Get the free Installment Purchase and Security Agreement With Limited Warranties - Horse Equine s...

Show details

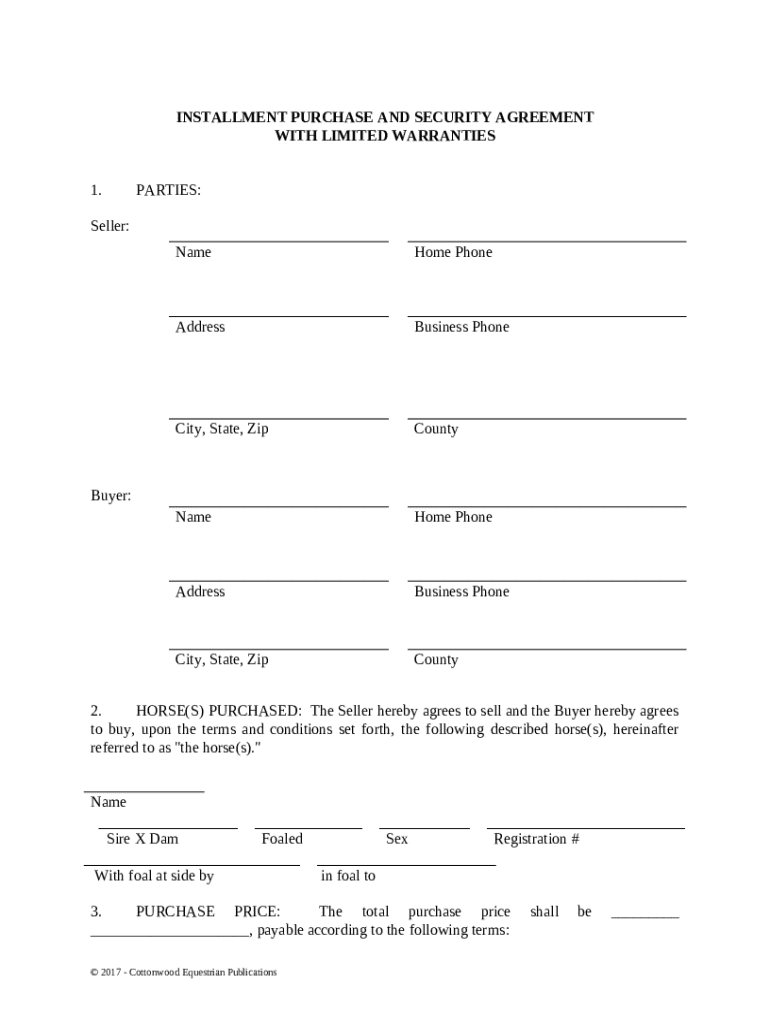

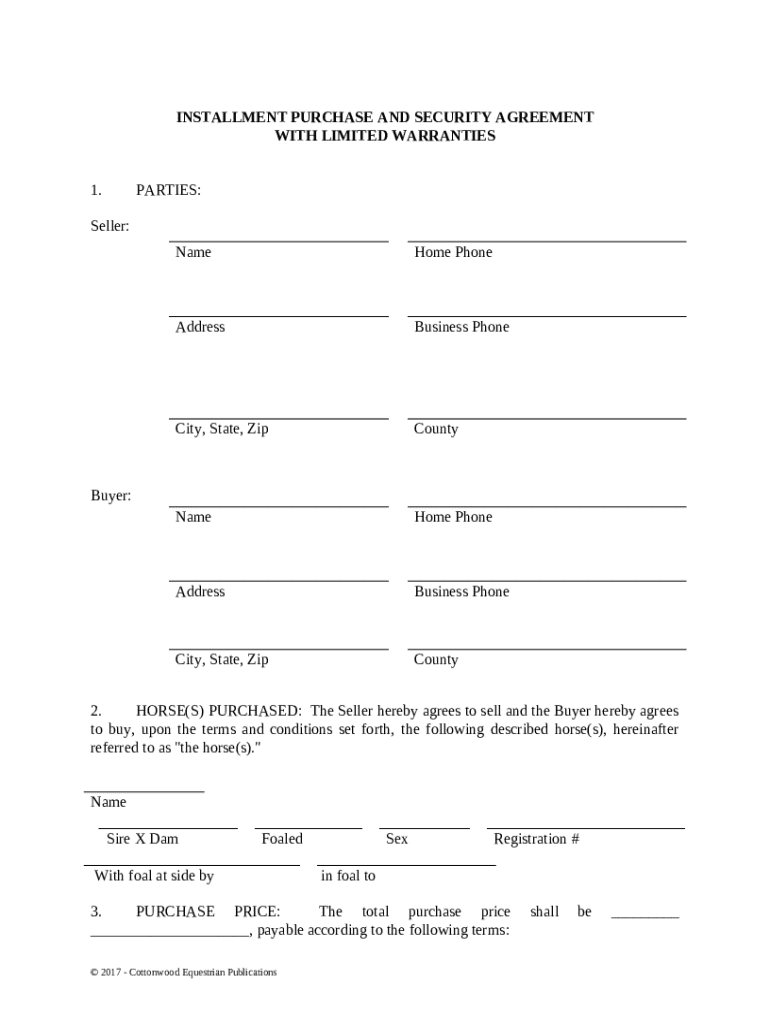

This Installment Purchase and Security Agreement With Limited Warranties Horse Equine form is an installment purchase and security agreement in connection with the purchase of a horse. It provides

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

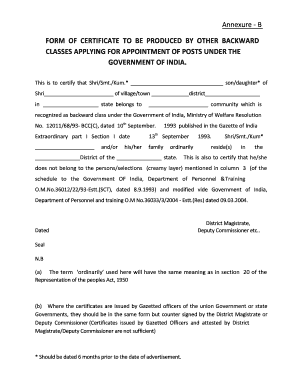

What is installment purchase and security

An installment purchase and security agreement is a financial arrangement that allows a buyer to pay for a product or service in regular payments while providing the seller with a security interest in the item until paid in full.

pdfFiller scores top ratings on review platforms

Great experience. PDF Filler really cuts down on the time to fill out documents.

Thanks for being here. It is easy to use. I would like to have control over the font size, however. The print is very tiny.

Personal use has been to sign real estate forms. As an advocate, I complete forms to be signed by those I represent.

It's hit or miss would love to know how to use all of the features

Generally good for what I need - signing docs, creating PDFs and emailing docs.

So far so good some issues when printing it comes up blank

Who needs installment purchase and security?

Explore how professionals across industries use pdfFiller.

How to fill out the installment purchase and security

-

1.Open the pdfFiller app and upload the installment purchase and security document.

-

2.Carefully read through the document to understand all sections.

-

3.Start with the buyer's information: fill in your full name, address, and contact information in the designated fields.

-

4.Next, locate the seller's information section and enter the seller's name, business name, and contact details.

-

5.For the agreement section, clearly specify the total purchase amount and the down payment amount, if applicable.

-

6.Detail the installment payment structure, including the number of payments, payment frequency (monthly, weekly), and due dates.

-

7.In the security interest section, describe the collateral being secured by the loan.

-

8.Make sure to include any terms regarding late payments or default conditions.

-

9.Review the document for accuracy before finalizing.

-

10.Sign and date the document in the designated area, and if required, have it witnessed or notarized.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.