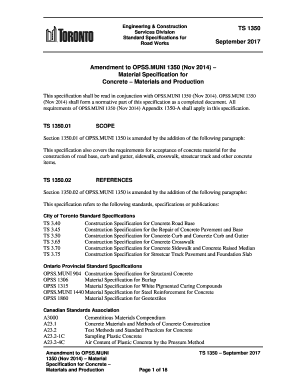

Comprehensive Guide to Completing the Borrower and Co-Signer Form

How can you effectively fill out a borrower and co-signer form?

Filling out a borrower and co-signer form accurately is crucial for anyone looking to secure an auto loan. This guide will walk you through the process step-by-step, clarifying roles and expectations for both the borrower and the co-signer. By following this guide, you'll gain insights into the legal implications, necessary documentation, and best practices for completing this essential agreement.

What is the borrower and co-signer agreement?

A borrower and co-signer agreement is a legal document outlining the responsibilities of both parties when it comes to a loan. It serves to protect the lender by ensuring that both individuals are accountable for loan repayments. The key roles involve the borrower, who receives the loan, and the co-signer, who guarantees the loan by assuming some financial risk.

-

The purpose of this agreement is to clarify financial responsibilities and ensure that the loan is secured; thus, it is essential for minimizing risks for lenders.

-

Understanding each party's role is critical; the borrower is primarily responsible for repayment, while the co-signer provides additional assurance to the lender.

-

In Idaho, auto loan agreements must comply with specific state regulations, which vary from federal guidelines. It's vital to understand these implications to avoid legal issues.

What key information is required on the agreement form?

-

Essential details such as the Year, Make, Model, Color, and VIN of the vehicle assist lenders in identifying the collateral secured by the loan.

-

Loan number and issuing institution details help streamline the approval process and ensure accuracy in record-keeping.

-

Full name, address, and income verification are necessary to assess the borrower's creditworthiness.

-

The co-signer must also provide their full name, address, and credit details to prove their financial capability.

How do you fill out the borrower and co-signer form?

Filling out the borrower and co-signer form requires careful attention to detail. Start by collecting all necessary documentation, including identification and financial records. Then, follow a systematic approach to complete each section.

-

Ensure you enter precise details for the vehicle; inaccuracies can cause delays in loan approval.

-

Break down loan details section-by-section to avoid overlooking critical information.

-

Create a checklist that includes all necessary personal information required from both the borrower and co-signer to minimize errors.

-

Gather documents ahead of time, like pay stubs and identification, as this will streamline the filling out process.

What are best practices for signing and managing the agreement?

Utilizing electronic signatures simplifies the signing process, making it efficient and secure. Both parties should review the document thoroughly to confirm its correctness before signing.

-

Electronic signatures enhance the security of the process and can be easily managed through platforms like pdfFiller.

-

Both parties should cross-check their information and understand the terms before finalizing the agreement.

-

Using pdfFiller enables secure cloud storage for easy access, ensuring you won’t lose any vital documents.

What are your rights and responsibilities in this agreement?

Understanding your rights and responsibilities as either the borrower or co-signer can significantly affect financial and legal outcomes. The borrower has specific ownership rights, while co-signers have distinct obligations.

-

The borrower maintains ownership of the vehicle and is primarily responsible for repayment, which protects their asset.

-

A co-signer may face financial repercussions if the borrower defaults on the loan, making understanding these responsibilities crucial.

-

Various resources are available for legal disputes involving such agreements, ensuring both parties can seek help if needed.

How can you resolve common issues regarding the borrower and co-signer agreement?

Conflicts over borrower and co-signer agreements can arise, but knowing how to address these issues promptly is essential.

-

If a co-signer wishes to withdraw, there are legal steps that need to be followed, often requiring the borrower to refinance the loan.

-

Clear communication channels should be established between the borrower and co-signer to resolve payment concerns effectively.

-

Any alterations in loan terms need to be documented and agreed upon by both parties to avoid future conflicts.

How to fill out the borrower and co signers

-

1.Open the borrower and co-signers form in pdfFiller.

-

2.Begin by entering the primary borrower's full name and contact information in the designated fields.

-

3.Provide details about the loan, including the amount, purpose, and terms of the agreement.

-

4.Next, add information for each co-signer, including their names, contact details, and social security numbers.

-

5.Ensure that all parties understand their obligations by reviewing the terms outlined in the document.

-

6.Both the borrower and co-signers should sign the document electronically where indicated, ensuring all signatures are dated.

-

7.Save the completed document and download or share it as needed for submission to lenders.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.