Last updated on Feb 17, 2026

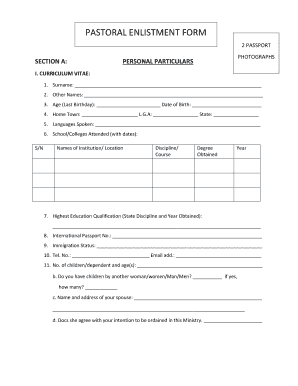

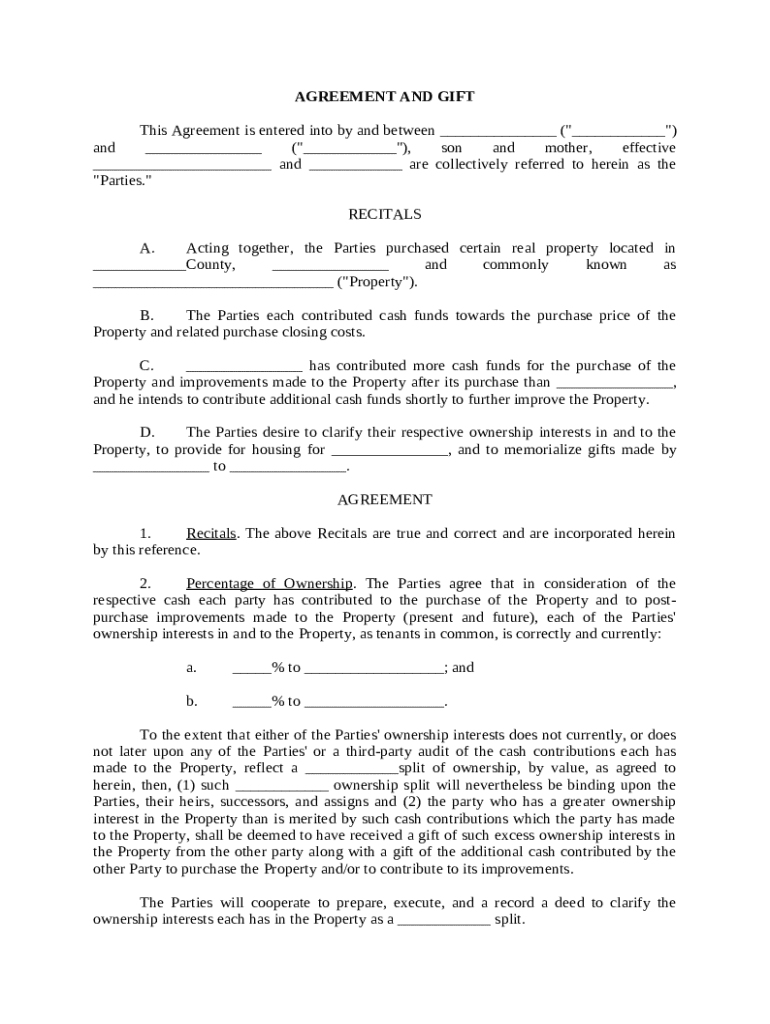

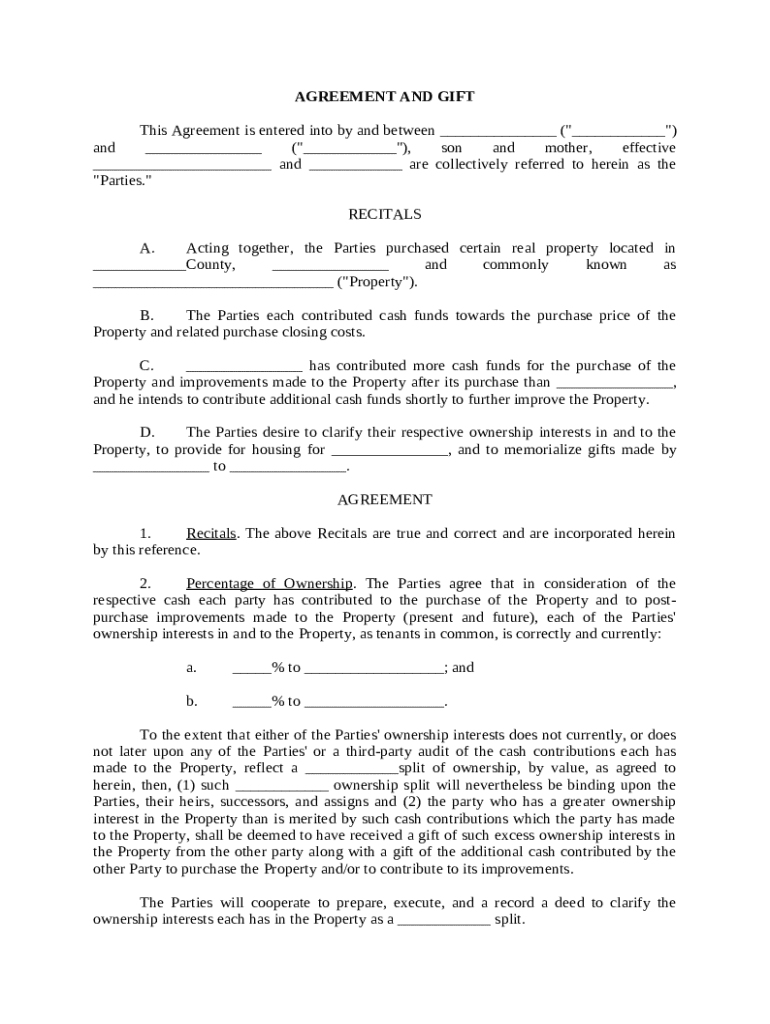

Get the free Agreement and Gift template

Show details

A conditional gift is one that is subject to or dependent on a condition. A conditional gift can be revoked if the recipient does not fulfill the conditions attached to the gift.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is agreement and gift

