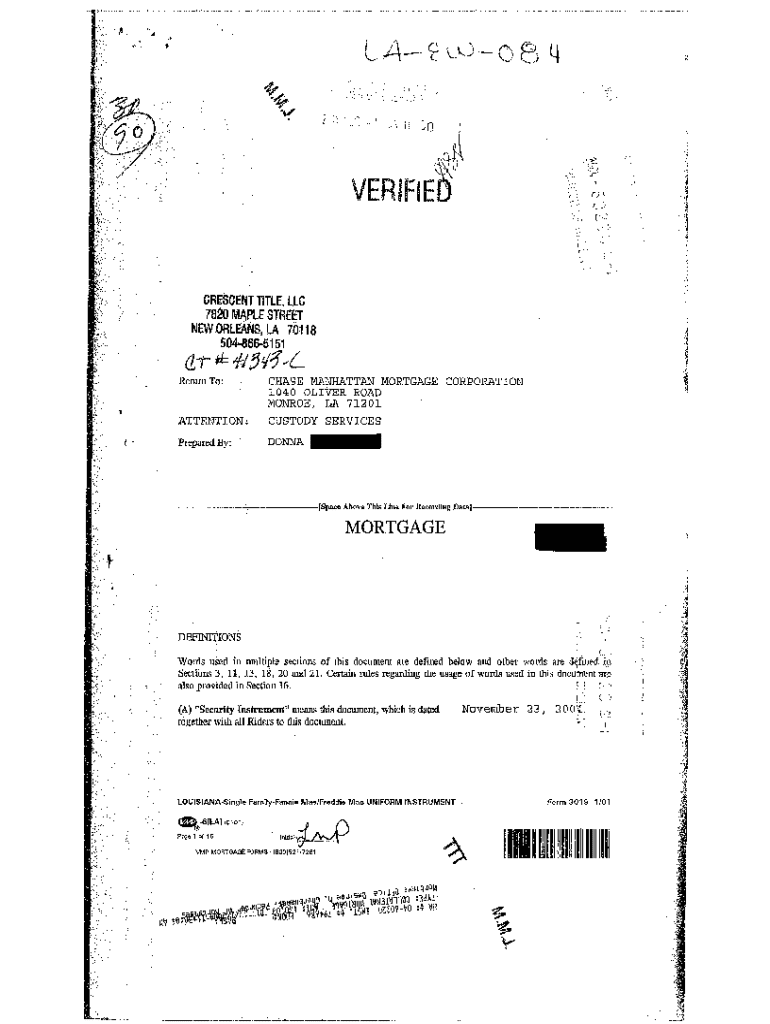

Get the free Sample Mortgage

Show details

Sample Mortgage

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample mortgage

A sample mortgage is a template document outlining the terms and conditions for a loan secured by real property.

pdfFiller scores top ratings on review platforms

Its great

its simple and able to use.

good

i understand.

it was so easy and fast to produce a documented I needed******

PDFiller has just saved a lot of time…

PDFiller has just saved a lot of time and trouble allowing me to easily editing my pdfs. Thank you!

Who needs sample mortgage?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Sample Mortgage Forms on pdfFiller

How to fill out a sample mortgage form

Filling out a sample mortgage form involves collecting key information about the borrower's identity, loan specifications, and closing costs. Utilize pdfFiller's intuitive interface to fill in, edit, and manage your mortgage documents effortlessly.

What are the key components of mortgage forms?

Mortgage forms are crucial in the lending process and cover various elements that influence the loan decision. Understanding key fields such as the borrower's information, loan details, and closing costs is essential.

-

This includes the borrower's name, address, Social Security number, and employment details.

-

Critical information about loan amount, interest rates, and terms.

-

Fees associated with obtaining the mortgage, which may include appraisal fees, title insurance, and origination fees.

Using pdfFiller's tools can significantly simplify the navigation through these components, enabling quick and accurate form completion.

How do loan estimates and closing disclosures differ?

Loan estimates and closing disclosures serve distinct purposes in mortgage transactions, crucial for informed decision-making. A loan estimate outlines the loan terms, anticipated rates, and monthly payments.

-

Primarily intended to provide a forecast of the loan’s costs, helping borrowers understand their financial commitments.

-

A detailed financial statement that outlines final loan terms and closing costs, provided a few days before closing.

Examples of scenarios for each form include pre-approval for the loan estimate and finalization for the closing disclosure, ensuring transparency between lenders and borrowers.

How can you utilize blank model forms?

Blank model forms offer flexibility for users to customize content specific to their needs. Accessing and editing blank loan estimate forms on pdfFiller can streamline the application process for potential borrowers.

-

With pdfFiller, simply choose a model template to start filling out relevant data.

-

Customize the closing disclosure according to your specific loan parameters and lender requirements.

Leveraging these forms through pdfFiller can lead to personalized and professionally crafted document outputs.

What insights do completed sample forms provide?

Examining completed sample forms can offer valuable insights into how others have successfully filled out their mortgage documents. A well-structured breakdown of completed sample loan estimate forms can lend guidance on filling out your own.

-

Analyzing common fields in completed forms helps in identifying variances in different loan types.

-

Understanding financial obligations from completed disclosures aids in better decision-making for future borrowers.

These insights can assist users in refining their documentation processes, streamlining communication with lenders.

What other blank model forms are helpful?

While loan estimates and closing disclosures are fundamental, several other forms are vital in the mortgage application process. Additional documents include pre-qualification forms, and property appraisal reports.

-

These forms help assess the borrower's financial situation before they apply for a loan.

-

Accompanies mortgage applications to verify property value and aid in securing loans.

Knowing how and when to use these additional sample forms can further aid in personalizing mortgage applications through pdfFiller’s interactive tools.

How do you print mortgage forms efficiently?

Printing mortgage forms accurately is critical. To ensure compliance, follow a structured approach when printing forms through pdfFiller.

-

Ensure that all fields are completed correctly before initiating a print to avoid errors.

-

Utilize pdfFiller’s print preview feature to check layout and content, minimizing waste.

Emphasizing accessibility in your document management approach can help ensure that all necessary parties have easy access to key forms.

What are eSignature options for mortgage documentation?

Integrating eSignature options can accelerate document processing times for mortgage documentation. pdfFiller provides tools for seamless eSigning, ensuring that electronically signed documents meet legal requirements.

-

Easily sign mortgage forms directly within the platform, which streamlines the process and improves turnaround time.

-

Banking institutions recognize eSignatures as legally binding, ensuring your mortgage forms are valid.

Guidelines on safely sending and managing these signed documents further facilitate secure communication between lenders and borrowers.

How to fill out the sample mortgage

-

1.Download the sample mortgage PDF from a reliable source.

-

2.Open the PDF in pdfFiller or upload it if you have it saved.

-

3.Start with the borrower's information; fill in your full name and contact details.

-

4.Input the lender's details, including the company name and address.

-

5.Specify the loan amount requested in the designated field.

-

6.Enter the interest rate for the mortgage as stated in your loan proposal.

-

7.Indicate the term length of the mortgage, typically in years.

-

8.Fill in property details, including address and type of property.

-

9.Review any additional terms or conditions, ensuring they reflect your agreement.

-

10.Sign and date the document in the compliance section before submitting it.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.