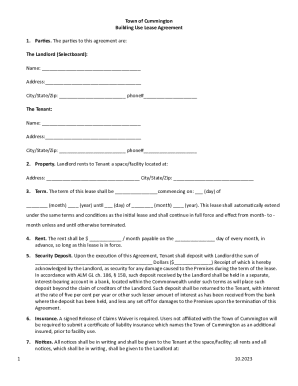

Get the free Complaint for Foreclosure template

Show details

This complaint seeks foreclosure for nonpayment of a mortgage.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is complaint for foreclosure

A complaint for foreclosure is a legal document filed by a lender to initiate the foreclosure process on a property due to the borrower's failure to make mortgage payments.

pdfFiller scores top ratings on review platforms

signature capture is awkard. It would be nice if you could pin the icon to windows screen.

very easy and the customer service is great

Pretty easy to use without looking at any of the tutorials

The mobile app is very handy ,but tends to glitch-up from time to time.

Excellent service, easy to use. Great customer care

They retrieved my documents which was a very difficult task

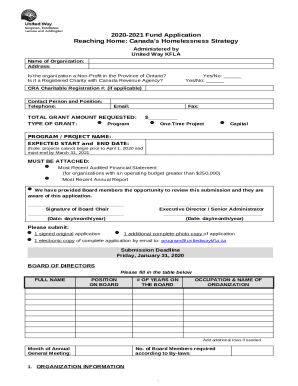

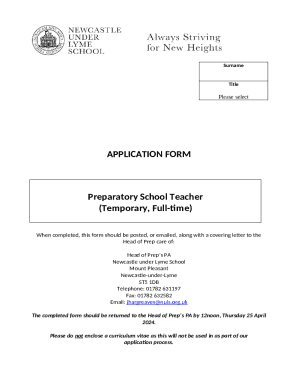

Who needs complaint for foreclosure template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Filing a Complaint for Foreclosure

Filing a complaint for foreclosure can be a daunting experience, especially if it's your first time. This guide will provide you with detailed insights on the process of filling out a complaint for foreclosure form, ensuring that you are well-prepared and informed.

What is a foreclosure complaint?

A foreclosure complaint is a legal document filed by a lender to initiate foreclosure proceedings against a borrower who has defaulted on their mortgage payments. This document outlines the lender's case and seeks legal permission to repossess the property secured by the mortgage.

-

The purpose of the complaint is to formally notify the borrower of the lender's intention to foreclose, providing grounds for the action.

-

In Kentucky, the foreclosure process typically involves a court filing, a judgment, and potentially a public auction of the property.

-

Proper documentation is crucial as it ensures that all legal requirements are met, which can affect the outcome of the case.

What are the key components of a complaint for foreclosure?

Understanding the key components of a complaint for foreclosure is essential for both lenders and borrowers. Each element must be clearly articulated to support the lender's claims in court.

-

The plaintiff is usually the lender, and the defendant is the borrower facing foreclosure.

-

The promissory note outlines the borrower's promise to repay the loan and its significance in establishing the debt.

-

Default occurs when the borrower fails to make scheduled payments, which is a key reason for the initiation of foreclosure proceedings.

-

This section includes financial aspects such as the amount owed, property details, and the legal basis for foreclosure.

-

The mortgage serves as security for the loan, and its details must also be included in the complaint.

How do you fill out a complaint for foreclosure form?

Filling out the complaint for foreclosure form accurately is critical to ensure your case is heard in court. Here’s a step-by-step breakdown.

-

Collect all relevant documents including the Note, Mortgage, and payment histories, as they are essential for substantiating the case.

-

Carefully fill out each section of the court form, ensuring that all information is complete and accurate.

-

Use clear and concise language to guarantee that the court understands your position without ambiguity.

-

Avoid common mistakes such as missing signatures or filing in the wrong jurisdiction, as these can delay your case.

How can pdfFiller assist you in this process?

pdfFiller provides a user-friendly platform to help you create and edit your complaint for foreclosure form seamlessly. Here are some features you can take advantage of.

-

With pdfFiller, you can easily edit your complaint form to meet your requirements without any hassle.

-

Digital eSigning is available, ensuring that your complaint is signed securely and efficiently.

-

You can share the document with legal advisors or family members to get feedback before submission.

-

Access your completed documents anytime and anywhere, providing convenience and peace of mind.

What steps should you follow to submit your complaint?

After preparing your complaint for foreclosure form, it’s important to understand how to navigate the legal process for submission.

-

Identify the appropriate court in Kentucky where your complaint must be filed based on your property’s location.

-

Be prepared for filing fees, which can vary depending on the court and any additional costs that may apply.

-

You must notify all involved parties of the foreclosure proceedings, adhering to legal requirements to avoid complications.

-

After filing, you will need to wait for the court's response and prepare for potential subsequent steps.

How to maintain compliance with foreclosure laws?

Staying compliant with foreclosure laws is essential to avoid legal repercussions during the foreclosure process.

-

This act outlines your rights as a borrower and ensures that debt collectors adhere to ethical collection practices.

-

Both parties in foreclosure have specific legal obligations to fulfill, which must be understood to avoid legal issues.

-

Be aware of local Kentucky laws regarding foreclosure, as these can differ from federal guidelines.

What happens after filing your complaint?

Filing your complaint is just the beginning of the process. Understanding what happens next is crucial.

-

Typically, a foreclosure case in Kentucky can move through various stages, which usually span several months.

-

Borrowers have options available to them post-filing, including contesting the foreclosure or seeking alternative resolutions.

-

It’s advisable to seek legal support or resources to guide you through the foreclosure process for better outcomes.

Conclusion: How to navigate your foreclosure journey

Accurate filing of your complaint for foreclosure is crucial for navigating the legal landscape. Utilize the tools available on pdfFiller and stay organized throughout this process to ensure compliance with laws and effective management of your documents. Remember, being informed leads to better outcomes.

How to fill out the complaint for foreclosure template

-

1.Go to pdfFiller's website and log in to your account or create a new account if you do not have one.

-

2.Navigate to the templates section and search for 'complaint for foreclosure'.

-

3.Select the form template and click on 'Fill' to open the form editor.

-

4.Review each section of the form; the key fields typically include borrower information, lender information, loan details, and grounds for foreclosure.

-

5.Fill out your personal details accurately, including name, address, and contact information for both the borrower and lender.

-

6.Provide the mortgage account number and the loan's outstanding balance to complete the financial information section.

-

7.Include a detailed description of the default, such as missed payments and any communications with the borrower regarding the default status.

-

8.Review the entire form for accuracy and completeness before proceeding to submit or save the filled document.

-

9.Download or send the completed complaint for foreclosure to the appropriate court or parties as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.