Get the free Complaint- Debt template

Show details

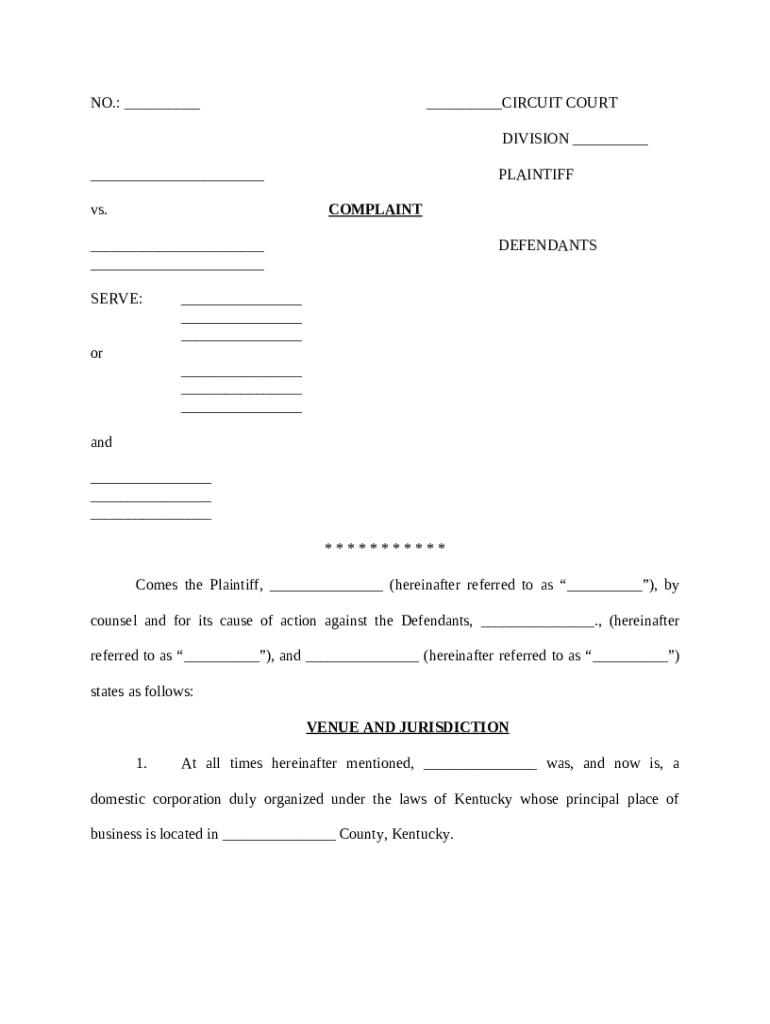

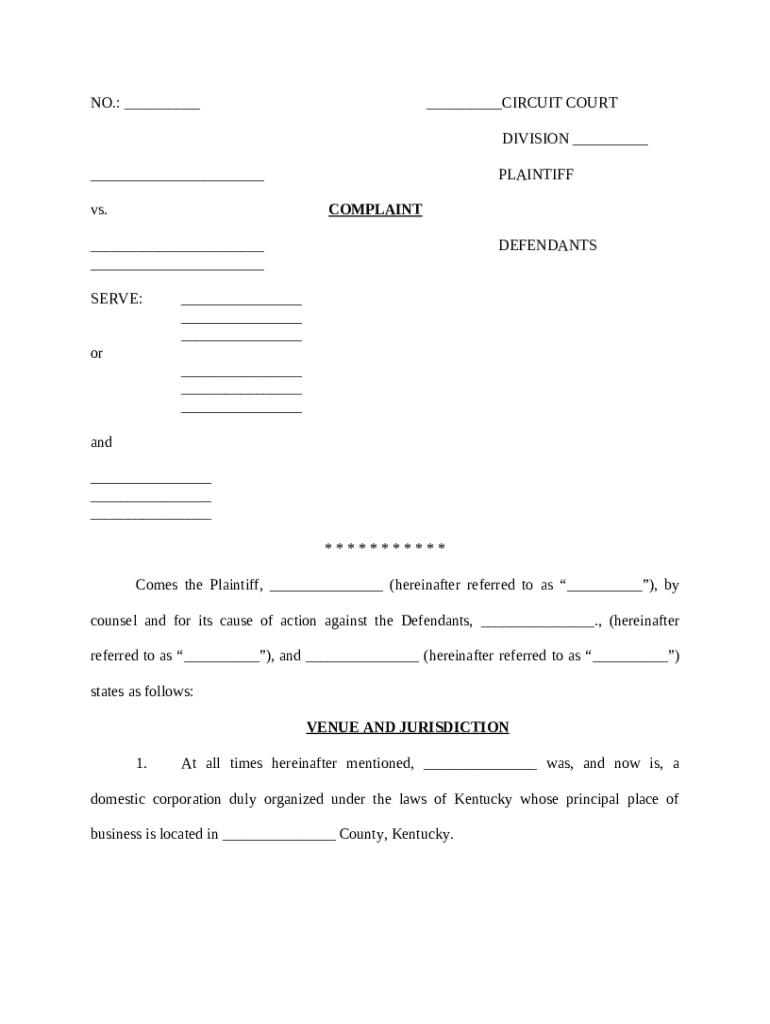

This sample complaint for collection for nonpayment of goods, merchandise, and services sold and or delivered on account.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is complaint- debt

A complaint-debt is a legal document filed by a creditor to initiate a lawsuit against a debtor for the recovery of owed money.

pdfFiller scores top ratings on review platforms

EASY TO USE

GOOD

Great tool

as far as I can see Its works for me

Amazing site for editing documents

Love this

Who needs complaint- debt template?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Filing a Debt Complaint with pdfFiller

How do you fill out a complaint debt form?