An agreement and gift is a legal document that outlines the terms of a gift transfer between parties, ensuring clarity and compliance with relevant laws.

pdfFiller scores top ratings on review platforms

It is not working in some tasks, Like loading, email to fill. I have difficulty transferring documents from the email to pdfiller.

Somewhat user friendly is you are only using to fill in forms. I could probably do more with a little bit of training/literature on other features.

This software is awesome for filling in blank pdf docs that you are otherwise unable to do online.

I struggled a bit when the form was completed because I failed to see where the "Print" button was located, but a rep from Customer Care (Paul) helped me and I was all set. Looking forward to exploring and using the PDF filler site frequently.

I am satisfied with the PDF filler. I will not need it often enough to pay a monthly fee. We will only use once or twice a year at the very most for personal use.

First time using PDFfiller. Very easy to use. thank you

Who needs agreement and gift template?

Explore how professionals across industries use pdfFiller.

How to Effectively Use the Agreement and Gift Form

How do you understand the agreement and gift form?

The agreement and gift form is a legal document used to formally record the transfer of ownership of a gift from one party (the donor) to another (the donee). This form ensures that both the donor's intent and the recipient's acceptance are documented, which can prevent potential disputes over ownership in the future. Additionally, it serves as a protective measure, providing legal clarity in situations where gifts may have tax implications.

-

It's a legal document confirming the transfer of a gift.

-

Legal clarity helps prevent disputes and establishes a clear record.

-

Commonly used in familial settings, charitable giving, and financial contributions.

What are the key components of the agreement and gift form?

Understanding the key components of the agreement and gift form is crucial. Properly documenting these components helps ensure a smooth transaction and reduces the likelihood of misunderstandings. The primary elements typically include identifying the parties involved, detailing the property being gifted, and specifying any financial inputs or ownership percentages.

-

Clearly state who is giving and receiving the gift.

-

Include a comprehensive description of the gift.

-

Record any monetary contributions as a part of the gift.

-

Specify the proportion of ownership if the gift involves shared assets.

How do you fill out the agreement and gift form?

Filling out the agreement and gift form involves several steps that should be followed carefully to ensure completeness and accuracy. Each section of the form serves a specific purpose, contributing to the overall validity of the documentation.

-

Fill in the donor's full name and contact information.

-

Complete the donee's name and contact specifics.

-

Provide a detailed description of the property being gifted.

-

Clearly state any ownership distributions.

-

Both parties must sign and date to make the form legally binding.

What common mistakes should you avoid?

When completing the agreement and gift form, there are common pitfalls that can lead to complications later on. Being aware of these mistakes can save you from potential legal issues or tax complications.

-

Ensure financial contributions are clearly documented.

-

Both parties must sign to validate the form.

-

Revise ownership details if contributions change.

-

Be aware of potential gift tax liabilities.

How can pdfFiller assist you with the agreement and gift form?

Using pdfFiller for your agreement and gift form offers several benefits. This platform provides easy access to templates and tools for editing, eSigning, and managing your documents, ensuring an efficient document workflow.

-

Streamlines the entire process, making it user-friendly.

-

Easily locate and utilize the tailored template online.

-

Collaborative options allow for easy sharing and completion.

-

Facilitate teamwork with real-time editing and commenting features.

What best practices should you follow when finalizing your agreement and gift form?

Finalization of the agreement and gift form is a crucial step. Following best practices can help in maintaining records and ensuring compliance with legal standards. Proper management and storage of this document are essential for future reference.

-

Digital storage solutions can ensure safety and easy retrieval.

-

Seek legal advice if uncertainties arise regarding the form.

-

Decide whether to file with a relevant authority, maintaining compliance.

How to fill out the agreement and gift template

-

1.Open the pdfFiller website and log in to your account or create a new one if necessary.

-

2.Search for the 'agreement and gift' template in the document library.

-

3.Select the appropriate template and click on 'Fill Out' to begin editing.

-

4.Fill in the required fields such as donor's name, recipient's name, and details about the gift.

-

5.Ensure that all relevant terms and conditions are outlined clearly to avoid future disputes.

-

6.Add any necessary clauses regarding the return of the gift or conditions under which the gift is given.

-

7.Review the entire document for accuracy and completeness before finalizing.

-

8.When satisfied with the content, click on 'Save' to keep a copy for your records.

-

9.If needed, choose the option to send the completed agreement directly to the recipient via email or download it for printing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.