Get the free Simplified Verified Disclosure

Show details

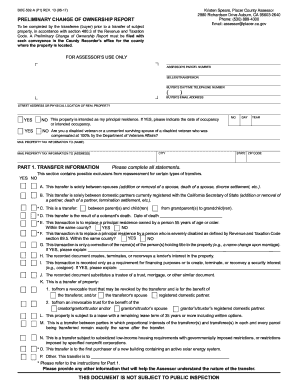

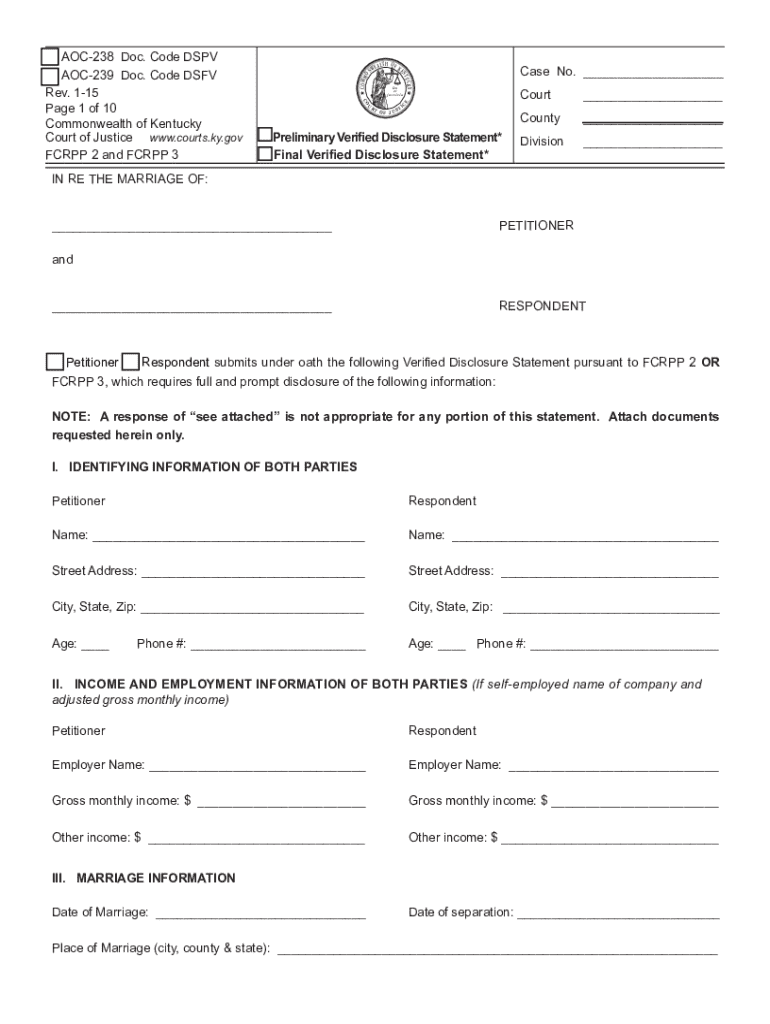

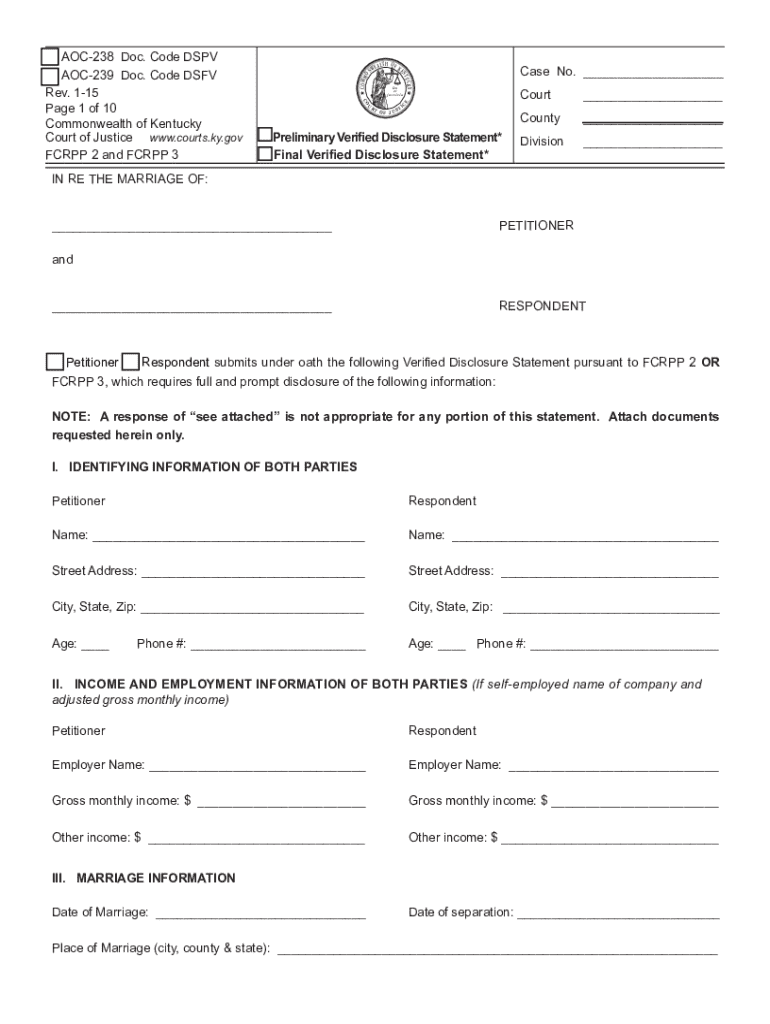

This form is used in an uncontested divorce to verify disclosures for the petitioner and the respondent.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is simplified verified disclosure

A simplified verified disclosure is a streamlined document that provides essential financial information to facilitate transparency and understanding among stakeholders.

pdfFiller scores top ratings on review platforms

Great way to quickly edit some pdf's, good stuff

Good choice of forms, never had an issue with downloading or printing.

Great app, but the SignForm program isn't synced with this one.

I was in a rush to get some documents preparred. This was a easy tool to use.

Sometimes there are too many steps to get to the document.

maybe need to improve on the circling the words

Who needs simplified verified disclosure?

Explore how professionals across industries use pdfFiller.

How to fill out a simplified verified disclosure form

Understanding the simplified verified disclosure form

The simplified verified disclosure form is a crucial document in legal proceedings, particularly in divorce cases. It is designed to enhance transparency between parties by clearly outlining financial and personal information. The importance of this form cannot be overstated, as it not only meets the legal requirements for disclosure but also ensures fairness during proceedings.

-

This form serves as a transparent method for each party to disclose their financial circumstances.

-

It enables both parties and the court to understand each individual's financial situation fully.

-

Many jurisdictions mandate this form to ensure compliance during dissolution of marriage.

What are the key sections of the simplified verified disclosure form?

The simplified verified disclosure form contains several key sections that gather pertinent information from both parties involved. These sections are important for building a comprehensive financial picture, which can significantly impact legal decisions.

-

This section requires complete names and addresses, contact details, and age verification, ensuring that all parties can be accurately identified.

-

This includes details on income sources and employment verification, providing a clear picture of financial standing.

-

Documenting the marriage date, location, and separation details contextualizes the legal matters at hand.

-