Filing a debt complaint can be a straightforward process if you understand the necessary steps and requirements. This guide will lead you through how to fill out a complaint debt form effectively. It also highlights your rights, the documentation needed, and the tools available through pdfFiller to streamline the process.

Understanding your rights: The Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) establishes clear provisions to protect consumers from unfair debt collection practices. This means that as a consumer, you have specific rights regarding how debt collectors interact with you. If you believe a debt is invalid or mishandled, it’s critical to know your rights before filing a complaint.

-

Overview of the FDCPA: This act regulates how debt collectors can communicate and collect debts, ensuring they do not use abusive or deceptive practices.

-

Your rights: You have the right to dispute a debt and request validation or proof that the debt is actually owed.

-

Invalid debts: If you suspect the debt is not yours or is incorrect, the FDCPA allows you to challenge it formally.

How to navigate the complaint process: Step-by-step instructions

Filing a complaint may seem daunting, but breaking it into manageable steps can simplify the process significantly. Knowing exactly what information you need and the most common mistakes to avoid will enhance your chances of a successful resolution.

-

Outline necessary steps: Begin by gathering your personal data, details about the debt, and records of any previous correspondence.

-

Required information: Be prepared to include your contact information, the debt collector's contact details, and specific debt information.

-

Pitfalls to avoid: Ensure that all documents are complete to prevent delays in processing your complaint.

Gathering required documents for your debt complaint

To support your complaint adequately, collecting the right documentation is crucial. This will bolster your case against the debt collector and may help expedite the resolution process.

-

Documents needed: Prepare essential documents such as account statements, payment records, and any other relevant communication.

-

Obtaining documentation: Request copies of documents from your debt collector if necessary to ensure you have all relevant information.

-

Organizing paperwork: Use tools from pdfFiller to sort and save your documents in an accessible format.

How to fill out your complaint form: Field-by-field breakdown

Completing the complaint form correctly is essential for clarity and legal validity. Understanding each section of the form will save you time and potential frustrations.

-

Plaintiff vs. Defendant: Clearly define who is filing the complaint and the party being complained against.

-

Venue and jurisdiction: Understand where to file your complaint based on geographical jurisdiction and location relevance of the debt.

-

Articulating your claims: Ensure you clearly outline your grievances and the total amounts owed, making them easy to understand.

How does pdfFiller enhance your filing experience?

Using pdfFiller can significantly improve your experience when filing a debt complaint. Its suite of tools allows for easy editing and management of forms, which is essential for a smooth filing process.

-

Editing tools: pdfFiller allows you to modify PDF documents seamlessly, making it easier to prepare forms.

-

Cloud-based benefits: Leveraging cloud technology facilitates easy access, tracking, and sharing of documents from anywhere.

-

Examples of forms: Learn how to utilize the array of editable templates offered by pdfFiller tailored for debt complaint filings.

What happens after you submit a debt complaint?

Once your complaint is submitted, it's important to know what to expect. Understanding the process after filing can help manage your expectations.

-

Expected timelines: Processing times can vary; anticipate some variance based on location and the agency involved.

-

Resolution outcomes: Be aware of potential outcomes, including negotiation, dismissal, or full investigation of your complaint.

-

Next steps if unresolved: If your complaint is dismissed, know your options for further action, possibly including seeking legal advice.

Document management: Retaining records of your complaint

Keeping detailed records of your complaint is essential for future reference and follow-up actions. Proper documentation can be crucial in cases of escalating disputes.

-

Importance of records: Maintaining accurate records ensures transparency and accountability throughout the complaint process.

-

Using pdfFiller: Take advantage of pdfFiller’s document management features to store and access your records securely.

-

Best practices: Regularly update your documents and ensure that all communications are logged for future reference.

How can pdfFiller support collaboration on debt complaints?

Collaboration can play a vital role in preparing a robust debt complaint. pdfFiller offers several features that facilitate teamwork while ensuring security.

-

Team collaboration: Leverage pdfFiller’s shared access features for team-based document preparation and review.

-

Effective practices: Establish clear communication and roles to enhance collaboration efficiency.

-

Security features: Ensure your shared documents are protected by utilizing pdfFiller’s encryption and access controls.

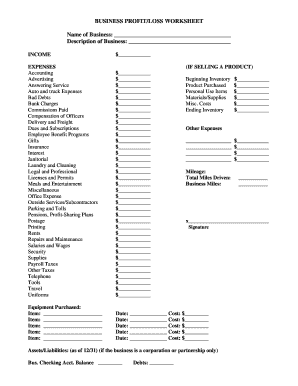

How to fill out the complaint- debt template

-

1.Obtain the complaint-debt template from pdfFiller.

-

2.Open the PDF file and read through the initial instructions carefully.

-

3.Fill in the plaintiff's information, which is typically the creditor's name and address, in the designated fields.

-

4.Include the defendant's information, entering the debtor's name and address accurately.

-

5.Specify the amount of debt owed in the appropriate section, providing any relevant details about the debt.

-

6.Attach any supporting documents or evidence, such as contracts or invoices, if required by the court.

-

7.Review all filled areas for accuracy and completeness before submission.

-

8.Save your completed document and follow pdfFiller's instructions to submit or print the complaint-debt for filing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.