This section details any minor children, covering names, ages, custody-related expenses, and child support obligations.

-

A thorough account of assets and debts is essential for equitable division in legal proceedings.

How should you fill out the simplified verified disclosure form?

Filling out the simplified verified disclosure form accurately involves careful attention to detail. Securing both parties' financial integrity is paramount, and doing so requires following step-by-step instructions.

-

Follow a structured approach for each section to ensure clarity and compliance.

-

Double-check entries, avoid vague descriptions, and ensure all required fields are addressed.

-

Utilize official documentation and consult with legal professionals to support your disclosures.

How can you edit and manage your disclosure form on pdfFiller?

pdfFiller provides a robust platform for editing and managing your simplified verified disclosure form. Users can leverage advanced features to ensure their documents are accurate and secure.

-

pdfFiller's interface allows for seamless editing, making corrections easy.

-

Documents can be electronically signed and securely sent to the required parties.

-

Legal teams can collaborate directly on the document, streamlining communication and approvals.

What are the legal considerations and compliance factors in disclosure?

Understanding the legal nuances of the simplified verified disclosure form is essential for compliance. Each state has specific requirements, and staying informed about these can mitigate risks.

-

In Kentucky, specific guidelines dictate the completeness and accuracy of disclosures required.

-

Failing to adhere to disclosure norms can lead to legal penalties or unfavorable judgments.

-

Consulting legal professionals can provide clarity and prevent mishaps during the filing process.

How to fill out the simplified verified disclosure

-

1.Obtain the simplified verified disclosure form from pdfFiller.

-

2.Open the PDF in pdfFiller and click on 'Fill' to begin editing.

-

3.Start with entering your name and contact information in the designated fields.

-

4.Provide accurate details in the financial sections, including income and assets.

-

5.Fill in any liabilities or debts as requested in the form.

-

6.Review all entered data for accuracy and completeness to prevent errors.

-

7.Use the 'Add Signature' feature to sign the document digitally.

-

8.Once completed, click 'Save' to store your filled document.

-

9.Choose 'Download' to save it as a PDF or 'Share' to send it directly to recipients.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.